The market showed signs of weakening in the afternoon session as selling pressure started to weigh on prices. Bottom-fishing stocks were heavily sold off, putting pressure on the blue-chip group and pushing mid- and small-cap stocks lower. However, the VN30-Index remained resilient, supporting the VN-Index, although the gain narrowed significantly.

Closing the morning session, the VN-Index gained 7.84 points with 201 gainers and 135 losers. By the end of the day, the index was up 4.51 points, with 163 gainers and 206 losers. The most notable change was the breadth, reflecting the relatively clear pressure.

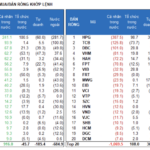

The Midcap index closed 0.43% lower, while the Smallcap index fell 0.14%. In contrast, the VN30-Index rose 0.64% with a balanced breadth of 14 gainers and 14 losers. Compared to the morning session’s close, the VN30 basket saw 18 stocks trading lower and only nine improving. However, not many blue chips fell sharply (only nine stocks fell below the reference price), and the leading stocks remained strong.

MSN and FPT performed better in the afternoon, with MSN gaining an additional 0.38% from the morning session’s close and ending 3.9% above the reference price. FPT also edged up 0.57%, closing with a total gain of 4.65%. BID, the market’s second-largest stock, improved by 0.51%, ending the day 0.61% higher. VPB rose 0.74%, closing 1.48% higher. MWG saw the biggest gain, rising 1.09% from the morning session’s close and ending the day 1.25% higher.

However, with more stocks falling in the VN30 basket, the support weakened, causing the VN-Index’s gain to narrow. STB, TCB, VHM, VIC, HPG, and VNM were the weak red chips in the afternoon. This was partly due to the profit-taking sentiment, as buying interest at higher prices waned. VN30 basket’s liquidity dropped by 23% in the afternoon. However, stocks that attracted buying interest and saw price improvements included VPB, MSN, FPT, GAS, and MWG.

The rest of the market did not fare as well as the blue-chip group, with many stocks reversing sharply. Of the 206 losers on the VN-Index, 61 stocks fell more than 1%, double the number in the morning session. In addition to STB in the VN30 basket, the stocks that faced significant pressure were mainly in the Midcap group, such as VCI, which fell 2.67% with a liquidity of 419.1 billion; VIX, which fell 1.66% with a match of 330.5 billion; MSB, down 1.55% with a volume of 271.5 billion; HSG, down 1.88% with a match of 244.1 billion; and PDR, down 1.65% with a volume of 151.3 billion. The total liquidity of this deeply falling group accounted for 18.9% of the HoSE exchange’s trading value.

On the upside, liquidity remained concentrated and provided good price support, but the spread was poor. In addition to the outstanding performance of FPT and MSN, the stocks that attracted buying interest were VPB, up 1.48% with a volume of 927.1 billion; MWG, up 1.25% with a volume of 561.5 billion; HDB, up 1.67% with a volume of 290.8 billion; CMG, up 4.9% with a volume of 153.9 billion; FRT, up 1.36% with a volume of 135.1 billion; NTL, up 3.1% with a volume of 120.2 billion; PNJ, up 1.17% with a volume of 115 billion; and PAN, up 2.51% with a volume of 90.5 billion. Out of the 163 gainers on the VN-Index, 49 stocks rose more than 1%, and their liquidity accounted for 33.2% of the floor value. However, the top ten stocks accounted for nearly 94% of the group’s total trading value.

The afternoon trading session saw a decrease in buying interest, with a notable drop in high-price liquidity. HoSE’s afternoon trading volume fell 13.5% from the morning session, with prices generally lower.

Foreign investors also reduced their trading activity in the afternoon, with net purchases of 982.5 billion and net sales of 890.2 billion, resulting in a slight net buy of 92.3 billion. In the morning session, they had net bought 413.7 billion. MSN and FPT continued to see strong buying interest, with MSN ending the day with a net buy of 366.8 billion and FPT with a net buy of 311.7 billion. Additionally, NTL saw net purchases of 157.9 billion, TCB of 135.6 billion, and CMG of 20.9 billion. On the selling side, STB led with net sales of 126.1 billion, followed by CTG with 49.4 billion, VPB with 49.3 billion, HCM with 33.7 billion, MSB with 33.5 billion, and VHM with 31.6 billion…

The Flow of Funds: Consecutive Failures at the 1300-Point Peak – Is There Still a Chance for a Breakthrough?

Over the past five trading sessions, the VN-Index has witnessed two attempts to breach the 1300-point mark, yet it fell short of success. The notable surge in trading volume during these failed attempts leaves a profound impression of distribution activities.

The Ever-Rising Bridge Tolls: A Costly Commute

Although the VN-Index only slightly increased by 3.24 points (+0.25%) during the morning session, the index traded above the reference level for most of the time, with a positive market breadth. This is a result of buying power pushing the market to higher price levels. Blue-chips are leading the gains and dominating market liquidity, accounting for more than half of the total trading volume.