Buy LCG with a target price of VND 13,900/share

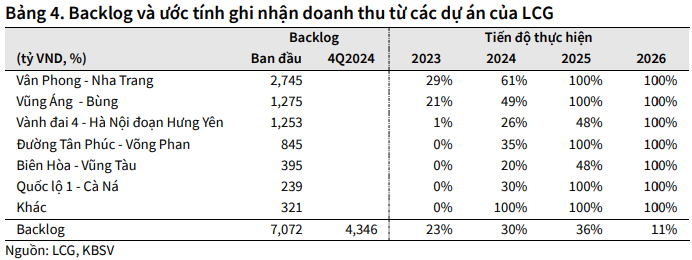

KBSV Securities Company (KBSV) believes that the main growth driver for Lizen Joint Stock Company (HOSE: LCG) in the period of 2024-2026 comes from large public investment projects (expressways), with an estimated backlog of more than VND 4,300 billion as of Q3 2024. The two largest packages are the Vung Ang – Bung and Van Phong – Nha Trang expressways, which are making good construction progress with a disbursement rate of 87%/51% of the 2024 plan (as of August 2024, according to the report of the Ministry of Finance). Both projects are expected to complete the main route before 04/30/2025, and are expected to be completed and accepted in Q2 2025, in line with the planned deployment. With the success in the construction and handover of the current expressways, LCG‘s capabilities will be significantly improved, creating a competitive advantage in bidding for large public investment projects in the period of 2026 – 2030. KBSV estimates LCG‘s revenue in 2024/2025 to reach VND 2,322 billion and VND 2,984 billion, respectively (up 16% and 29% over the previous year).

KBSV positively evaluates LCG‘s construction, implementation, and project handover capabilities, supported by advance payments from investors, which have helped improve the number of receivable turnover days significantly in Q2 2024 (reaching 178 days, compared to 357 days in the same period). Taking advantage of advance payments from investors creates room for LCG to proactively construct, offset capital, and debts with subcontractors and banks.

On the other hand, the transfer contract worth VND 298 billion (cancellation cost of VND 73 billion) related to the Chu Ngoc Solar Power Project (total capacity of 40 MW, phase 1 has a capacity of 15 MW) has the last day of the contract implementation as of 09/30/2024. KBSV estimates that after the successful transfer of the above project, LCG can record a sudden financial profit of VND 108 billion in the second half of 2024.

With the above expectations, KBSV recommends buying LCG with a target price of VND 13,900/share.

See more here

Buy PTB with a target price of VND 79,200/share

BSC Securities Company (BSC) assesses that in August 2024, the wood export of Phu Tai Joint Stock Company (HOSE: PTB) reached USD 6.7 million (up 25% over the same period last year) with the main driver coming from the recovery of orders for indoor wooden furniture products. In particular, outdoor wooden tables and chairs recorded USD 1.3 million (up 5%); indoor wooden furniture reached USD 2.5 million (up 53%); small wooden furniture and decoration reached USD 2.89 million (up 16%).

BSC evaluates that up to the present time, the export wood business situation of PTB is suitable and in line with the expectations of this securities company when the export value maintains a positive recovery compared to the same period. For the downward trend of export value by month, BSC believes that this is mainly due to seasonal factors (May-September is the low season for Vietnam’s wood exports).

For the remainder of 2024 and 2025, BSC maintains the view that the recovery of wood exports will continue to recover thanks to: (1) US furniture retail sales in July 2024 recorded USD 11.3 billion (flat over the same period last year but up 2% from the previous month) has tended to bottom out and recover, BSC believes that this trend will continue in the remainder of 2024 and 2025 when (i) mortgage lending interest rates in the US have fallen and are expected to continue to fall after the Fed cut interest rates (ii) consumption in the US is expected to recover in late 2024 and 2025.

For the stone segment, BSC adjusted down the domestic market growth from 16% to 8% due to (1) Q2 2024 revenue was lower than 10% compared to BSC’s expectations due to the real estate market in the southern provinces and Ho Chi Minh City is still relatively slow. (2) BSC maintains the expectation that the demand for bricks and tiles will recover in 2025.

Prospects for supplying stones for Long Thanh Airport, BSC believes that if winning the bid, PTB will start recording in the business results of 2026 due to:

(1) PTB expects to become a stone supplier for the Long Thanh Airport project thanks to (i) owning two granite mines (ii) being one of the few contractors with machinery capable of producing materials that meet the technical requirements of the airport (iii) the current capacity of PTB‘s stone factory is estimated at 4.4 million m2 and is only operating at 70% capacity, so it can fully meet the volume requirements of the work (iv) the bidding for the tile supplier is expected to take place in late 2024.

(2) The Long Thanh Airport Project Phase 1 is expected to consume 500,000 m2 of stone tiles, PTB estimates the contract value to bring in revenue of about VND 250-300 billion.

(3) Currently, the passenger terminal of the project has completed all the reinforced concrete columns, beams, and floors of the 1st, 2nd, and 3rd floors, and the construction of the 4th floor has also reached 100% of the area. It is expected that by the end of 2025, the construction of the frame will be completed and the tiling will be carried out at the same time.

In the export market: BSC maintains the expectation that the export market will recover, focusing on 2025 when the demand in the main markets starts to warm up again.

For the real estate segment, BSC expects the Phu Tai Central Life project to be recognized in 2025 thanks to: (1) The project is expected to hand over the house to the buyer from the middle of 2025, the project is currently progressing as expected, as of the end of August 2024, the construction contractor has completed the concrete pouring of the 13th floor of the building. (2) The two launches in Q1/2024 and Q3/2024 have basically been sold out as soon as they are launched (i) prime location in Quy Nhon City (ii) full legal status, supporting buyers with the book right after the house is handed over (iii) PTB aims at the actual housing needs of buyers.

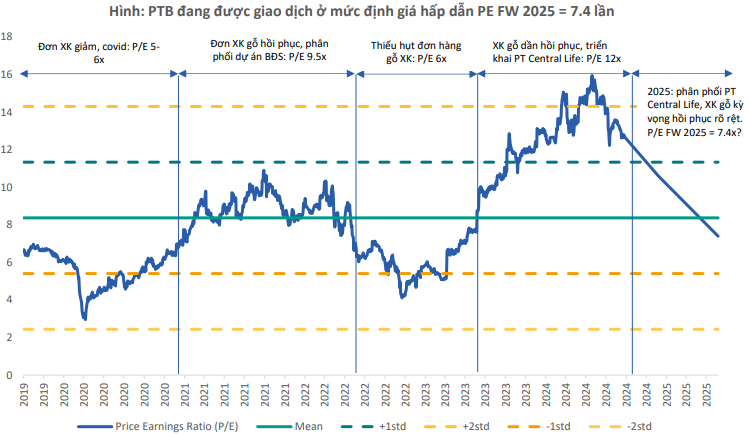

BSC evaluates that the present time is a reasonable time to buy after the PTB stock price has been discounted relatively back to a low valuation with a projected P/E 2025 of 7.4 times compared to: (1) 45% growth prospect in 2025 thanks to (i) recovery of wood exports compared to the same period (ii) recognition of Phu Tai Central Life real estate project (2) The average P/E in 2021 was 9.5 times when this was the period (i) has the same growth of 44% (ii) similar context, the same period of wood industry recovery and distribution of Phu Tai Residence real estate project.

In 2024, BSC forecasts that PTB will record net revenue and net profit of VND 6,037 billion (up 7.5% over the previous year) and VND 383 billion (up 31%), equivalent to a projected EPS of 2024 of VND 5,723/share and a projected P/E of 2024 of 10.8 times. The main change comes from: (1) Stone segment revenue decreased by 4% due to adjusted domestic revenue.

In 2025, BSC maintains its forecast that PTB will record net revenue and net profit of VND 7,512 billion (up 24.4%) and VND 556 billion (up 45%), equivalent to a projected EPS of 2025 of VND 8,314/share and a projected P/E of 2025 of 7.4 times. BSC notes that in its assumption, real estate profit accounts for about 10% of the profit structure in 2025.

With the above factors, BSC gives a recommendation to buy PTB with a target price of VND 79,200/share.

See more here

Buy HAH with a target price of VND 48,259/share

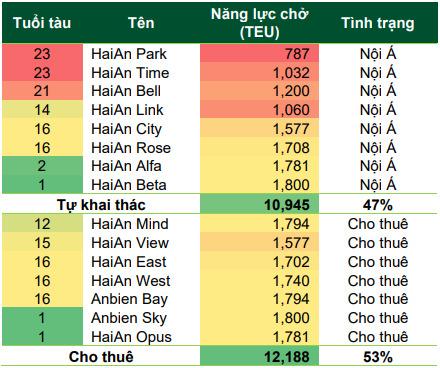

Vietcombank Securities Company (VCBS) said that in July 2024, Hai An Transport and Stevedoring Joint Stock Company (HOSE: HAH) received the Opus ship, the last newly built ship in the project of 4 newly built ships delivered from the end of 2023 to now. Thus, with these 4 new ships, HAH has increased its fleet capacity by 45% compared to the beginning of 2023. (ship price is about USD 27 million, breakeven cost of new ship is USD 14,000/day).

In September 2024, HAH approved the investment policy to buy more used container ships, Panamax size (3,500-5,000 TEU) to prepare for the expansion of production and business activities. HAH‘s ships are all size from 787-1,800 TEU. Currently, HAH has 3 ships over 20 years old, namely HaiAn Park, Time, and Bell. VCBS believes that these 3 ships have been almost fully depreciated and have very low investment costs. Currently, the price of a 25-year-old ship for Feeder and Handy ships is from USD 4-10 million. The price of a 10-year-old Panamax ship is USD 46.8 million (nearly VND 1,200 billion), and a 15-year-old ship is USD 33 million (VND 840 billion). If it increases the purchase of new ships, HAH can sell old ships and record good abnormal profits when ship prices are still high. VCBS believes that by Q1/2025, the price of old ships will still be good due to the alliances after the change (02/2025) and rearranging their service routes, the demand for ships is still positive. (it takes about 2 years for a new ship to be delivered)

VCBS believes that the purchase of 4 new ships by HAH ordered in 2022 and delivered in late 2023-2024 is a quite reasonable price and much better than the previous batch of ships bought at high prices and delivered in 2021-2022 when ship prices were at their peak.

Due to the rerouting of the Suez Canal through the Cape of Good Hope from the end of 2023 and the high congestion at ports in the second and third quarters of 2024, the need to add more ships for shipping lines is quite large, and with the change of alliances, the world’s Top shipping lines after the deadline of 02/2025, shipping lines that lack transport capacity have had to invest heavily in new ships despite the high ship prices recently. (old ship prices increased more than new ship prices)

Currently, HAH has 7 ships for time charter (53% of fleet capacity), of which 2 new ships are for time charter (Anbien Sky & Opus) and 2 ships are for self-operation (Alfa & Beta).

The two new ships Mind and Opus are both chartered until the end of the year, with Opus signed until 07/2026. With the spot price fluctuating strongly in the recent period, self-operation will benefit more than time charter, and time charter with a short time frame will be preferred as the time charter price often has a lag compared to the spot price.

The re-signing price of the ships has improved compared to the beginning of the year, and the new ships signed in Q3.24 all have a price of USD 15-18,000/day compared to the rates of USD 14-15,000/day at the beginning of the year. The re-signing of contracts at high prices ensures a positive result for HAH in the second half of 2024.

The time charter price has a lag and is less volatile than the spot price. Currently, the spot freight rate continues to decrease after peaking in July. With freight rates increasing sharply from May to July, shipping lines are still pushing for new orders and peaking in August with a record new order of 1.4 million TEUs. In addition, after 02/2025, when the 2M alliance ends and new alliances are formed, shipping lines will also promote new ship investments for a new round of capacity competition.

In the self-operating ship segment, in July 2024, HAH adjusted the freight rate for domestic routes down by 10-37%, while the freight rate for international routes remained the same as before, but the surcharge for international routes was adjusted up by 7-13% compared to the beginning of the year.

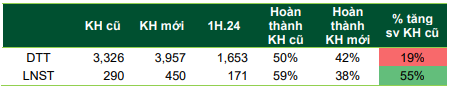

After the positive business results in the first half of 2024, although only completing 50% of the revenue plan and 59% of the profit plan, HAH has a resolution to adjust the business plan for 2024 as follows:

Source: VCBS

|

The volume of port and ship exploitation according to the new adjusted plan increased slightly by 1.5-5.7% compared to the old plan. VCBS believes that HAH is quite confident in adjusting the profit plan while the old plan has only completed 59%.

In July 2024, HAH approved the transfer of the entire capital contribution of the subsidiary – Cai Mep Luu Nguyen Port Service Joint Stock Company in Phu My town, Ba Ria – Vung Tau province. This is a company that HAH bought in 12/2023 and holds 51.54% with a total capital of VND 124.4 billion. The area is more than 31 ha (310,508 m2) is expected to be used as a container yard and cargo storage. According to the explanation, the land has been paid for land use fees once and has been granted a land use right certificate since May 2020. If calculated at the current market price, VCBS believes that if Luu Nguyen is divested, HAH can record abnormal profits from this transaction.

The General Secretary and President Encourages Francophone Community to Invest in Semiconductors and AI in Vietnam

In his address at the Franco Tech Innovation and Creativity Forum, held in Paris, France, on October 4th, as part of the 19th Francophonie Summit, Comrade To Lam, General Secretary and President, emphasized the importance of innovation and collaboration within the Francophonie community.

“The Danang – Thailand Economic Partnership: A Recipe for Mutual Success”

The clean energy, oil and gas, logistics, retail, agricultural, and industrial waste management sectors present themselves as fertile ground for bilateral cooperation. These industries, facilitated by the East-West Economic Corridor (EWEC), offer a wealth of opportunities for both parties to collaborate and thrive.

The Transport Ministry Proposes Alterations to the Implementation Plan for the Construction of Ho Chi Minh City’s Ring Road 4

The Ministry of Transport has proposed a plan to the Ministry of Planning and Investment and the People’s Committee of Ho Chi Minh City to develop the city’s Ring Road 4. This proposal highlights the ministry’s proactive approach in addressing the city’s infrastructure needs and enhancing its transportation network.