Masan Consumers: Unveiling Plans for a Brighter Future

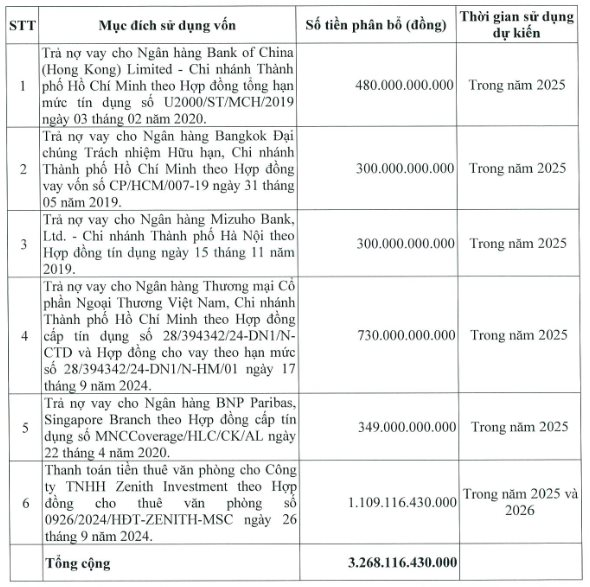

On October 14, Masan Consumer Holdings (stock code: MCH) passed a resolution to offer 326.8 million shares to existing shareholders at a ratio of 100:45.1 (shareholders owning 1,000 shares are entitled to purchase 451 new shares). The offering price is set at VND 10,000 per share.

The expected total proceeds of VND 3,268 billion will be primarily used by the company to repay debts. Masan Consumers’ chartered capital is anticipated to increase from VND 7,355 billion to VND 10,623 billion.

Masan Consumers: Strategizing for Growth

A notable appearance by Bill & Melinda Gates Foundation Trust

among the voting shareholders caught attention. This organization currently holds over 1 million MCH shares, valuing approximately VND 212 billion in the market.

With their existing holdings, Bill & Melinda Gates Foundation Trust is expected to have the right to purchase an additional 458,000 new shares if they wish to maintain their ownership percentage. The estimated amount they will need to invest to acquire these shares is approximately VND 4.6 billion.

Additionally, on October 2, Masan Consumer Holdings sought shareholder approval for an interim dividend for 2024, with a maximum ratio of 100% (equivalent to VND 10,000 per share). Previously, in 2023, the company finalized a plan to distribute cash dividends to shareholders at a ratio of 268%.

Consequently, Bill & Melinda Gates Foundation Trust could receive more than VND 38 billion in dividends from Masan Consumer Holdings for 2023 and 2024 combined.

MCH Share Price Soars

– Since the beginning of the year, MCH shares have more than doubled in value, currently trading at VND 199,000 per share. The market capitalization stands at VND 144,200 billion (USD 5.7 billion).

Managing a Massive Investment Portfolio

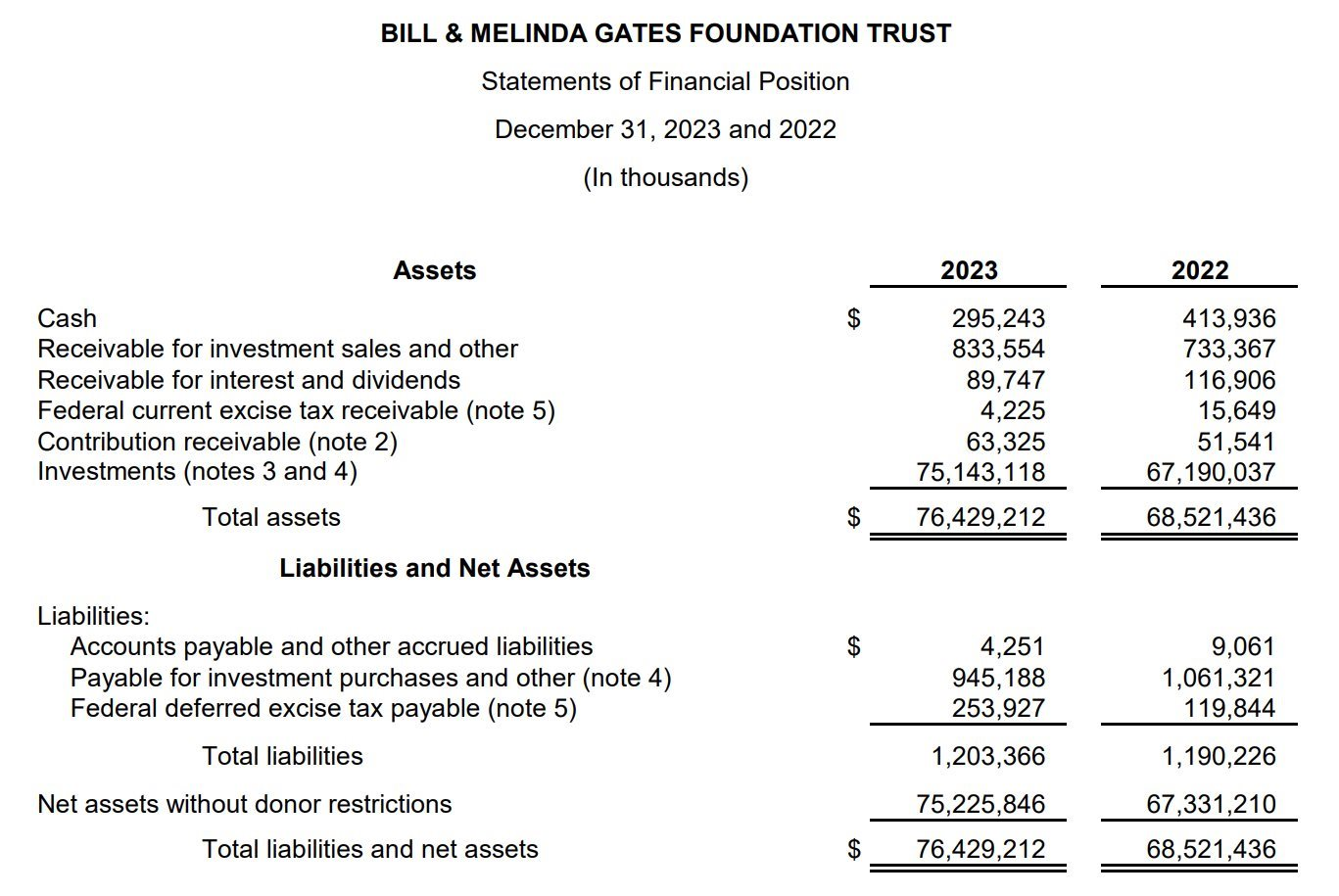

Bill & Melinda Gates Foundation Trust oversees the finances of the Bill & Melinda Gates Foundation (BMGF), a charitable organization founded by Bill Gates, co-founder of Microsoft, and his former wife, Melinda Gates. As of the end of 2023, BMGF Trust’s net assets were valued at over $75 billion, primarily consisting of financial investments.

Bill & Melinda Gates Foundation: Making a Global Impact

BMGF Trust has been indirectly investing in Vietnam for a long time, particularly in the stock market through the Vietnam Enterprise Investments Limited (VEIL) fund, the largest investment fund in Vietnam managed by Dragon Capital.

As the second-largest shareholder of VEIL, BMGF Trust holds nearly 24.7 million fund certificates, currently valued at over $183 million based on VEIL’s trading price on the London Stock Exchange.

It is worth noting that BMGF Trust has not traded VEIL for an extended period.

VEIL: A Long-Term Investment Strategy

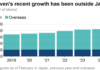

While the fund has been aggressive in investing in the Vietnamese stock market, it sold a series of shares in major global technology companies in the fourth quarter of 2023. According to Dataroma, the Bill & Melinda Gates Foundation Trust offloaded its entire holdings in tech giants like Apple, Meta (Facebook’s parent company), Alphabet (Google’s parent company), Amazon, and Nvidia.

The fund also exited positions in a range of other well-known companies, including Walt Disney, Morgan Stanley, Johnson & Johnson, Unilever, Goldman Sachs, Exxon Mobil, Lockheed Martin, and PepsiCo. Additionally, the Bill Gates-backed fund reduced its holdings in two of the largest stocks in its portfolio: Microsoft and Berkshire Hathaway.

Forbes

ranks Bill Gates as the 13th richest person globally, with an estimated net worth of $107 billion. The billionaire also owns 111,288 hectares of land, making him the 42nd largest landowner in the United States. He is the country’s largest owner of agricultural land, according to Land Report, a land industry specialist magazine.

Gates dedicates most of his income to philanthropic endeavors through the Bill & Melinda Gates Foundation. In 2023, the foundation pledged $8.3 billion to fight poverty, disease, and inequality, a 15% increase from 2022. The foundation also aims to increase its annual payouts to $9 billion by 2026.

The $75 Billion Bill Gates Charity Fund Prepares to Buy 458,000 More Shares in Vietnamese Billionaire’s Company

Bill Gates’ investment fund has long had an indirect presence in Vietnam, particularly in the stock market.

Cheers to Bill Gates: The Unsung Hero Behind the iPhone’s Success

It is often said that Steve Jobs was the father of the iPhone, but if it weren’t for the “lifeline” that Bill Gates threw out 17 years ago, there probably wouldn’t be an iPhone 16 launching on September 9th.