After a sluggish morning session, the market suddenly received a surge of aggressive buying. Stock prices were pushed up vigorously, with the VN-Index turning positive to close at the highest point of the day. Bank and real estate stocks stood out in this unexpected turnaround.

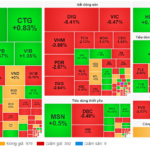

The VN-Index dipped slightly lower in the first five minutes of the afternoon session, falling 7.7 points. From this low, a recovery began and continued until the market close. The index ended up 7.04 points (+0.55%), surpassing the 1280-point mark again to close at 1286.52.

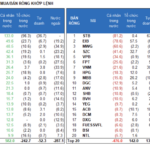

Blue-chips led the rebound, with 26 out of 30 VN30 stocks posting gains compared to the morning session, including 13 stocks that rose over 1%. Among the sectors, bank stocks made the most impressive showing, which wasn’t entirely surprising given that today was the expiry of derivatives, and the VN30 index would decide the market’s direction. Within this index, bank stocks carry the most weight.

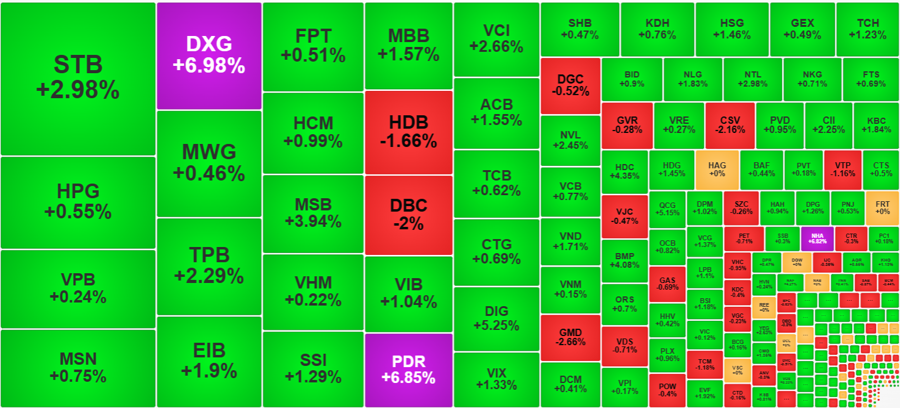

The two bank stocks that stood out in the afternoon session were STB and TPB. STB was down 0.6% at the morning close and fell further to -1.04% in the first 15 minutes of the afternoon session. However, strong buying soon after propelled the stock higher. STB closed up 2.98%, with an afternoon gain of 3.59%. It also had the largest volume in the VN30 basket, with a turnover of VND653.8 billion for the afternoon and VND919.8 billion for the full day. TPB rose 3.47% in the afternoon compared to its morning closing price and ended up 2.29% for the day, with a turnover of VND332.1 billion for the afternoon and VND396.7 billion for the full session. Apart from these two strong performers, all other bank stocks in the VN30 basket improved, with MBB, ACB, BID, CTG, SSB, and VIB all gaining over 1% and successfully turning positive.

In addition to the banks, several other stocks in this blue-chip basket also performed well. MSN, for instance, reversed a 2.02% morning loss to close up 0.75%. FPT turned around 1.03% to end up 0.51%. HPG reversed 1.49% to close up 0.55%… Many blue-chips contributed to the strong afternoon recovery, with banks playing the most significant role in the VN-Index’s movement. At the close, 9 out of the 10 stocks with the most significant impact on the index were from the banking sector, led by VCB, which rose 0.77%, followed by BID (up 0.9%), MBB (up 1.57%), STB (up 2.98%), and ACB (up 1.55%). Out of the remaining 27 banking stocks, only HDB declined by 1.66%, while two others, NAB and VBB, closed unchanged. In contrast, 14 stocks in this group rose over 1%.

While only one real estate stock, PDR, made it into the top 10 contributors with a 6.85% surge, stocks in this sector saw a robust turnaround. DXG’s performance was as impressive as that of the bank stocks, if not more so. By around 2:15 pm, this stock had hit the daily limit-up. Other stocks in this sector, such as DIG, QCG, SCR, DXS, HPX, HDC, and NTL, all closed with gains of over 3%. Unfortunately, the real estate heavyweights, VHM and VIC, didn’t show similar strength. VHM managed a meager 0.56% gain in the afternoon compared to its morning closing price and barely turned positive, ending up 0.22% for the day. VIC, meanwhile, slipped 0.12% in the afternoon, trimming its daily gain to 0.12%.

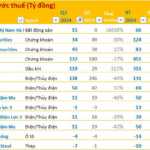

Although blue-chips played a pivotal role in the rebound, the rally’s breadth was also positive. Specifically, at the VN-Index’s low, the market breadth was 55 gainers/297 losers, but by 2:15 pm (when the index crossed into positive territory), there were 177 gainers/158 losers. At the HoSE closing, there were 224 gainers and 128 losers. Such a significant shift in market breadth indicates widespread buying. Turnover on the HoSE in the afternoon surged 94% compared to the morning session, reaching VND9,234 billion. Including HNX, the total matched volume in the afternoon session increased by 91%, amounting to VND9,812 billion.

The impact of this strong buying momentum was evident: Out of the 40 stocks on the HoSE with a turnover of over VND100 billion, only four ended in the red, while the rest posted gains, with 20 of them rising over 1%. At the morning close, only 22 stocks had gained more than 1%, but by the end of the day, this number had jumped to 81. These top-performing stocks accounted for 43.8% of the total trading value on the exchange.

There weren’t many large transactions among the stocks that lagged in this afternoon’s turnaround. Apart from HDB, DBC fell 2% on a turnover of VND273.6 billion, GMD dropped 2.66% with VND110.4 billion, CSV declined 2.16% with VND92.2 billion, VTP slipped 1.16% with VND60.5 billion, and TCM decreased by 1.18% with VND41.9 billion.

Foreign investors also increased their trading activity in the afternoon, reducing their net selling position to VND113.8 billion compared to net selling of VND288.7 billion in the morning session. The most sold stocks were FUESSVFL certificates (-VND123.8 billion), HDB (-VND122.3 billion), DBC (-VND73.3 billion), KDH (-VND68.7 billion), NLG (-VND63.9 billion), VHM (-VND48.4 billion), and MSB (-VND45.2 billion). On the buying side, they purchased STB (VND176.6 billion), NTL (VND84.4 billion), MSN (VND32.6 billion), DXG (VND30.1 billion), VCI (VND29.4 billion), EIB (VND24.9 billion), and SSI (VND21 billion).

The Savvy Solo Investor: Betting Big on Bank Stocks

Self-employed net buy of 447.7 billion VND, with a net buy of 132.0 billion VND in matching orders. Today’s top net buy orders by self-employed investors included FUEVFVND, STB, VNM, ACB, and VPB.

The Pennies-for-Dollars Stock Market Gems

As of the market close on 11/10/2024, the VN-Index stood at 1,288 points, marking a notable 14% increase since the beginning of the year, equivalent to a rise of 157 points. However, not all stocks have fared equally well. Some have plummeted or stagnated, lingering around extremely low prices, often referred to as the “tea and chat” zone, for almost a year now.

The Market Beat: VN-Index Hanging on at 1,280 Points

The market closed with the VN-Index down 1.6 points (-0.12%) to 1,279.48, while the HNX-Index fell 0.69 points (-0.3%) to 228.26. The market breadth tilted towards decliners with 381 losers and 287 gainers. The large-cap stocks in the VN30-Index basket witnessed a similar trend, with 18 stocks declining, 9 advancing, and 3 unchanged.