Volatility in Investment Channels

Just within the past two weeks, gold ring prices have continuously hit new highs. As of October 7, gold ring prices at renowned brands reached 83.5 million VND per tael. Specifically, Bao Tin Minh Chau currently lists gold ring prices at 82.68-83.58 million VND per tael. Phu Nhuan Jewelry (PNJ) follows suit with prices ranging from 82.7-83.6 million VND per tael. SJC gold bars also maintain their value at 82 million VND per tael for buyers and 84 million VND per tael for sellers. Compared to the beginning of the year, SJC gold bars have increased by over 13%, while gold rings have surged by 30%.

Meanwhile, in the real estate market, prices for apartments and houses in Hanoi’s alleyways continue to soar. According to a recent report by Savills, a renowned market research firm, the average price of new apartments in Hanoi reached 69 million VND per square meter, marking a 28% year-over-year increase. In the secondary market, apartment prices escalated by 41% year-over-year, reaching an average of 51 million VND per square meter.

Regarding residential land, experts from OneHousing, a leading research organization, assert that finding a house with a budget of 3-4 billion VND in Hanoi’s inner city is extremely rare. They also predict that land prices will likely increase steadily rather than surge drastically within a few months.

Illustrative image

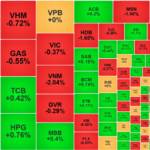

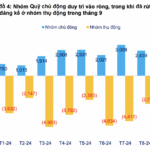

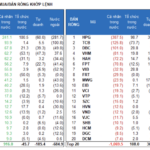

On the other hand, the stock market has witnessed complex movements. According to statistics from the Vietnam Securities Depository (VSD), the VN-Index experienced a prolonged correction in the first half of September, plunging by 40 points before recovering in the latter half of the month. At the close of the last trading session in September, the VN-Index stood at 1,287.94 points, reflecting a slight increase of 0.3% compared to the previous month’s close. Average trading liquidity reached over 643 million shares per session, equivalent to 15,918 billion VND, indicating a decrease of 0.9% in volume and 3.39% in value.

Notably, in September, domestic individual investors opened an additional 158,212 trading accounts. In contrast, domestic institutional investors only added 90 accounts during the same period, bringing the total to 17,371 accounts. The number of new stock accounts opened by domestic individual investors has decreased by more than 50% compared to the previous month.

Which Investment Channel Will Be the Most Attractive?

Providing insights into the potential allure of various investment channels in the upcoming period, Dr. Dinh The Hien, a renowned economic expert, predicts that gold prices from now until the end of 2024 and beyond, into 2025, will be influenced by the outcome of the US elections. He states, “If Donald Trump wins, gold prices are likely to cool down; otherwise, we can expect a further climb in prices.” However, Mr. Hien forecasts a higher probability of gold prices cooling down.

Regarding the real estate investment channel, Mr. Hien believes that the market lacks new momentum, and investors are currently adopting a wait-and-see approach. Delving deeper into this channel, he asserts that, with the government’s policies and improvements in the real estate market, it will be challenging for the market to witness frenzied speculation driven solely by companies leveraging pre-sales to fund projects. He adds that investors, even those engaging in short-term speculation, will now have to rely on their expertise and financial capabilities. While the real estate market may not offer easy profits, it remains the top investment channel in Vietnam for the foreseeable future.

The expert anticipates that it will take until 2026 for the supportive policies to significantly impact the market. “In 2025-2026, the market may experience investment waves driven by individuals with foresight and analytical skills. This development is positive as it contributes to a more mature market and boosts the confidence of the populace,” he adds.

Concerning the stock market, Mr. Hien forecasts a robust wave in the fourth quarter, lasting for several weeks. However, he expects many investors to cash in their profits, causing the VN Index to retreat to around 1250 points by the Lunar New Year holiday. For those with a few billion VND or more seeking investment channels, bank deposits offering 5% interest rates may not be appealing. Instead, they may opt to divert a portion of their funds into the stock market, lured by the prospect of higher returns.

The Stock Market Surge: A Conundrum of Surging Stocks and Drought-like Liquidity

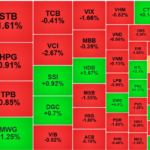

The VN-Index witnessed a significant decline during the afternoon session, plunging below the reference level due to substantial pressure from the blue-chip group. While bottom-fishing funds became more active at lower price levels, facilitating the recovery of many stocks, the buying momentum failed to spread sufficiently, causing today’s overall liquidity to sink to a 14-session low.

Profits Pressure Mounts, Blue-Chip Stocks Stay Resilient

The market showed signs of weakening in the afternoon session as selling pressure began to weigh on prices. Bottom-fishing stocks were aggressively offloaded, putting pressure even on the blue-chip group while pushing mid and small-cap stocks lower. Despite this, the VN30-Index outperformed, propping up the VN-Index, although the gain narrowed significantly.

The Flow of Funds: Consecutive Failures at the 1300-Point Peak – Is There Still a Chance for a Breakthrough?

Over the past five trading sessions, the VN-Index has witnessed two attempts to breach the 1300-point mark, yet it fell short of success. The notable surge in trading volume during these failed attempts leaves a profound impression of distribution activities.