Today’s market showed significantly more positivity, not in the sense of rising indices, but in the balance and bottom-fishing momentum. The shift from indiscriminate selling to price selection and consolidation indicates a notable change in investor psychology and risk assessment.

The information landscape today remains unchanged from yesterday and is not particularly better than last week. However, trading activities have stabilized considerably. This can only be attributed to a shift in supply and demand dynamics, with the primary driver being the parties’ acceptance of prevailing prices.

After continuous declines over several days, the deceleration in stock prices and low liquidity suggest that the most vulnerable stocks have been offloaded, leaving those willing to hold on to their positions. Investors who ‘bite the bullet’ and endure losses contribute to the formation of a bottom. Meanwhile, those holding cash need to decide if they are satisfied with the current discounted prices.

Bottom-fishing activities were more evident today compared to yesterday, with active buying not only during red periods but also with upward momentum. Naturally, not all stocks received strong capital inflows, but the ability to maintain gains is always a positive signal in this situation. If buyers don’t get their desired prices, eventually, those holding cash will have to change their minds. If enough participants and large capital make this shift, demand will strengthen, and price direction will change. Therefore, stocks with larger trading volumes and higher trading liquidity are preferable.

The tug-of-war and intraday volatility also reflect the ongoing supply-demand dispute, which has not yet tilted decisively in favor of either side. While there was a selling wave in the afternoon, it lacked the strength to reverse the upward trend significantly. Going forward, the dispute will likely focus on the green zone, and any downward movements will likely be of limited magnitude. Technically, consecutive sessions with this dynamic will trigger bottom-formation signals across various indicators.

I maintain the view that the market is undergoing a positive correction, and stocks are purchasable. Buying opportunities remain abundant during the session, so it’s essential to time your entries well to optimize resources and avoid getting caught up in the excitement of high-velocity trading.

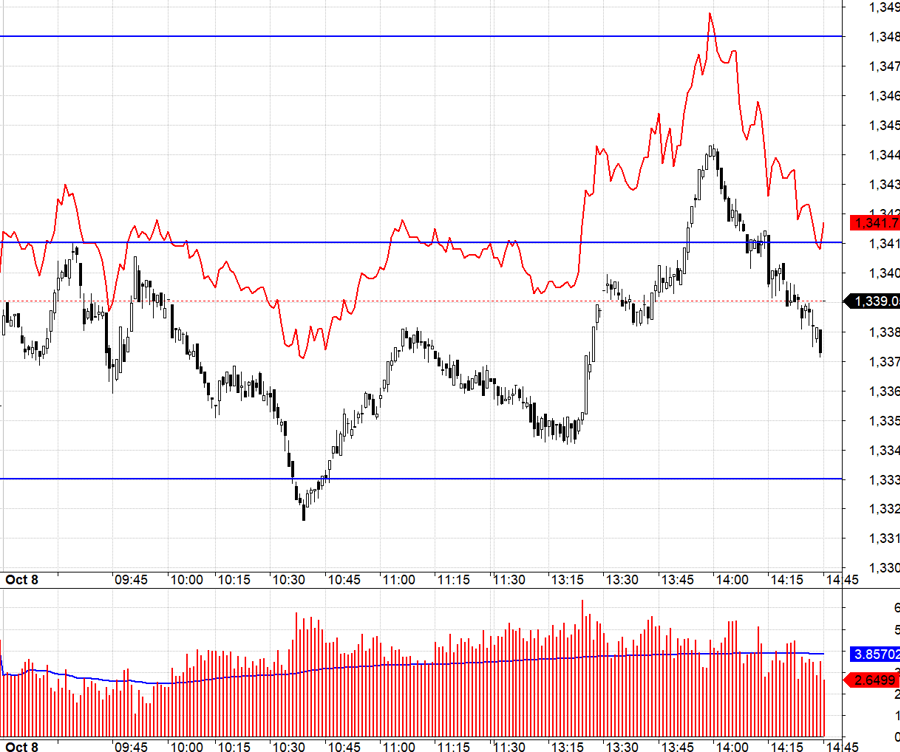

The derivatives market also witnessed a recovery in liquidity today, with foreign investors taking long positions for the first time in three sessions. Basis remains a nagging issue, as when the VN30 decreased intraday, the F1 future contract did not decrease proportionately, and when the VN30 increased, the basis tended to widen. At the start of the session, the VN30 formed two peaks at 1341.xx, an attractive short entry point, but even when the VN30 fell to 1333.xx, the F1 did not decrease significantly. As the VN30 rebounded from 1333.xx, the basis expanded further. Even during the final upward push, the F1 failed to maintain the basis and rise accordingly.

Today’s underlying market sent a clearer signal of supply-demand equilibrium. However, there could still be a need for another supply test, as the current low selling volume requires pressure on large-cap stocks to expand the index’s range and create a more substantial psychological impact. The strategy remains to buy stocks, dynamically long/short futures contracts, and prioritize long positions if there is pressure on large-caps.

The VN30 closed today at 1339.05. The nearest resistance levels for tomorrow are 1341, 1348, 1356, 1366, 1369, and 1376. The support levels are 1333, 1325, and 1318.

“Blog chứng khoán” reflects the personal views of the author and does not represent the opinions of VnEconomy. The assessments and investment views expressed are solely those of the author, and VnEconomy respects the author’s perspective and writing style. VnEconomy and the author are not responsible for any issues arising from the published assessments and views.