On the program “Order Matching 10/14/2024: A Rising Tide Lifts All Boats,” expert Tran Hoang Son – Market Strategy Director of VPBank Securities Joint Stock Company (VPBankS) shared notable insights on factors that could drive capital inflows into the stock market in the coming time. Mr. Son also expressed his expectations for a turnaround in foreign investors’ activities and provided appropriate investment strategies.

Expert Tran Hoang Son – Market Strategy Director of VPBank Securities Joint Stock Company (VPBankS)

|

Three Factors to Drive Capital Inflows into the Stock Market

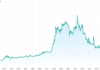

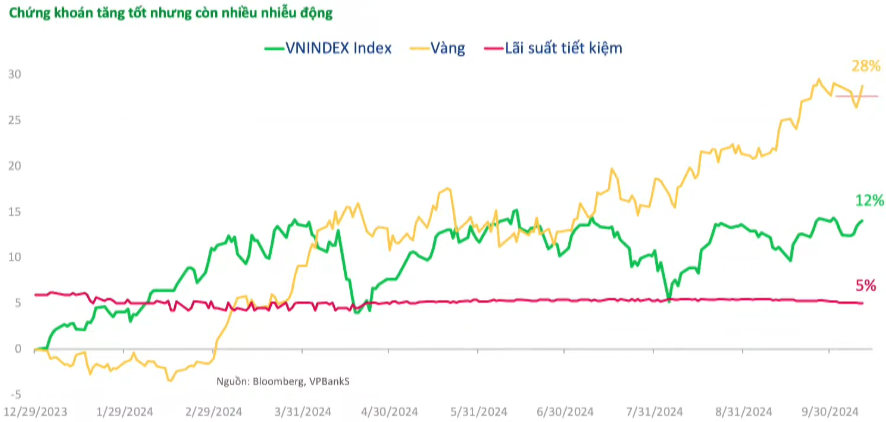

According to Mr. Son, in 2024, gold experienced a strong upward trend and was one of the preferred investment assets for individuals. With an increase of about 28% since the beginning of the year, gold has been a competitive investment channel compared to securities. Meanwhile, the average savings interest rate is at 5% for a 12-month term. It is evident that the 12% performance of the VN-Index is higher than the savings interest rate but falls short of the gold channel.

Since the beginning of the year, the VN-Index has risen by approximately 12%, but there have been a few adjustments in April and August, causing the performance to drop to 5% at times. Therefore, volatility is a barrier that makes investors hesitant to inject more money into the market. The fact that the VN-Index has failed to surpass the 1,300 threshold multiple times has also somewhat narrowed the capital inflows.

Source: VTV Money

|

There are a few narratives that will encourage capital inflows into the stock market in the near future. First, economic recovery will lead to increased corporate profits, thereby driving capital back into the market.

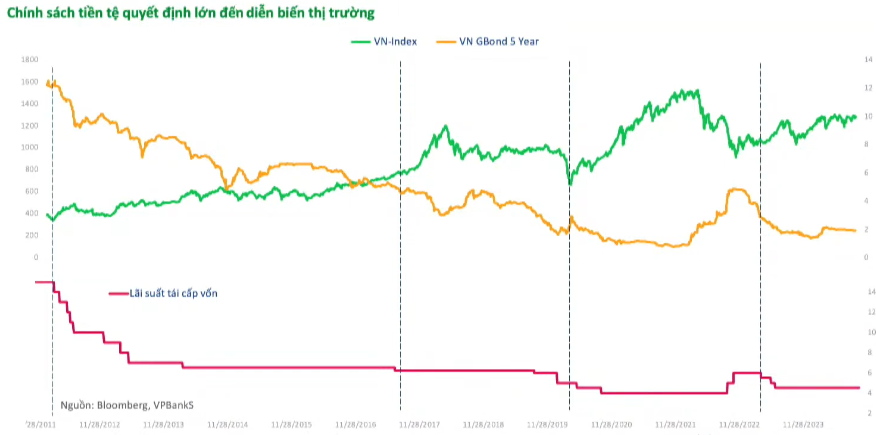

The second factor is monetary policy. In the last decade, when the refinancing interest rate has been adjusted downward, the stock market has tended to rise in the long term. During the interest rate reduction phase from 2011 to 2016, the yield on 5-year government bonds decreased rapidly, stimulating capital inflows into the stock market. During the COVID-19 pandemic in 2019-2020, the refinancing interest rate hit a historical low, and the yield on government bonds also decreased, while the stock market trended upward. By the end of 2022, the refinancing and rediscount rates started to decline from record highs, and the yield on 5-year government bonds also fell after peaking, while the stock market bottomed out and rebounded.

Mr. Son expects that if the Fed and other central banks continue to cut interest rates, narrowing the gap between the VND and USD, exchange rate issues will not cause too much pressure. As a result, the State Bank of Vietnam will have room to cut the refinancing interest rate by about 25 basis points by the end of 2024 or early 2025, enabling the stock market to recover similarly to the period from March to May 2023.

Source: VTV Money

|

The third factor is the market upgrade story. According to the latest update from FTSE Russell, Vietnam remains on the watchlist for an upgrade from a frontier to a secondary emerging market and has received some positive assessments, especially Circular 68 issued by the Ministry of Finance on August 19, which removed the margin trading restriction for foreign institutional investors.

High Expectations for a Turnaround in Foreign Capital Flows

Analyzing the foreign capital flow situation over the past nine months, Mr. Son identified two influencing factors. Firstly, Thailand’s announcement of taxing overseas investments caused a significant withdrawal of Thai-sourced capital from Vietnam, resulting in a net selling wave from January to April 2024. Secondly, the interest rate differential between VND and USD, especially the tension from June to August 2024, with the spread reaching up to 500 basis points at times.

At the present, foreign investors have narrowed their net selling, indicating the first positive signal. Additionally, a recent Bank of America report showed that inflows into emerging markets reached a record high since 2007, suggesting a shift in capital as the Fed and ECB lowered interest rates.

Mr. Son believes that the upgrade story will attract foreign capital to Vietnam in 2025 and 2026. More optimistically, in the short term, the Diamond ETF, which absorbed about $19 million, a substantial amount in recent months, will deploy capital in the coming period.

Cash or Stocks? Which Industries Should Investors Focus On?

In Mr. Son’s opinion, the Vietnamese stock market will be very positive in the medium and long term, with many factors to anticipate, such as interest rate cuts, economic recovery support packages after Typhoon Yagi, and gradual improvements in the upgrade story after the March 2025 review. By September 2025, the market may achieve an upgrade.

At the moment, investors can maintain a 50% stock and 50% cash ratio to advance and retreat reasonably. If the VN-Index surpasses 1,300, they can increase their stock allocation, and if there is profit-taking pressure, they can reduce it to a safe level. However, in the medium and long term, investors should hold a certain proportion of stocks to stay close to the market because opportunities can arise very quickly.

Mr. Son assessed that the 1,300 level remains a psychological challenge for short-term investors, so they should monitor the market while managing risks as fluctuations may occur.

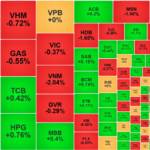

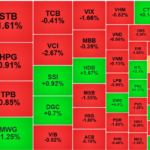

The recent market recovery wave came from the VN30 group, mainly bank stocks, while the Mid Cap group has mostly recovered and traded sideways, and the Small Cap group has been weak. Therefore, surpassing the 1,300 threshold depends on the performance of the VN30 group.

Regarding the banking sector, as the prices of some group 2 and 3 bank stocks are attractive, it is quite reasonable to accumulate them for the long term. When the economy recovers, the banking group will witness robust profit growth. With the forecast of economic recovery in 2025 due to lower interest rates, banks can reduce provisioning costs, thereby boosting profits.

For the Mid Cap group, if there is a correction, there will be many stocks with reasonable buying points, and investors should focus on stocks benefiting from public investment, retail, and consumer demand.

The Stock Market Surge: A Surprising Rise with Liquidity Still Lacking

The VN-Index witnessed a significant decline during the afternoon session, plunging below the reference level due to substantial pressure from the blue-chip group. While bottom-fishing funds became more active at lower price levels, facilitating the recovery of many stocks, the buying momentum failed to adequately spread across the market, resulting in today’s overall liquidity dipping to a 14-session low.

Profits Pressure Mounts, Blue-Chip Stocks Stay Resilient

The market showed signs of weakening in the afternoon session as selling pressure began to weigh on prices. Bottom-fishing stocks were aggressively offloaded, putting pressure even on the blue-chip group while pushing mid and small-cap stocks lower. Despite this, the VN30-Index outperformed, propping up the VN-Index, although the gain narrowed significantly.