On August 29, 2024, the State Securities Commission requested clarification from KHG regarding the master developer and relevant information pertaining to the new urban area and Tan Qoi entertainment and resort complex project. In its explanation dated September 5, KHG stated that the Tan Qoi project is currently being handled by Khai Minh Land in terms of legal procedures. KHG also noted that Khai Minh Land is not its subsidiary.

Regarding the project, KHG shared that the Tan Qoi new urban area is located in Binh Tan district, Vinh Long province, spanning 330 hectares with a total expected investment of VND 6 trillion. The project encompasses nearly 10,000 units of various types, including apartments, shophouses, and villas, and is expected to accommodate a population of 15,000 people.

|

According to our understanding, the province of Vinh Long has not disclosed any information about the master developer of the Tan Qoi new urban area project. The project is still entangled in the process of selecting an investor and has not yet organized the investor selection process in accordance with bidding laws and regulations. |

In terms of legalities, the project has received approval for its 1/500 scale planning design and has completed the procedures for planning announcement. Up to now, Khai Minh Land is still coordinating with departments to finalize the procedures for investment listing and land clearance.

KHG stated that it is collaborating with Khai Minh Land during this phase to obtain the priority right to be the exclusive developer and distributor of all products, as well as to purchase wholesale (if available) when the project meets the conditions for business operations.

Tan Qoi New Urban Area and Entertainment and Resort Complex. Source: KHG’s 2023 Annual Report

|

The Connection Between Khai Minh Land and KHG

According to KHG’s reviewed semi-annual financial statements for 2024, as of June 30, 2024, KHG recognized several items related to Khai Minh Land, including: short-term receivables from customers exceeding VND 32.5 billion (compared to nearly VND 726 million at the beginning of the year); escrow for secondary brokerage contracts of VND 122.5 billion (VND 190 billion at the beginning of the year); and other escrow deposits of VND 1,847.6 billion. Additionally, KHG also recorded financial revenue of over VND 55 billion in the first half of 2024 from Khai Minh Land.

The business cooperation contract between KHG and Khai Minh Land states that KHG will participate in contributing capital to the project with an amount of VND 1,387.6 billion, equivalent to 25% of the total investment. In return, KHG will receive 25% of the project’s products. Furthermore, KHG will be the exclusive developer and distributor of all project products when they meet the conditions for business operations. However, in its financial statements, as of the end of June 2024, KHG recorded an escrow deposit of VND 1,847.6 billion related to this business cooperation contract (an increase of VND 3 billion compared to the beginning of the year).

KHG’s financial statements also mentioned that Ms. Nguyen Thi Le Thuy, Director of KHG’s Business Block and sister of Chairman Nguyen Khai Hoan, is a major shareholder of Khai Minh Land.

Who is Khai Minh Land?

According to its business registration, Khai Minh Land was established in July 2016, with its head office located in District 7, Ho Chi Minh City. At the time of its establishment, the company had a chartered capital of VND 20 billion, with Mr. Nguyen Khai Hoan (Chairman of KHG) contributing 70%, Mrs. Tran Thi Thu Huong (Mr. Hoan’s wife) contributing 29%, and Mr. Vo Cong Son, the Director and legal representative, holding 1%.

In mid-2017, Mr. Hoan withdrew from the list of shareholders of Khai Minh Land. The position of General Director and legal representative was then transferred to Ms. Nguyen Thi Hoai Quyen, who still holds this position to date.

From March 2018 to January 2021, the company’s capital was continuously increased, and it currently stands at VND 1,200 billion.

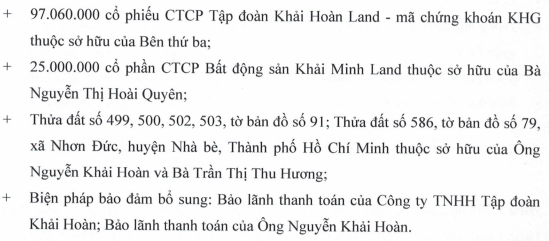

On September 4, 2024, the owner of the bond KHGH2123001 issued by KHG passed a resolution regarding the adjustment of collateral for this bond lot, mentioning an individual with the same name as the General Director of Khai Minh Land.

Specifically, the bondholder agreed for VietinBank Branch 01 in Ho Chi Minh City – the unit currently managing this bond lot, to accept additional collateral of 25 million shares of Khai Minh Land owned by Ms. Nguyen Thi Hoai Quyen, with a total value of nearly VND 262.5 billion.

On the other hand, VietinBank will release from collateral 20 million shares of Khai Minh Land owned by Ms. Nguyen Thi Le Thuy and the cash flow from the sale of 100 apartments in the future Khai Hoan Prime project.

The bond KHGH2123001 was issued by KHG on October 5, 2021, with a value of VND 300 billion, maturing on April 5, 2025. The issuance interest rate was 12%/year; from April 5, 2023, the interest rate increased to 13.5%/year; and from April 5, 2024, the interest rate decreased to 12%/year. The purpose of the issuance was to increase the scale of capital for business operations and/or implement the company’s programs and projects.

|

Collateral for the KHGH2123001 bond lot after the resolution dated September 4, 2024

Source: KHG

|

Ha Le

The Race to License a Ferry Service Across the Hau River: Connecting Can Tho and Vinh Long

The People’s Committee of Ninh Kieu District, Can Tho City, has announced that the ferry operator and the Can Tho Bridge Joint Stock Company must submit all necessary documents and applications for a new inland waterway port license by September 30, 2024. This decision aims to ensure that the ferry operator complies with the relevant regulations and acquires the necessary permits to continue their operations.

For the Second Time, Khai Hoan Land has “Requested” an Extension for the Maturity Date of a 300 Billion Bond Issuance

Khatoco Hoan Cau Land (KHG) has been granted a one-year extension on the maturity date of its KHGH2123001 bond by the bondholders. This marks the second consecutive time that the real estate developer has delayed the maturity date of this bond.