A spectacular derivatives expiry session. With pressure relieved, sentiment remained cautious throughout the morning, causing the index to continue dipping, but as the afternoon progressed, buying momentum intensified, and the index rebounded strongly, surging 7 points to close at 1,286 points. The market breadth was more favorable, with 224 gainers overpowering 128 losers. The two large-cap groups, banks and real estate, led the rally, with most stocks in these sectors turning green.

There was strong consensus among banks, except for HDB, which declined. The rest finished firmly in the green, including STB, LPB, MBB, TPB, and ACB. Large-cap stocks in this sector, such as VCB, BID, CTG, and TCB, also edged higher but with relatively weaker gains. Meanwhile, several real estate stocks soared to the maximum daily limit, including NHA, PDR, and DXG, while others, like CEO, DIG, NVL, HDC, and NLG, posted significant advances.

Securities firms kept pace, with SSI, VCI, VIX, VND, and MBS climbing by an average of 2%. No sector was left behind, as most other groups, including Materials, Software, Telecommunications, and Energy, also painted a lush green picture. The stocks that contributed the most to the market’s gains today were VCB, BID, MBB, STB, ACB, CTG, and MSB, with the banking group alone accounting for nearly 4 points of the index’s rise.

Money is flowing into the market, with combined trading volume across the three exchanges reaching VND18 trillion, while foreign investors continued to offload holdings, recording a net sell figure of VND418.8 billion. However, if we consider only matched orders, they were net buyers to the tune of VND359.3 billion.

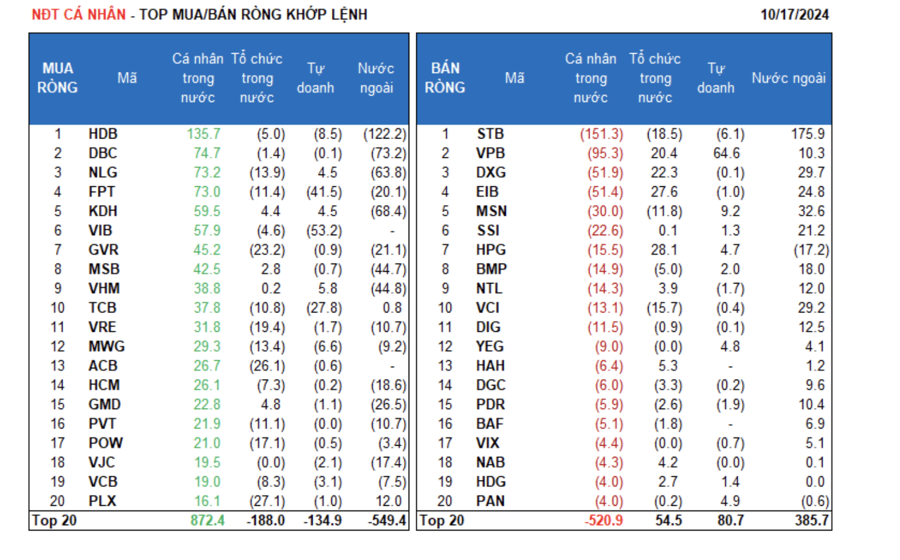

The sectors that witnessed net buying from foreigners in the matched orders category were Financial Services and Oil & Gas. The top stocks that foreign investors net bought were STB, MSN, DXG, VCI, EIB, SSI, BMP, DIG, NTL, and PLX.

On the other side, the sectors that witnessed net selling from foreigners in the matched orders category were Real Estate. The top stocks that foreign investors net sold were HDB, DBC, KDH, NLG, VHM, GMD, GVR, VNM, and FPT.

Retail investors net bought VND353.8 billion worth of shares, and their net buying figure for matched orders stood at VND603.9 billion.

Considering only matched orders, retail investors net bought stocks in 13 out of 18 sectors, primarily in the Real Estate industry. Their top purchases included HDB, DBC, NLG, FPT, KDH, VIB, GVR, MSB, VHM, and TCB.

On the selling side, they net sold stocks in 5 out of 18 sectors, mainly in the Basic Resources and Media sectors. The stocks that made their top sell list were STB, VPB, DXG, EIB, MSN, SSI, BMP, NTL, and VCI.

Proprietary traders net bought VND261.7 billion worth of shares, and their net buying figure for matched orders stood at VND38 billion.

Drilling down to matched orders, proprietary traders net bought stocks in 8 out of 18 sectors. The sectors that witnessed the most substantial net buying from proprietary traders were Food & Beverage and Construction & Materials. The top stocks that proprietary traders net bought were VPB, VNM, MSN, MBB, PC1, VHM, PNJ, PAN, YEG, and HPG. On the flip side, they net sold stocks in the Banking sector. The top stocks in their sell list included VIB, FPT, TCB, CTG, HDB, E1VFVN30, MWG, SHB, STB, and SSB.

Local institutional investors net sold VND211.2 billion worth of shares, and their net selling figure for matched orders stood at VND206.5 billion.

Considering only matched orders, local institutions net sold stocks in 15 out of 18 sectors, with the highest net selling value in the Banking sector. The top stocks in their sell list included PLX, ACB, GVR, VRE, STB, POW, VCI, VNM, MBB, and PNJ. On the buying side, they net bought stocks in the Basic Resources sector. The top stocks in their purchase list were HPG, EIB, DXG, VPB, BWE, HAH, GMD, KDH, GEX, and NAB.

Today’s negotiated trading value reached VND3,251.2 billion, a substantial increase of 85.6% from the previous session, contributing 17.5% to the total trading value.

A notable negotiated trade occurred in MSB, with 11.3 million shares worth VND152.6 billion changing hands between foreign institutions.

Additionally, retail investors remained active in the Banking sector (STB, HDB, SSB), FPT, and GEX.

There was an increase in the allocation of funds to Real Estate, Banking, Securities, Steel, and Textiles, while sectors such as Construction, Chemicals, Food & Beverage, Retail, and Software witnessed a decrease in fund allocation.

Focusing on matched orders, there was an increase in the allocation of funds to mid-cap stocks (VNMID) and a decrease in large-cap (VN30) and small-cap (VNSML) stocks.