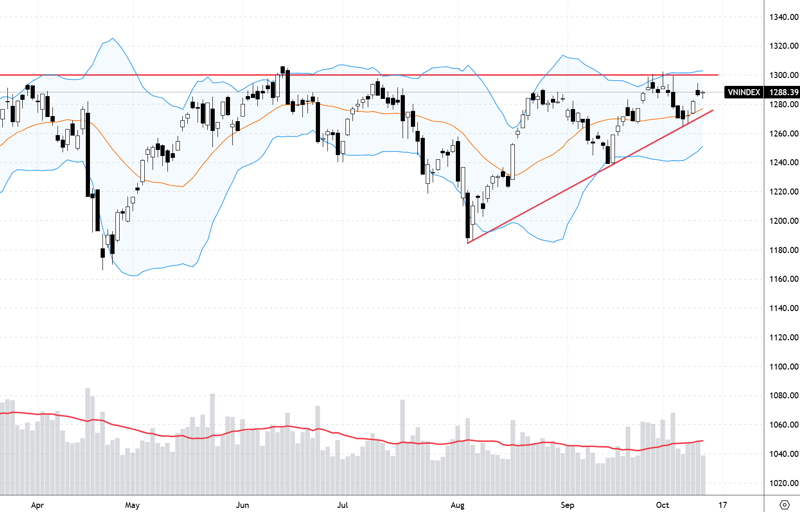

Quarterly business results for Q3 2024 are pouring in, but market movements have not shown commensurate reactions. Last week, the VN-Index fell for the first three consecutive sessions, recovered on Thursday, but faltered in the final session. The index also retreated once again after approaching the 1,300-point mark. The average matched order liquidity on the HoSE also did not show any progress and even slightly decreased.

Nevertheless, the strong gain on Thursday helped the VN-Index establish a higher bottom and maintain a narrowing fluctuation range, preserving the short-term uptrend since the beginning of August 2024. According to experts, this is a positive technical development as a “continuing upward trend model” is forming, promising a breakthrough opportunity. However, liquidity is still a factor that makes experts cautious, and in fact, the market has had several opportunities to break through in the past few weeks but has been unsuccessful.

Commenting on the Q3 2024 earnings effect, experts still expect profit information to support the market, and in fact, this is the force that makes the adjustment paces smaller. However, there are also many cases where stocks with good financial reports do not increase in price. According to experts, investors can act depending on their state and strategy. If it is short-term speculation, the poor stock response may be due to “information already reflected in the price,” and the holding ratio should be reduced, especially if using margin. If it is a long-term investment, the good financial results will gradually be reflected in the long-term price trend, especially as the Q4 outlook is more positive. Therefore, investors can continue to hold or even buy more when the price retreats.

Technically, continuously creating a higher bottom and moving within a narrowing range are signs similar to the “Ascending Triangle” model. This may indicate a continuation of the upward price trend.

Nghiêm Sỹ Tiến

Nguyễn Hoàng – VnEconomy

The market fluctuated erratically last week, partly due to the derivatives expiry session. The VN-Index fell in the first three sessions of the week but recovered in the last two sessions and created a higher bottom than the October peak. Some opinions assessed this as a positive technical signal when the index fluctuated with narrower adjustments and continuously hovered around the 1,300-point mark, consolidating the breakthrough opportunity. What are your thoughts on this?

Nguyễn Việt Quang – Director of Business Center 3, Yuanta Hanoi

The index’s fluctuation range is getting narrower and is hovering around the 1,300-point mark. Many people believe this to be a positive development, and the index is following a pattern of narrowing trading amplitude. However, the excessive narrowing, along with the VN-Index chart resembling a beautiful painting, gives me a different perspective. I believe that when you climb to the “peak” of a mountain, you will see the most beautiful scenery. Additionally, on Thursday, the index broke through the trend channel formed by the bottoms of August 5, September 17, and October 7, along with the negative developments on Friday. Thus, I remain cautious rather than excited, and I have implemented risk management measures by significantly reducing my position. When the market convincingly surpasses 1,300, I will consider investing again; it won’t be too late then.

Nghiêm Sỹ Tiến – Investment Strategy Specialist, KBSV Securities

Technically, continuously creating a higher bottom and moving within a narrowing range are signs similar to the “Ascending Triangle” model. This may indicate a continuation of the upward price trend, following the sideways accumulation phases with decreasing liquidity and forming higher support points.

After many failed tests, the resistance zone around 1,300 points is creating significant pressure on the market’s psychology, causing profit-taking and position-reducing selling to dominate when the index approaches this level again. Nevertheless, with the short-term uptrend being preserved, the probability still leans towards the scenario of the VN-Index successfully conquering the resistance threshold.

Lê Đức Khánh – Analysis Director, VPS Securities

The accumulation zone revolving around the old peak is narrowing, and the trading amplitude is getting shorter. The sideways accumulation is tight, and the market is preparing for a breakthrough opportunity to set a new peak. I believe this development will likely occur next week or, at the latest, in the last week of October.

Money Flow Trend: As the Q3 Earnings Season Begins, Will the Momentum Be Different This Time?

Exchange Rate Surges, State Bank Issues Bills to Absorb Money

Margin Lending Sets Another Record High of VND 235,000 Billion, but It’s “Harmless”

Nguyễn Thị Mỹ Liên – Analysis Room Manager, Phu Hung Securities Company

Technically, the VN-Index’s fluctuations are forming a VCP pattern with a narrowing amplitude. Typically, this is a positive pattern that provides an opportunity to open a new upward movement if it breaks through the 1,300-point mark. However, it is essential to note that any pattern has a certain success probability. In the past 1-2 weeks, I noticed that the market had a few chances for buying force to participate and help complete the pattern, but this has not happened yet. If the buying force does not show a more positive shift this week, I think caution is necessary.

Lê Minh Nguyên – Senior Director of Individual Customers, Rong Viet Securities

In the last trading session, the VN-Index closed at the support level of 1,285.46 points and is likely to continue testing this support level. If the market maintains this support level in the new trading week, it will consolidate the opportunity to approach the 1,300-point mark. However, with the current low liquidity, the market is likely to fluctuate within the range of 1,240 to 1,300 points for accumulation rather than breaking through the 1,300-point mark. In this information trough phase, we cannot expect a strong market breakthrough but should wait for gradual accumulation as we approach the end of the year and positive supporting information emerges.

Nguyễn Hoàng – VnEconomy

Last week, you expected the money flow to be more positive this week as the business results were released. However, we still cannot see a clear change in liquidity, and transactions have even slightly decreased. Meanwhile, statistics show that individual investors have been net buying continuously with a large scale. It seems that investors are still very cautious, or is the money flow in the market really weakening? How do you assess the demand for margin at this point?

Nguyễn Thị Mỹ Liên – Analysis Room Manager, Phu Hung Securities Company

Positive business results will be reflected in stock prices, and money will flow into those stocks if the valuation is still attractive. However, it cannot improve the overall market liquidity. In fact, in the past week, domestic individual investors’ net buying was due to the net withdrawal of foreign investors. It appears that the buying force is still quite weak, and investors’ psychology remains cautious as the VN-Index cannot surpass the 1,300-point threshold. Therefore, investors should maintain a moderate position and refrain from using margin in this phase.

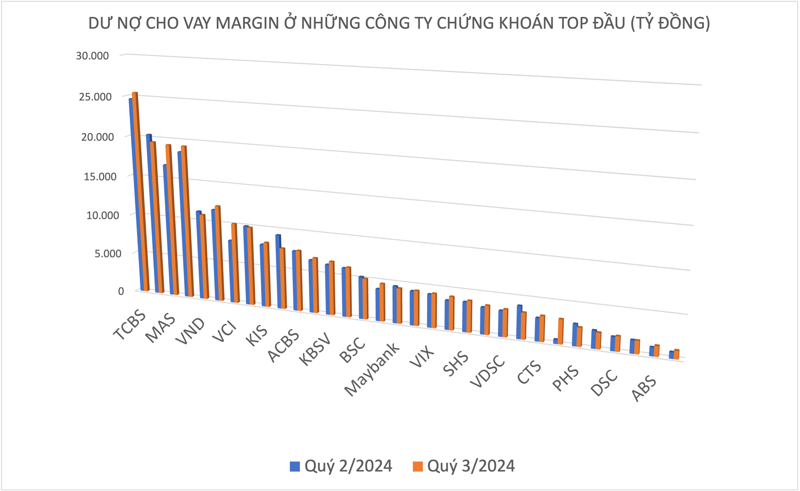

In the current phase, I assess the demand for margin to be moderate, and the source is still abundant.

Nguyễn Việt Quang

Nghiêm Sỹ Tiến – Investment Strategy Specialist, KBSV Securities

Quite a few enterprises have announced their Q3 2024 business results so far. However, looking at the general picture, profits are showing signs of stagnation and even decreasing in some sectors. The below-expectation operational results have likely been reflected in the market’s liquidity in recent sessions, with more cautious transactions. These data may not be negative enough to trigger a sell-off, but they also cannot create a significant impetus to increase buying force. Therefore, at least in the first half of Q4 2024, the demand for margin will unlikely surge.

Nguyễn Việt Quang – Director of Business Center 3, Yuanta Hanoi

In my opinion, many investors still hold a certain stock ratio and closely monitor the market’s movements to decide whether to increase or decrease their positions. This also partly contributes to the lackluster market liquidity. In the current phase, I assess the demand for margin to be moderate, and the source is still abundant.

Lê Minh Nguyên – Senior Director of Individual Customers, Rong Viet Securities

The business results released so far have been positive, but the market seems to be waiting for better news to attract money flow and break through. Currently, individual investors mainly drive the market, while large money flows remain on the sidelines, observing and waiting for clear opportunities to participate. The VN-Index is fluctuating within a narrow range, and liquidity has not increased with the support of Q3 financial results. This indicates that the demand for margin is not high at the moment, and short-term trading is becoming more challenging.

The accumulation zone revolving around the old peak is narrowing, and the trading amplitude is getting shorter. The sideways accumulation is tight, and the market is preparing for a breakthrough opportunity to set a new peak. I believe this development will likely occur next week or, at the latest, in the last week of October.

Lê Đức Khánh

Lê Đức Khánh – Analysis Director, VPS Securities

In this phase, investors may still need and use margin, but it is crucial to control the number of stocks in their portfolios and carefully select stocks. If the opportunity is uncertain, the stock price performance is favorable, the stock liquidity is high, and the trading style is fast, using margin can be effective. However, value investors are likely to use it less.

Nguyễn Hoàng – VnEconomy

Foreign capital suddenly turned to strong net selling last week, ending the previous four weeks of balanced transactions, with some weeks even recording good net buying. Has the exchange rate effect faded, or does foreign capital want to take profits around the 1,300-point peak?

Nghiêm Sỹ Tiến – Investment Strategy Specialist, KBSV Securities

The return to net selling by foreign capital may be due to the sharp rise in exchange rates recently. Several factors are believed to be the cause, such as the increase in the DXY Index, the surge in USD foreign currency demand, and the outflow of large amounts of USD from the system. Generally, foreign capital in the stock market is quite sensitive to exchange rate fluctuations, and this issue should also be observed as foreign net selling can affect the market’s overall psychology in the context of a lack of supportive information.

Lê Minh Nguyên – Senior Director of Individual Customers, Rong Viet Securities

I think that with the VN-Index approaching the 1,300-point mark amid low liquidity and large money flows remaining on the sidelines, it is understandable that foreign capital has returned to net selling.

Nguyễn Thị Mỹ Liên – Analysis Room Manager, Phu Hung Securities Company

The strong net selling by foreign investors last week was significantly impacted by the rebound in exchange rates and the escalating geopolitical tensions. The USD Index has been continuously increasing since the end of September and has reached its highest level in over two months. Additionally, the SBV had to intervene to ease the pressure on exchange rates by issuing bills worth up to VND 12,300 billion after a nearly two-month hiatus.

Foreign capital continues to flow between markets, and I believe foreign investors are becoming more cautious as October brings several variables, such as the US presidential election, the Fed’s interest rate cut scale in 2024, tensions in the Middle East and the Korean Peninsula, and the attractiveness of risky assets like stocks has diminished due to their valuation backdrop.

In the past 1-2 weeks, I noticed that the market had a few chances for the buying force to participate and help complete the pattern, but this has not happened yet. If the buying force does not show a more positive shift this week, I think caution is necessary.

Nguyễn Thị Mỹ Liên

Nguyễn Việt Quang – Director of Business Center 3, Yuanta Hanoi

After a long time of trading in Vietnam, foreign capital has also made strategic adjustments to adapt better to our market. When encountering strong resistance zones or profitable levels, it is understandable that they would take profits. It will take time for the effects of the Fed’s interest rate cut to be reflected in foreign capital flows.

Lê Đức Khánh – Analysis Director, VPS Securities

The area around the old peak or the rapid rise in bank stock prices, for example, could increase selling or profit-taking pressure. The reduction in the ratio of stocks held by foreign investors is also explainable and appropriate in this context.

Nguyễn Hoàng – VnEconomy

Many stocks have released their financial results, but their prices have not progressed significantly, and some have even decreased last week. How should investors act in this situation?

Nguyễn Việt Quang – Director of Business Center 3, Yuanta Hanoi

It is common for stock prices to remain unchanged or deviate from financial results. This can be explained by the phrase “information has