Vietnam’s housing market is under immense pressure as prices continue to soar. Ho Chi Minh City, the country’s business and financial hub, is now one of the most expensive cities in Southeast Asia for locals, surpassing Bangkok, Jakarta, and Singapore, according to the Business Times (Singapore).

The growing population, speculative home-buying activities, and stagnant supply are driving housing prices far beyond income growth, reflecting the challenges faced by some of the world’s major cities.

Troy Griffiths, Deputy CEO of Savills Vietnam, told the leading business-economic newspaper of the island nation: “There’s no doubt that the supply of housing in Ho Chi Minh City is at a record low.”

He points to a combination of legal constraints, developers’ issues, financial markets, and the public sector.

Savills, a London-headquartered real estate advisory firm, forecasts a shortage of over 18,000 homes in Ho Chi Minh City between this year and 2026. Less than 5% of the expected supply in the next three years will be affordable, defined as apartments priced below VND 3 billion (SGD 157,290 or over USD 120,000).

Vietnamese property prices are soaring.

In the capital, Hanoi, soaring property prices have also fueled discontent among homebuyers.

This discontent led to the formation of a community group on Facebook called “Community to Stop Buying Houses in Hanoi to Avoid Speculation,” which has attracted over 100,000 members since its launch in April this year.

Furthermore, a new land price framework, introduced in many localities in Vietnam following the amended Land Law and aimed at adjusting prices to market levels, is causing some concerns.

The Ministry of Construction warned in a report released in September that these adjustments could push up housing prices by 15-20% due to increased development costs.

The draft land price framework in Ho Chi Minh City, published in late July but still awaiting approval, states that land prices could increase by five to ten times. Some areas even face increases of up to 50 times compared to the fixed price frame from five years ago.

In Vietnam, land use fees typically account for 7-20% of development costs for high-rise apartment projects and 25-50% for condominiums and villas.

“Hopefully, the recently amended Land Law will facilitate more clean land for development, but as private sector developers still require viable profits, there will always be price tension,” Griffiths said.

According to Numbeo, a community-contributed global database, since mid-2022, Ho Chi Minh City and Manila have been ranked as the most expensive cities in Southeast Asia for apartments. In Ho Chi Minh City, it now takes over 32 years of average disposable income for a family to buy a 90-square-meter apartment.

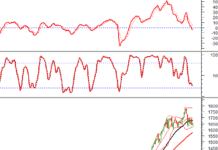

Ho Chi Minh City and Hanoi’s housing prices rank among the most expensive in ASEAN. Graphic: BT.

Ho Chi Minh City also surpasses Singapore in having the most significant gap between average property prices and estimated rent across Southeast Asian cities, making renting more cost-effective than buying in the city center.

However, industry experts note that the house price-to-income ratio may exacerbate the affordability crisis in Vietnam’s major cities, as most Vietnamese rely not only on wages for their income.

“Vietnam is also considered an investment market where people generally prefer equity over debt. Many buy property without relying on bank loans, thus maintaining strong demand and fueling the housing cycle,” the paper noted.

Despite the price hikes, domestic real estate transactions may increase by up to 35% year-over-year in the first nine months of 2024, according to estimates by Vietnam-based investment firm VinaCapital.

On Batdongsan.com.vn, a Vietnamese real estate portal owned by Singapore’s PropertyGuru, searches for land, private homes, and apartments in Q3 this year increased by 49%, 25%, and 24%, respectively, compared to the same period last year.

Waiting for the Real Estate Thaw

Vietnam’s real estate industry entered a recession in 2022 and only recovered growth in the first quarter of 2024.

However, construction credit, short-term loans used to finance construction projects, has not caught up with the overall credit growth recovery as of May, while bond issuance in the first half remained low, according to BMI.

The real estate market is expected to return to growth soon.

“The Vietnamese real estate sector appears to be recovering from a prolonged downturn, but we believe this critical sector of the economy will take two to three years to return to pre-recession growth rates,” the company wrote in a note on September 12.

The company believes that the country’s housing supply-demand imbalance will take time to normalize due to delays in constructing and providing affordable housing to address the shortage.

However, there is optimism that recent reforms under the 2024 Land Law, the 2023 Real Estate Business Law, and the 2023 Housing Law will help address issues of inefficient land access, project development, and providing incentives for social housing, gradually paving the way for a more positive outlook for the sector.

Eric Levinson, Director of Institutional Partnerships at VinaCapital, noted that “the government has some tools it can use to stimulate the economy, such as increasing infrastructure spending and facilitating a further thaw in the real estate sector.”

He added that “a stronger real estate market would almost certainly improve consumer psychology and consumption in Vietnam, which has been somewhat subdued in 2024.”

Additionally, developers are also looking to the provinces surrounding the major cities to address the shortage of affordable housing. The provinces near Ho Chi Minh City, such as Binh Duong, Dong Nai, and Long An, offer developers cheap land while also benefiting from improved infrastructure and connectivity.