The market correction’s slip no longer holds significance for investors. All attention is now on the Q3 earnings season, with forecasts of exceptional growth compared to the previous year and higher than the previous quarter’s increase. The VN-Index opened positively, maintaining its momentum throughout the session and closing nearly 10 points higher, approaching the 1,281 level.

The breadth was overwhelmingly positive, with 255 gainers and 114 losers. Except for the energy sector, which faced corrective pressure, most other sectors breathed a sigh of relief. Large-cap real estate stocks performed well, with notable gainers such as VHM, up 2.16%; VIC, up 1.71%; DXG, up 1.31%; SZC, up 3.44%; and KBC, up 1.62%.

The banking sector continued its strong showing, led by familiar names like ACB, up 2.94%; STB, up 1.34%; MBB, up 1.59%; and TCB, up 1.02%, alongside VPB and CTG. In the transportation sector, VTP saw active trading from the start, closing at the upper limit, while HVN gained 3.19%, and ACB and HAH rose 6.55% and 1.57%, respectively. The materials sector benefited from news of anti-dumping duties on imported steel, boosting HPG.

The top stocks driving the market today included VHM, HPG, ACB, BID, MSN, VIC, and FPT, contributing a total of 5.81 points to the overall market. Bottom-fishing sentiment strengthened, with combined trading volume on the three exchanges reaching VND18,800 billion, higher than the previous session.

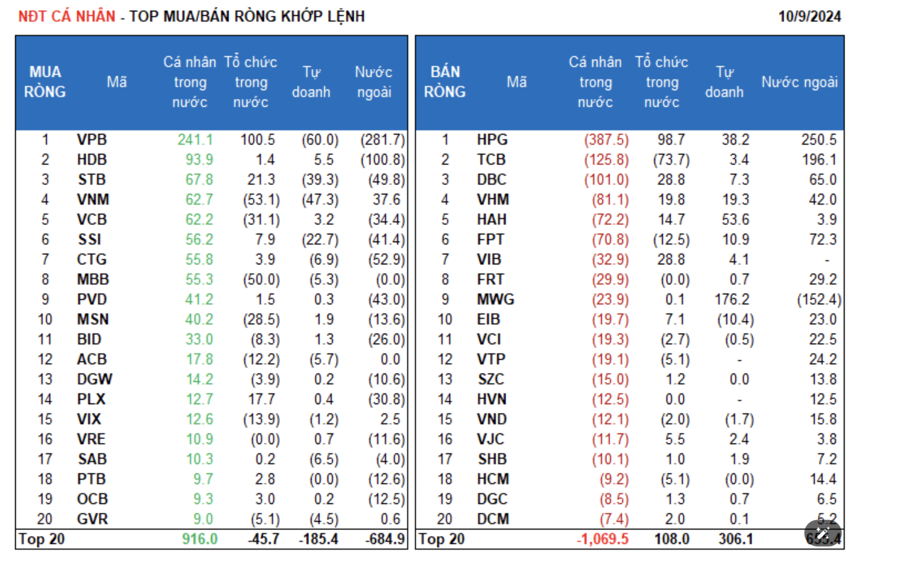

Foreign investors sold a net VND142.9 billion, with a net sell of VND15.2 billion in matched transactions.

Their main net buys on the matched transactions were in the Basic Resources, Food & Beverage, and Financials sectors. The top net bought stocks by foreigners on a matched basis were HPG, TCB, FPT, DBC, VHM, VNM, FRT, VTP, EIB, and VCI.

On the sell side, their main focus was on the Banking sector. The top net sold stocks by foreigners on a matched basis were VPB, MWG, HDB, CTG, STB, SSI, VCB, PLX, and BID.

Individual investors sold a net VND71.3 billion, including a net sell of VND148.1 billion in matched transactions.

In terms of matched transactions, they bought a net of 7 out of 18 sectors, mainly in the Banking sector. Their top net bought stocks included VPB, HDB, STB, VNM, VCB, SSI, CTG, MBB, PVD, and MSN.

On the net sell side, they sold a net of 11 out of 18 sectors, primarily in the Basic Resources and Industrials & Business Services sectors. Their top net sold stocks included HPG, TCB, DBC, VHM, HAH, FPT, FRT, MWG, and EIB.

Proprietary trading accounts bought a net of VND53.8 billion, with a net buy of VND143.1 billion in matched transactions.

In matched transactions, proprietary trading accounts bought a net of 12 out of 18 sectors. The top sectors were Retail and Industrials & Business Services. The top net bought stocks by proprietary trading accounts today were MWG, HAH, HPG, VHM, FPT, DPR, DBC, BVH, NLG, and HDB. On the sell side, the focus was on the Banking sector, with the top net sold stocks being VPB, VNM, STB, SSI, TPB, EIB, CTG, SAB, ACB, and SSB.

Domestic institutions bought a net of VND63.7 billion, with a net buy of VND20.1 billion in matched transactions.

In terms of matched transactions, domestic institutions sold a net of 12 out of 18 sectors, with the highest value in the Food & Beverage sector. The top net sold stocks were TCB, VNM, MBB, VCB, MSN, NLG, VIX, FPT, ACB, and VGC. On the buy side, the main sector was Basic Resources. The top net bought stocks were VPB, HPG, VIB, DBC, STB, VHM, PLX, HSG, HAH, and TPB.

Block trades today reached VND1,310.4 billion, up 55.8% from the previous session, contributing 7.0% of the total trading value.

Notable block trades were seen in VIC, with over 5.7 million shares worth VND236.4 billion traded between individual investors. Additionally, there was a transfer of 4.8 million HDB shares (valued at VND129.6 billion) between domestic institutions.

Money flow allocation increased in Banking, Retail, Food & Beverage, Agriculture & Fisheries, Software, and Courier sectors, while decreasing in Securities, Real Estate, Steel, Chemicals, and Oil & Gas.

In terms of matched transactions, the money flow allocation increased in the large-cap VN30 sector while decreasing in the mid-cap VNMID and small-cap VNSML sectors.