In its latest strategy update report, KBSV Research observes that the Vietnamese stock market is entering a crucial phase in 2024, buoyed by positive signals from macroeconomic factors and monetary policies.

For the outlook in the second half of 2024, the analysis team identifies five key factors shaping the trends in the Vietnamese stock market:

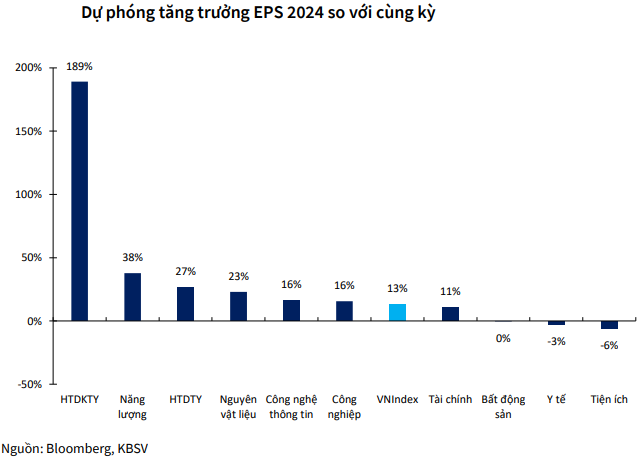

Firstly, the recovery trend in listed companies’ profits continues, supporting the overall market trend in Q4. KBSV Research forecasts a 13% average EPS growth for listed companies on the HOSE exchange.

Secondly, the US Federal Reserve’s rate cut boosts global stock markets.

Thirdly, with the Fed’s 50-basis point rate cut, currency pressure has eased significantly. This enables the State Bank to maintain its loose monetary policy, with low-interest rates stimulating credit demand and economic growth.

Fourthly, the US presidential election in November 2024 presents a significant unknown for global stock markets, including Vietnam. A potential Donald Trump re-election could bring trade policy risks for Vietnam. Trump has previously announced plans to increase import taxes by up to 10% on goods from several countries, including Vietnam, which could impact exports and, consequently, the economy and stock market.

Fifthly, the weakness of the Chinese economy has been confirmed by disappointing macroeconomic indicators. Given the high level of economic integration between the two countries, this also poses a notable risk to the Vietnamese stock market.

In summary, KBSV Research maintains its VN-Index expectation for the end of 2024 at 1,320 points, corresponding to a market P/E of 15 times.

“In the first half of Q4, the market will fluctuate, especially as the VN-Index approaches the resistance threshold of 1,300 points in the absence of supportive information”, the analysts predict, forecasting a clearer upward trend in the second half of the quarter as financial results are released and Q4 expectations materialize.

Regarding industry prospects for the second half, KBSV Research is positive about the banking, securities, real estate, industrial real estate, port, and oil and gas sectors. The chosen investment themes for Q4 include economic recovery, progress towards market upgrades, La Nina, public investment, and FDI attraction.

Earlier, on September 18, 2024, the Ministry of Finance officially issued Circular No. 68/2024/TT-BTC, amending and supplementing a number of articles of Circular No. 120/2020/TT-BTC on securities trading.

KBSV Research considers this a significant step in meeting the FTSE Russell’s upgrade criteria by allowing foreign investors to buy stocks without requiring sufficient order placement funds and enabling settlement on T+1 or T+2 days.

However, the analysts believe that the earliest the Vietnamese market will receive official news of an upgrade is in March 2025 during the FTSE Russell’s internal review, with the effective date one year later.