In the latest strategy update report, TPS Research observed that the market continued to struggle at the 1,300-point resistance level in September 2024. Looking at the monthly chart, the VN-Index has maintained its highest point within the 1,280-1,300 resistance zone for the past seven months. Additionally, liquidity has been on a downward trend since June, raising the question of whether the market will break through the 1,300-point resistance in October.

Based on technical indicators, TPS Research has outlined two scenarios for the market in October 2024.

The analysts lean towards the positive scenario, which they believe has a 70% chance of occurring, where the VN-Index breaks above 1,300 points and initiates a new upward trend. This scenario unfolds with strong buying pressure, increased liquidity, and confirmation of a new bullish trend.

In this positive scenario, the VN-Index requires a liquidity surge beyond the 25 trillion VND threshold, coupled with a breakthrough in the resistance level. The index’s potential target price range is expected to reach 1,340 points.

For the neutral scenario, which TPS assigns a 30% probability, the VN-Index is anticipated to consolidate around 1,220 points and seek upward momentum. In this case, the market may face challenges at the 1,300-point resistance level, leading to a subsequent correction. However, from a mid to long-term perspective, the VN-Index is expected to continue its upward trajectory. The potential price correction zones for the VN-Index are identified as 1,260 and 1,280 points.

Source: TPS

|

Regarding investment strategies for October, TPS Research suggests monitoring sectors such as banking and securities.

Specifically, for the securities sector, monetary policies like Directive No. 14/CT-TTg, aimed at addressing production challenges, will boost the macroeconomy and enhance access to capital from both domestic and foreign sources. As a result, the liquidity of the securities sector has witnessed notable improvements and sustained momentum since the beginning of the year.

In the remaining months of the year, the US Federal Reserve’s decision to lower interest rates by 0.5% sets a favorable precedent for international capital inflows into the Vietnamese stock market. This also alleviates pressure on monetary policies, ensuring continued economic liquidity and fostering a positive environment for the securities market.

The Soaring Stock: How the Petroleum Company’s Shares Rose by Almost 100% in Six Consecutive Trading Sessions, with a Familiar Explanation.

The stock of the Joint Stock Company for Additive and Petroleum Product Development (UPCoM: APP) surprised investors with a streak of six consecutive session gains from October 4-11, doubling its market price in just one week to reach VND 8,500 per share.

The Stock Market Surge: A Surprising Rise with Liquidity Still Lacking

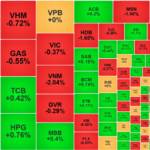

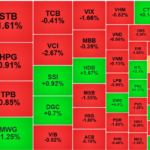

The VN-Index witnessed a significant decline during the afternoon session, plunging below the reference level due to substantial pressure from the blue-chip group. While bottom-fishing funds became more active at lower price levels, facilitating the recovery of many stocks, the buying momentum failed to adequately spread across the market, resulting in today’s overall liquidity dipping to a 14-session low.

The Golden Conundrum: Where Will Money Flow as Property Prices Rise, Stocks Fluctuate, and Gold Soars?

According to economic experts, the real estate market remains an attractive investment avenue, despite a lack of significant momentum at present. This prediction stands in contrast to the potential decline in gold prices expected later this year.

Profits Pressure Mounts, Blue-Chip Stocks Stay Resilient

The market showed signs of weakening in the afternoon session as selling pressure began to weigh on prices. Bottom-fishing stocks were aggressively offloaded, putting pressure even on the blue-chip group while pushing mid and small-cap stocks lower. Despite this, the VN30-Index outperformed, propping up the VN-Index, although the gain narrowed significantly.