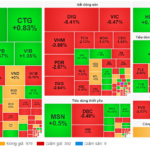

The market experienced a cold spell this weekend, with liquidity drying up and money flowing out of indices. The lack of positive momentum from yesterday’s gains led to a slight drop of over one point at the closing bell. The breadth was unfavorable, with 211 declining stocks outweighing 157 gainers, and most sectors underwent corrective pressure.

Banks displayed a clear divergence, with some heavyweights like VCB, TCB, and STB holding their ground, while VPB, CTG, MBB, and ACV faced significant profit-taking pressure. Real estate giants, including VHM and VIC, posted modest gains, and industrial stocks also edged higher, even as NVL, PDR, DIG, and KDH declined.

The top stocks dragging the market down were VPB, HPG, CTG, MSN, and MBB. Conversely, STB, EIB, HDB, VCB, and TCB helped recoup nearly two points for the Vn-Index.

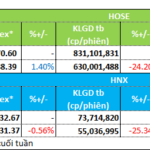

Liquidity decreased despite overwhelming selling pressure, indicating a lack of bottom-fishing demand. The total matched orders across the three exchanges reached 16,700 billion VND, with foreign investors net selling 162.5 billion VND. Specifically, in matched orders, they were net sellers to the tune of 209.9 billion VND.

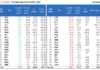

Foreign investors’ main net buying focus on the matched orders side was on the retail and information technology sectors. The top net bought-matched orders stocks by foreign investors were MWG, EIB, FPT, VPB, SHB, STB, SZC, MSN, BID, and DGC.

On the net selling side, their focus was on the financial services sector. The top net sold-matched orders stocks by foreign investors were FUEVFVND, MSB, VHM, VCI, CTG, SSI, GMD, KBC, and OCB.

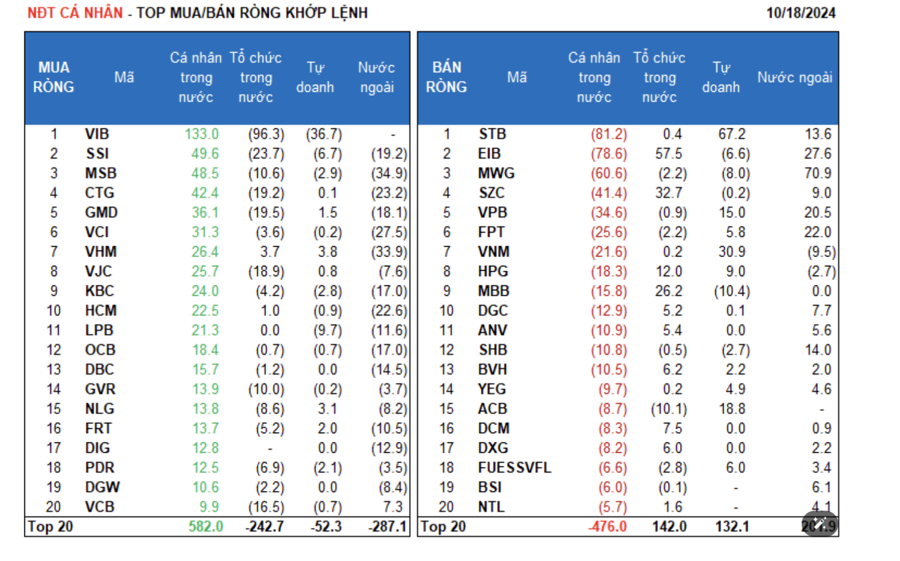

Individual investors net sold 151.6 billion VND, with a net buying value of 211.2 billion VND in matched orders. In terms of matched orders, they were net buyers in 10 out of 18 sectors, mainly in financial services. Their top net bought stocks included VIB, SSI, MSB, CTG, GMD, VCI, VHM, VJC, KBC, and HCM.

On the net selling side, they net sold 8 out of 18 sectors, primarily in retail and information technology. The top net sold stocks by individual investors were STB, EIB, MWG, SZC, VPB, FPT, HPG, MBB, and DGC.

Proprietary trading accounted for a net buy of 447.7 billion VND, with a net buy value of 132.0 billion VND in matched orders.

In terms of matched orders, proprietary trading was net buyers in 14 out of 18 sectors, with the strongest presence in financial services, food and beverage, and real estate. The top net bought-matched orders stocks by proprietary trading today were FUEVFVND, STB, VNM, ACB, VPB, HPG, FUESSVFL, FPT, YEG, and BMP. The top net sold sector was retail, with VIB, TCB, MBB, LPB, MWG, SSI, EIB, MSN, TPB, and VIX being the most prominent stocks in this category.

Domestic institutional investors net sold 138.5 billion VND, with a net selling value of 133.3 billion VND in matched orders.

In terms of matched orders, domestic institutions net sold 10 out of 18 sectors, with the highest value in banks. The top net sold stocks by domestic institutions were VIB, FUEVFVND, SSI, GMD, CTG, VJC, VCB, MSB, ACB, and GVR. Their net buying focus was on the real estate sector, with EIB, SZC, MBB, TCB, HPG, DCM, HDB, BVH, HAH, and DXG being the top net bought stocks.

Today’s matched orders and negotiated deals reached 2,054.6 billion VND, a decrease of 36.8% compared to the previous session, contributing 12.1% to the total trading value.

Notably, there was a significant transaction in SSB, with 22.6 million units worth 384.7 billion VND changing hands between individual investors.

Additionally, there was a transaction in EIB, where individual investors sold 12.5 million units (valued at 248.8 billion VND) through negotiated deals to domestic proprietary trading.

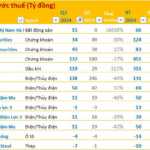

The money flow allocation increased in banks, rubber & plastic, and investment funds while decreasing in real estate, securities, construction, steel, chemicals, aquaculture & seafood, food & beverage, electrical equipment, oil & gas, software, water transport, and textiles & garments.

Specifically, in terms of matched orders, the money flow allocation increased in the large-cap VN30 group while decreasing in the mid-cap VNMID and small-cap VNSML groups.

The Pennies-for-Dollars Stock Market Gems

As of the market close on 11/10/2024, the VN-Index stood at 1,288 points, marking a notable 14% increase since the beginning of the year, equivalent to a rise of 157 points. However, not all stocks have fared equally well. Some have plummeted or stagnated, lingering around extremely low prices, often referred to as the “tea and chat” zone, for almost a year now.

The Market Beat: VN-Index Hanging on at 1,280 Points

The market closed with the VN-Index down 1.6 points (-0.12%) to 1,279.48, while the HNX-Index fell 0.69 points (-0.3%) to 228.26. The market breadth tilted towards decliners with 381 losers and 287 gainers. The large-cap stocks in the VN30-Index basket witnessed a similar trend, with 18 stocks declining, 9 advancing, and 3 unchanged.