An unprecedented, brilliant derivatives expiry. Pressure relieved, psychology still cautious throughout the morning, causing the index to continue to fall deeply, but as the afternoon progressed, buying pressure increased, and the index rebounded strongly by 7 points, closing at 1,286 points. Breadth was much improved, with 224 gainers and 128 losers. The two large-cap groups, banks and real estate, continued to lead the index, with the former turning green across the board, except for HDB, which declined.

The banking group was highly consensus, with STB, LPB, MBB, TPB, and ACB closing strongly in the green, while the large-cap group was also in the green but underperformed, with VCB, BID, CTG, and TCB. Meanwhile, many real estate stocks surged to the maximum trading limit, including NHA, PDR, and DXG, while others, such as CEO, DIG, NVL, HDC, and NLG, also posted significant gains.

The securities group also performed well, with SSI, VCI, VIX, VND, and MBS gaining an average of 2%. No sector was left behind, as most other sectors, including Materials, Software, Telecommunications, and Energy, were also in the green. The stocks that contributed the most to the market today were VCB, BID, MBB, STB, ACB, CTG, and MSB, with the banking group alone contributing nearly 4 points to the overall index.

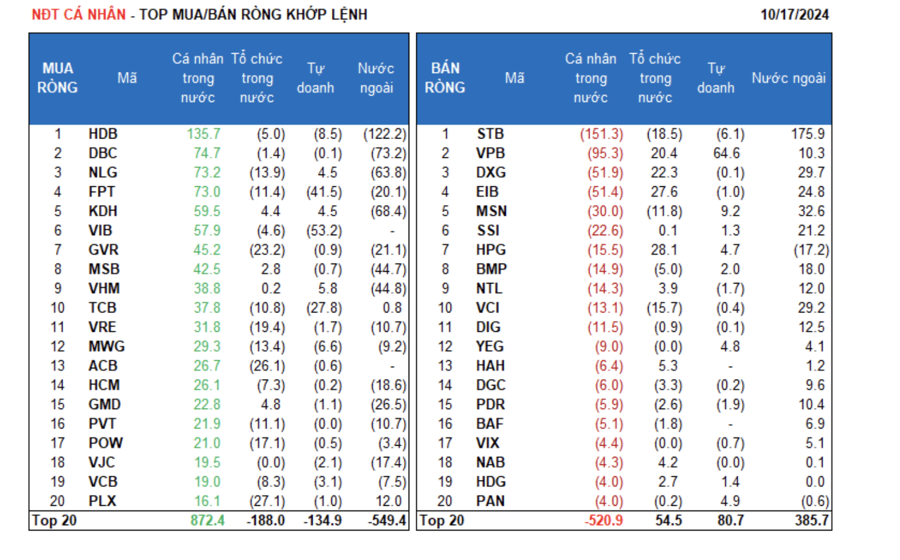

Money is gradually flowing into the market, with liquidity on the three exchanges increasing to 18 trillion VND. Foreign investors, however, remained net sellers, offloading 418.8 billion VND, with a net sell of 359.3 billion VND in matched orders.

On the foreign buying side, the main sectors were Financial Services and Oil & Gas. The top stocks bought were STB, MSN, DXG, VCI, EIB, SSI, BMP, DIG, NTL, and PLX.

On the selling side, Real Estate was the main sector sold by foreigners. The top stocks sold were HDB, DBC, KDH, NLG, VHM, GMD, GVR, VNM, FPT.

Individual investors were net buyers, purchasing 353.8 billion VND worth of stocks, with a net buy of 603.9 billion VND in matched orders.

In terms of matched orders, they bought 13 out of 18 sectors, mainly in the Real Estate sector. The top stocks bought by individual investors included HDB, DBC, NLG, FPT, KDH, VIB, GVR, MSB, VHM, and TCB.

On the selling side, they sold 5 out of 18 sectors, mainly in the Basic Resources and Telecommunications sectors. The top stocks sold were STB, VPB, DXG, EIB, MSN, SSI, BMP, NTL, and VCI.

Proprietary trading accounted for a net buy of 261.7 billion VND, with a net sell of 38.0 billion VND in matched orders.

In terms of matched orders, proprietary trading bought 8 out of 18 sectors. The top-bought sectors were Food & Beverage and Construction & Materials. The top stocks bought today were VPB, VNM, MSN, MBB, PC1, VHM, PNJ, PAN, YEG, and HPG. The top-sold sector was Banks. The top-sold stocks were VIB, FPT, TCB, CTG, HDB, E1VFVN30, MWG, SHB, STB, and SSB.

Domestic institutional investors were net sellers, offloading 211.2 billion VND worth of stocks, with a net sell of 206.5 billion VND in matched orders.

In terms of matched orders, domestic institutions sold 15 out of 18 sectors, with the highest value in the Banking sector. The top-sold stocks were PLX, ACB, GVR, VRE, STB, POW, VCI, VNM, MBB, and PNJ. The top-bought sector was Basic Resources. The top-bought stocks were HPG, EIB, DXG, VPB, BWE, HAH, GMD, KDH, GEX, and NAB.

Today’s matched transactions totaled 3,251.2 billion VND, an increase of 85.6% compared to the previous session, contributing 17.5% of the total trading value.

Notable transactions today included MSB, with 11.3 million shares worth 152.6 billion VND traded between foreign institutions.

Individual investors also traded in the Banking sector (STB, HDB, SSB), FPT, and GEX.

Money flow allocation increased in Real Estate, Banking, Securities, Steel, and Textiles, while decreasing in Construction, Chemicals, Food & Beverage, Retail, and Software.

In terms of matched orders, money flow allocation increased in the mid-cap sector (VNMID) and decreased in the large-cap (VN30) and small-cap (VNSML) sectors.

The Market Beat: A Tale of Diverging Fortunes, VN-Index Falters at the 1,295 Mark

The market ended the session in negative territory, with the VN-Index down 2.05 points (-0.16%) to close at 1,286.34. The HNX-Index followed suit, falling 0.65 points (-0.28%) to 230.72. It was a sea of red across the broader market, as sellers dominated with 395 declining stocks compared to 294 gainers. The large-cap VN30-Index also painted a similar picture, with 19 stocks in the red, 8 in the green, and 3 unchanged.

The Bottom Fishing Trap: Unveiling the Secrets of Stock Market Profits

Patience among sidelined funds snapped any recovery attempts today. Only a deeper price dip would reveal larger waiting orders. Continuing low liquidity after last weekend’s session could be deemed positive, as those most eager to cut losses have already exited.

The Capital Flows In: MSN and FPT Witness Billion-Dollar Liquidity

A surge in trading activity this morning saw a 34% jump in liquidity across both exchanges compared to yesterday, with the breadth indicating a widespread rally. However, the money flow was not evenly distributed, but rather concentrated on a handful of strong stocks. FPT and MSN, for instance, witnessed massive buying interest from both domestic and foreign investors, accounting for 23.2% of the total matched value on the HoSE and nearly 37% of the VN30 basket.

The Golden Ticket to Landing a Job in Finance and Banking

At the seminar “Personal Financial Management and Job Opportunities in the Finance and Banking Industry” held on October 4 at the National University of Economics, renowned experts in the field of finance and banking shared their insights, guidance, and tips to help students create a “passport to success” when applying for jobs in the banking industry.