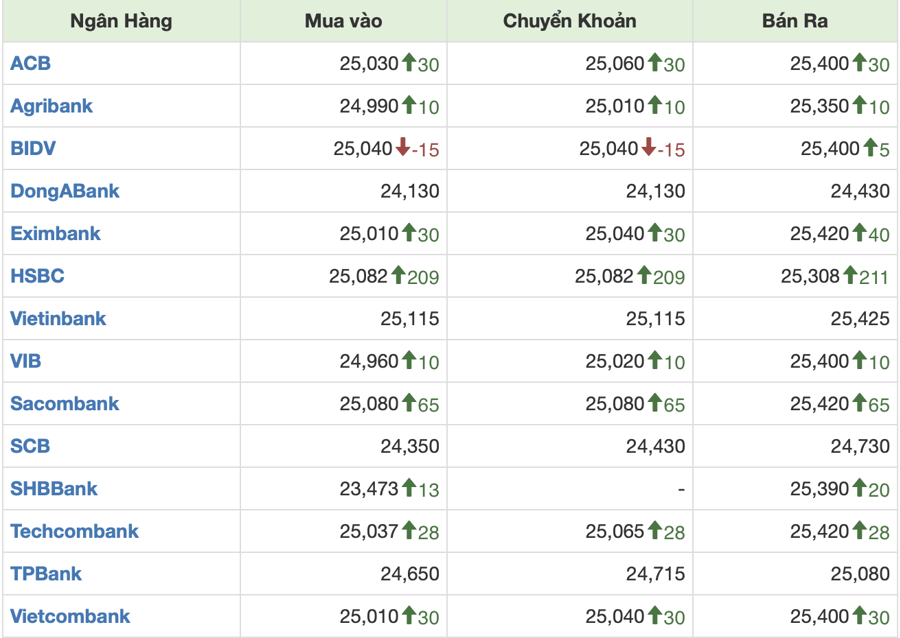

On October 18, the State Bank of Vietnam posted the central exchange rate at 24,213 VND/USD, a 14-dong increase from October 17. Consequently, the ceiling and floor rates were set at 25,423 VND/USD and 23,000 VND/USD, respectively.

Throughout the week of October 14–18, the State Bank made significant upward adjustments to the exchange rate, resulting in a week-over-week increase of 52 dong per USD as of the October 18 session.

Commercial banks witnessed a week-over-week increase of approximately 380 dong in their exchange rates during the same period.

On October 18, commercial banks also made substantial upward revisions to their exchange rates compared to the previous day’s session.

Vietcombank’s buying and selling rates were 25,010–25,240 VND/USD, a 30-dong increase from the previous day.

HSBC raised its buying rate by 209 dong to 25,082 VND/USD and its selling rate to 25,308 VND/USD, a 211-dong jump from October 17.

Eximbank, Sacombank, and Techcombank all listed their selling rates at 25,420 VND/USD.

During the week of October 14–18, the exchange rates at commercial banks climbed by approximately 380 dong.

In Hanoi’s free currency exchange market, the buying and selling rates for USD on October 18 remained unchanged from October 16, quoted at 25,260–25,360 VND/USD.

As of the close of the October 17 session (US time), the US Dollar Index (DXY), which measures the strength of the greenback against a basket of major currencies, stood at 103.58 points.

DXY surged to its highest level in 11 weeks after retail sales data showed a better-than-expected increase in September, bolstering the likelihood of a moderate interest rate cut by the Federal Reserve in the near term. Retail sales rose 0.4% in September, up from the 0.1% increase in August. Meanwhile, weekly jobless claims data reflected the severe impact of Hurricanes Helene and Milton on the job market, although there were few indications that the situation would deteriorate further.

Recent US economic data presents a mixed picture of a cooling yet resilient economy as it approaches a crucial juncture politically and economically. In less than three weeks, the country will hold its next presidential election, and the Fed will decide whether to cut interest rates further. Some Fed policymakers have recently indicated that they are considering a 0.25% reduction in the benchmark rate in November or even keeping the current rate unchanged.

The European Central Bank announced a 25-basis-point cut in its key interest rate from 3.5% to 3.25% at its second consecutive meeting last night, accelerating its pace of policy easing to support a weakening economy. The ECB stated that it would continue to adjust interest rates at each meeting based on incoming economic data. Markets now expect another rate cut at the ECB’s next meeting in December, bringing the key rate down to 3%.