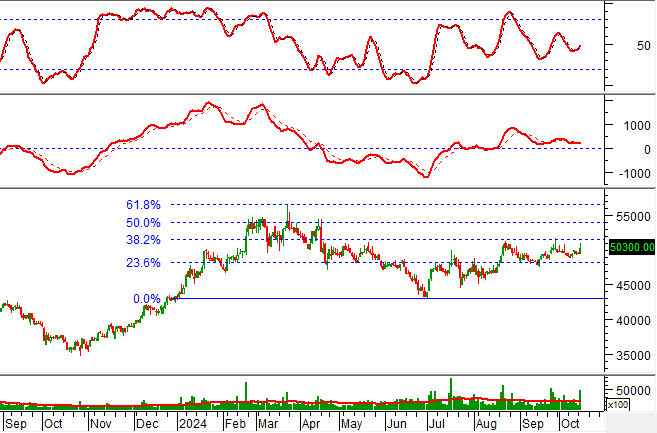

Technical Signals for VN-Index

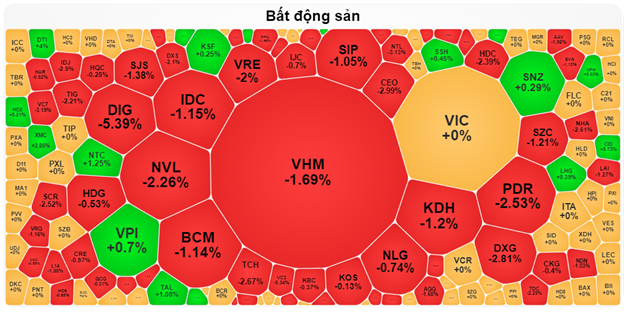

During the trading session on the morning of October 15, 2024, the VN-Index declined, alongside a significant increase in trading volume. This indicates a pessimistic sentiment among investors.

At present, the index is fluctuating around the Middle Bollinger Band, as the Bollinger Bands are narrowing (Bollinger Squeeze). This suggests that the sideways trend is likely to persist.

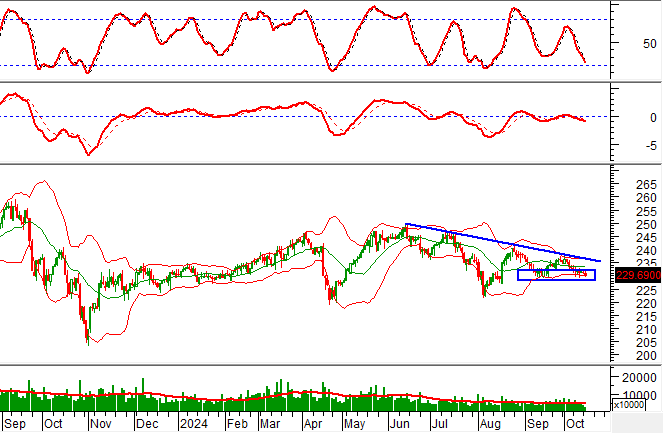

Technical Signals for HNX-Index

On October 15, 2024, the HNX-Index witnessed a decline, along with a notable surge in trading volume, reflecting investors’ pessimistic sentiment.

Additionally, the HNX-Index is retesting the September 2024 low (around 228-232 points) while the Stochastic Oscillator continues downward, following a previous sell signal. Should the index break below this support area, the downside risk could heighten in upcoming sessions.

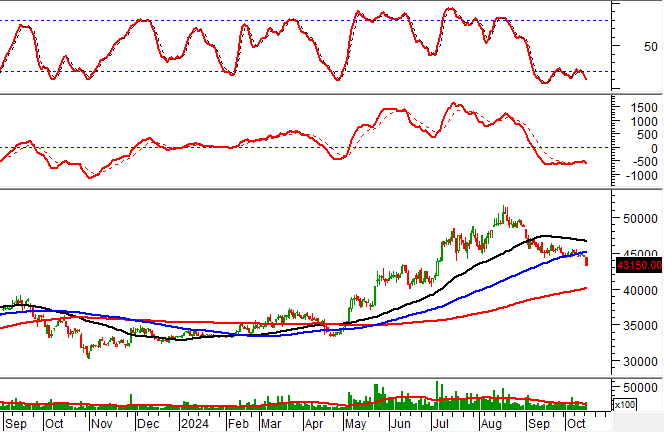

BID – Joint Stock Commercial Bank for Investment and Development of Vietnam

On the morning of October 15, 2024, BID witnessed an increase in its stock price, accompanied by a trading volume that surpassed the 20-session average, indicating optimistic investor sentiment.

Furthermore, the stock price is retesting the 38.2% Fibonacci Projection level (approximately 50,700-52,300), while the MACD indicator has generated a buy signal. Should the stock price successfully breach this resistance zone, a short-term bullish scenario could unfold in the upcoming sessions.

PLX – Vietnam Oil and Gas Group

During the morning session of October 15, 2024, PLX experienced a decline in its stock price, coupled with a significant increase in trading volume that exceeded the 20-session average, reflecting investors’ pessimistic outlook.

Additionally, the stock price extended its downward trajectory after falling below the 100-day SMA, while the Stochastic Oscillator maintains its previous sell signal, suggesting that the bearish prospect could persist in the near term.

Vietstock Consulting’s Technical Analysis Team

Are Stocks Running Out of Steam for the Final Quarter?

The VN-Index is poised to surpass the 1,300-point mark by the end of the year, according to experts. However, they caution that this upward trajectory may not be sustainable in the long run if it is not supported by fundamental factors.

The Stock Market Surge: A Surprising Rise with Liquidity Still Lacking

The VN-Index witnessed a significant decline during the afternoon session, plunging below the reference level due to substantial pressure from the blue-chip group. While bottom-fishing funds became more active at lower price levels, facilitating the recovery of many stocks, the buying momentum failed to adequately spread across the market, resulting in today’s overall liquidity dipping to a 14-session low.