After the recent adjustment, the VN-Index has quickly regained its growth momentum, and many investors expect the index to surpass the 1,300-point peak in 2024. Indeed, in the past year, after multiple declines from the 1,300 region, it only took 1-2 months for the VN-Index to rebound to its previous heights. With this accumulation and a currently positive macroeconomic context, the outlook remains promising.

However, according to Dr. Phung Thai Minh Trang, Head of Finance and Banking at Hoa Sen University, while the VN-Index is still expected to perform well until the end of the year, investors should maintain realistic expectations. Additionally, a more meticulous approach to investment opportunities is warranted.

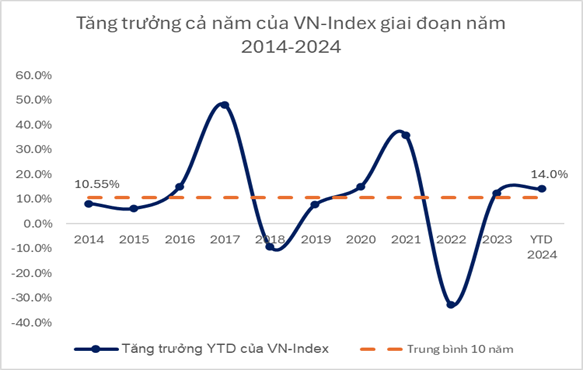

Specifically, since the beginning of the year, the VN-Index has risen by nearly 14%, outpacing the 10-year average of 10.54%. This means that the VN-Index has already exceeded expectations for multiple years. Should the market reach the 1,300-point milestone, the VN-Index’s growth compared to the beginning of the year could exceed 15%. Furthermore, considering the market’s dividend yield of approximately 2% per annum, the potential profit rate could reach 17% – a highly positive figure typically seen only when the economy demonstrates significant promise.

In contrast, the latest report from the General Statistics Office for the first nine months of the year shows a GDP growth rate of about 6.82% year-on-year, which is not exceptionally high, even considering the low growth in 2023. On the other hand, credit growth, while recovering to reach 8.53%, remains modest compared to pre-pandemic years.

Overall, while the economy has shown signs of recovery, the first nine months were not without challenges. Additionally, the impact of recent natural disasters will require greater efforts to achieve the GDP growth target of 6-6.5%. Furthermore, global geopolitical fluctuations will also pose challenges that investors should consider before making investment decisions.

“In this context, I believe that a growth rate of below 15% for the VN-Index in 2024 would be appropriate. It’s also important to note that market psychology can influence the index, and there is a possibility that the VN-Index could surpass 1,300 points and achieve more outstanding performance. However, without fundamental support, the market’s growth may not be sustainable,” said Dr. Trang.

Regarding investment positioning, Dr. Trang believes that the advantage currently lies with investors holding stocks. Those who have held stocks since the beginning of the year have likely already achieved above-expected returns, despite the market’s minor adjustments. With the biggest holiday of the year approaching, organizations and individual investors will likely aim to realize their investment profits.

Furthermore, the expectations for the entire year have already been largely reflected in the market’s upward trend, and new catalysts for a market boom have yet to emerge. Consequently, investors who switch to holding cash may incur opportunity costs in the last three months of the year. These factors put investors holding stocks in a better position to negotiate better prices compared to those holding cash.

There will still be opportunities for cash-holding investors during periods of adjustment. Additionally, the expected holding period should be considered to align with appropriate expectations.

“After taking advantage of opportunities during periods of adjustment, if your investment horizon is less than three months, a reasonable profit expectation for stocks is around 5-10%. While there may be some stocks that outperform this range, they will be rare. If your horizon is 6-12 months, the expected profit could exceed 20%. The most significant expectations are still for 2025, when the economy is projected to grow strongly and the Fed will likely lower interest rates more aggressively. Therefore, long-term investors should remain patient,” said Dr. Trang.

In summary, investment opportunities in the fourth quarter of this year may not be as abundant as before. However, adjustments will provide cash-holding investors with opportunities to accumulate stocks. It’s important to consider the expected realization period to align with appropriate growth expectations. For short-term holdings, investors should not expect too much due to the lack of new catalysts, while long-term investors need to exercise patience, as strong macroeconomic drivers are expected to persist into 2025.

The Stock Market Surge: A Surprising Rise with Liquidity Still Lacking

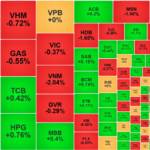

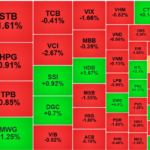

The VN-Index witnessed a significant decline during the afternoon session, plunging below the reference level due to substantial pressure from the blue-chip group. While bottom-fishing funds became more active at lower price levels, facilitating the recovery of many stocks, the buying momentum failed to adequately spread across the market, resulting in today’s overall liquidity dipping to a 14-session low.

Profits Pressure Mounts, Blue-Chip Stocks Stay Resilient

The market showed signs of weakening in the afternoon session as selling pressure began to weigh on prices. Bottom-fishing stocks were aggressively offloaded, putting pressure even on the blue-chip group while pushing mid and small-cap stocks lower. Despite this, the VN30-Index outperformed, propping up the VN-Index, although the gain narrowed significantly.