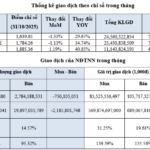

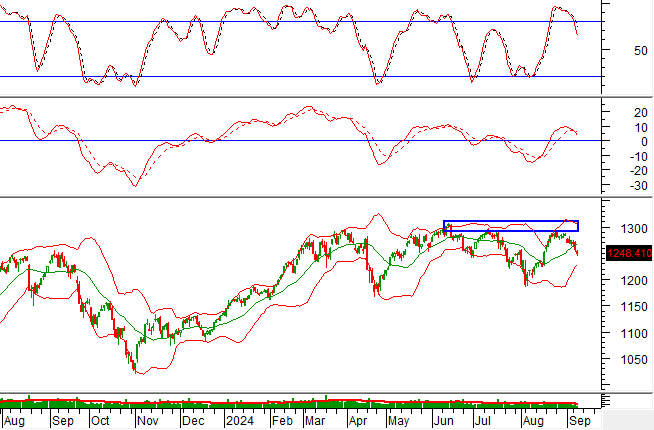

The latest corporate bond market report for September 2024, released by VIS Rating, reveals that the month was the first since October 2021 to record no new cases of payment delays. Consequently, the total value of newly delayed bonds in the third quarter of 2024 was 1.7 trillion VND, significantly lower than the average of the previous four quarters, which stood at 14.9 trillion VND.

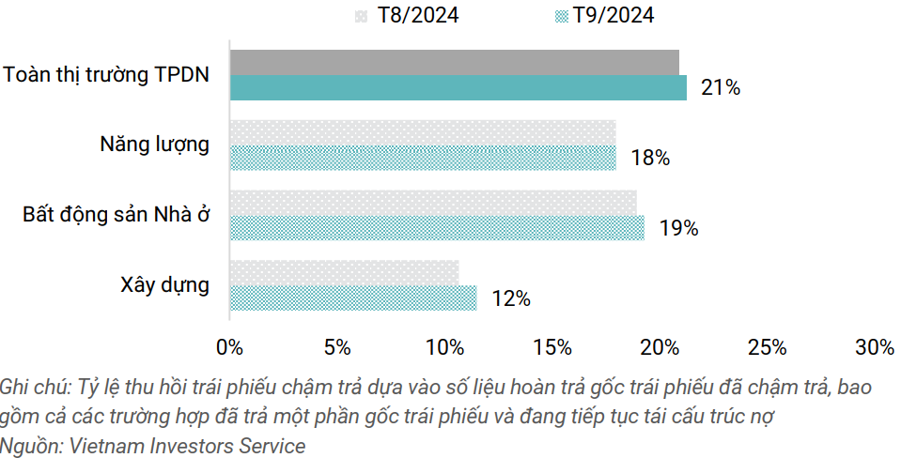

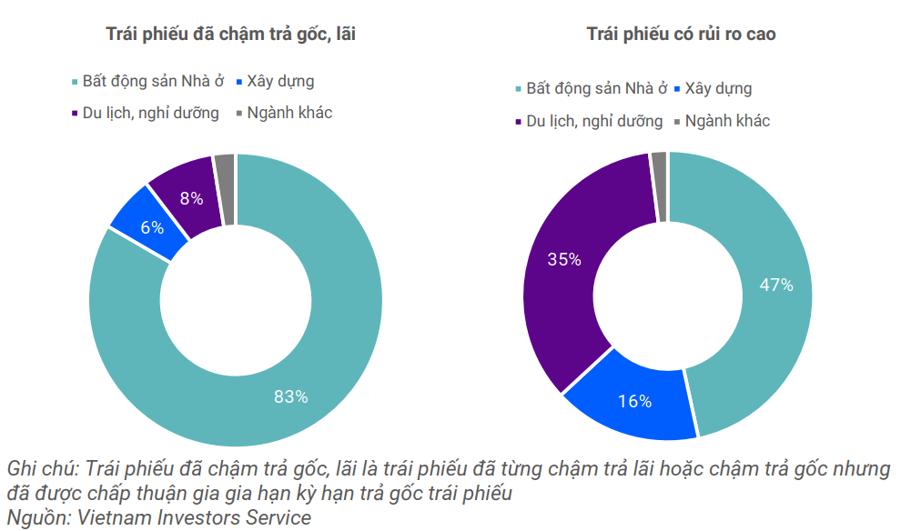

With this positive development, the cumulative delay rate at the end of September 2024 dipped slightly to 14.8%, compared to 14.9% in the previous month. Notably, approximately 62% of the cumulative delay value still belonged to the Real Estate and Housing group, with a cumulative delay rate of 30%.

In September 2024, ten issuers with delays in the Real Estate and Housing, Energy, and Construction sectors repaid a total of 781 billion VND in principal to bondholders. 70% of the repayment value came from companies in the Real Estate and Housing sector, including Saigon Glory LLC and Hai Phat Investment Joint Stock Company. The recovery rate of delayed bonds increased by 0.3% to 21.2% at the end of September 2024.

Saigon Glory, according to the VIS Rating report, repaid 448 billion VND in principal to bondholders in September 2024. Thus, since the beginning of the year, this issuer has repaid 1,341 trillion VND. After this payment, Saigon Glory’s outstanding bond principal stood at 8.7 trillion VND. According to disclosed information, Bitexco Group, the parent company of Saigon Glory, plans to transfer full ownership of the company to Hanoi Dong Phuong Real Estate Company Limited (Dong Phuong Hanoi). Dong Phuong Hanoi has committed to fulfilling the bond debt obligations to bondholders per the current bond terms and conditions.

Regarding high-risk corporate bonds approaching maturity, in October 2024, the total value of maturing bonds was approximately 15.3 trillion VND, a significant decrease from the previous month (24.5 trillion VND). Among these, VIS Rating expects eight bonds with a total face value of 420 billion VND to be at risk of principal payment delays. In the next 12 months, approximately 45% of the 245 trillion VND in maturing bonds belong to the Real Estate and Housing sector.

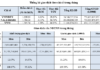

In terms of new issuances, September 2024 saw a decrease in new bond offerings to 55.9 trillion VND, down from 63 trillion VND in August 2024. Commercial banks accounted for the majority of new issuances, with a total of 45.2 trillion VND in offerings.

Of the bonds issued by banks in September 2024, 20% were qualified subordinated bonds eligible for Tier 2 capital, issued by VietinBank, Tien Phong Bank, Loc Phat Bank, Viet Capital Bank, HDBank, and BIDV.

These Tier 2 capital bonds have an average term of eight years and interest rates ranging from 5.2% to 7.9% in the first year. The remaining bonds were unsecured with a three-year term and fixed interest rates ranging from 4.9% to 6.0%.

Thus, by the end of September 2024, 10% of the total volume of newly issued bonds came from public offerings.

Corporate Bonds: The Elephant in the Room

An estimated 40% of high-risk corporate bonds defaulted on their principal payments in August 2024. What’s even more notable is that the majority of these bonds were privately issued, and the key investors were credit institutions and securities companies. To achieve the goal of expanding the corporate bond market to 30% of GDP by 2030, certain priorities must be addressed first and foremost.

Corporate Bonds: Back on the ‘Fast Track’

The corporate bond market is finding its feet again, with a surge in capital raising and much-needed debt restructuring from previous issuances. The market supply is heating up with a diverse range of issuances across different corporate structures. However, bond buyers, especially individual investors, still face significant risks.