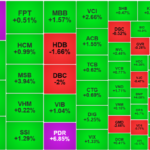

Bank stocks became the main driver of the VN-Index in September, with the index briefly surpassing the 1,300-point mark. However, strong profit-taking pressure soon after caused it to turn downward again. A series of bank stocks maintained their strong upward momentum in the past month, with VPB up nearly 12%; ACB up 6.3%; MBB up 5.36%; and TCB up 6.7%…

As of September 27, 2024, credit and system-wide mobilization growth were estimated at 8.53% and 4.79% year-to-date, respectively. These figures remain on track with the State Bank’s target of 14-15% credit growth for 2024. Additionally, with the pressure on exchange rates relieved, the State Bank has stopped bill absorption since the end of August 2024 but continues to maintain liquidity injection through the OMO channel and keeps the interbank interest rate for overnight loans relatively high in the last days of September 2024 (hovering around 4% and then gradually decreasing).

Commenting on this, BSC believes that this is consistent with the picture of accelerating credit growth. BSC maintains its forecast of 14% and 10% for credit and mobilization growth in 2024, respectively. The main driver is expected to be the private sector, revolving around banks that benefit from credit limit adjustments following the SBV’s document in late August 2024, such as ACB (forecasted at +15.6%), HDB (+23.4%), MSB (+19.2%), TCB (+20.0%), and some other names that have advantages due to the takeover of weak credit institutions like MBB (forecasted at +19.4%) and VPB (forecasted at +24.0%).

BSC believes that economic growth targets will be the priority of the regulators in the last three months of the year, especially after the negative impact of Typhoon Yagi. Therefore, it is expected that the deposit interest rate of the state-owned bank group will be maintained at its current level until the end of the year, averaging about 4.7% for a 12-month term, in line with the SBV’s orientation in supporting the economy’s borrowing needs. Note that the interest rates of private banks are still expected to increase slightly by the end of the year, as mentioned in the previous report.

In addition, compared to the record amount of state treasury deposits at state-owned banks, reaching nearly VND 292 trillion at the end of Q2/2024 (the highest in the last two years), the continued increase in mobilization growth and the decrease in the state treasury balance at commercial banks since September 2024 indicate efforts to disburse public investment in the last months of the year, thereby releasing a large amount of money into the economy.

The acceleration of public investment in the last months of the year often leads to a significant budget deficit in Q4. The forecast of an increase in net foreign currency assets at commercial banks due to the cooling down of exchange rates and the trend of increasing remittances in Q4 for the holiday season is the basis for expecting an additional source of money to flow into the market in Q4/2024, along with the momentum from private sector credit.

Therefore, BSC believes that the growth of money supply, including mobilization and credit growth, will narrow the phase difference in the coming months, bringing higher sustainability to the growth.

With the low base of profit recorded in Q3/2023, BSC estimates that the total pre-tax profit of tracked banks in Q3/2024 will reach a high of 20% thanks to the continued acceleration of credit growth and the expected stability of the industry’s average NIM. The forecast for pre-tax profit growth in 2024 is 16%, corresponding to a 15% growth rate in Q4/2024 compared to the same period last year.

In early October 2024, the State Bank announced and is seeking comments on a draft circular to support customers affected by Typhoon Yagi. According to estimates, the total debt affected by Typhoon Yagi is about VND 165 trillion, or 1.16% of the system’s credit as of mid-September 2024. In relation to Circular 02, which has the same nature, the State Bank stated that the total restructured debt of the system is now VND 230 trillion (1.62% of the system’s credit).

This draft is more supportive to banks as it allows for multiple rescheduling of debt repayment, for both due and overdue debts, and considers indirect impacts such as those affecting the customers’ partners. With this supportive policy, the impact of typhoon damage on banks’ balance sheets will be minimal, and thus it will not significantly affect the 2024 forecast.

Looking ahead to 2025, BSC assesses the bank stock outlook as positive, with a forecasted pre-tax profit growth of 22% for the tracked bank list. Notably, some names are expected to achieve outstanding profit growth next year, including CTG (forecasted at +24%), MBB (+20%), STB (+33%), TCB (+22%), and VPB (+32%).

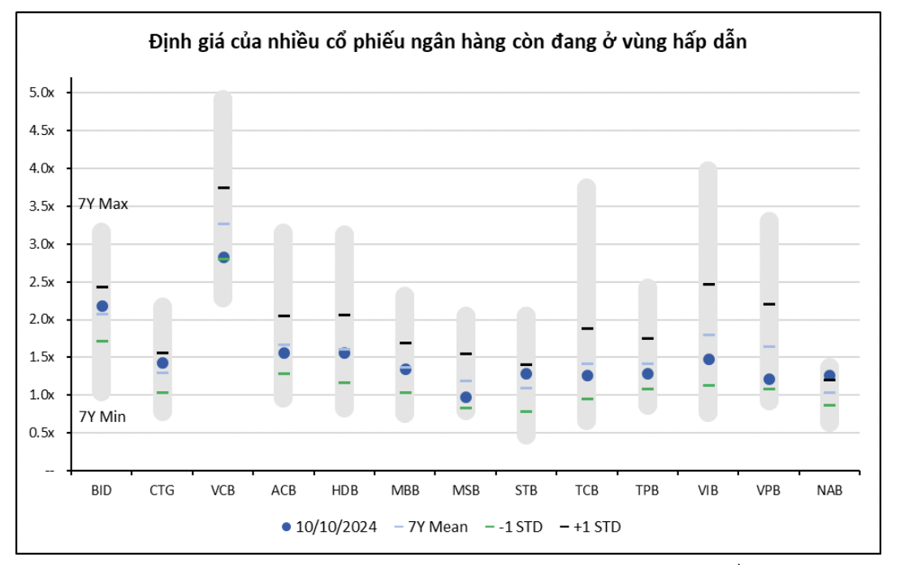

In terms of valuation, the growth prospects for next year are not yet reflected in the stock prices, as many banks are still relatively undervalued compared to their historical levels. Therefore, BSC recommends accumulating bank stocks for a medium and long-term vision, even if the short-term profit growth prospects are not surprising. Banks with strong and sustainable growth momentum that have not yet been valued accordingly include ACB, CTG, MBB, TCB, and VPB.

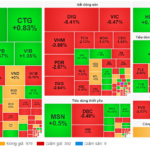

The Big Turnaround: Bank Stocks and Real Estate Make a Comeback to Lead the Market Surge

After a sluggish morning session, the market suddenly witnessed a surge of aggressive buying, propelling stock prices upward and triggering a broad reversal. The VN-Index surged past the reference point to close at the highest level of the day, led by a remarkable performance from banking and real estate stocks in this unexpected turn of events.

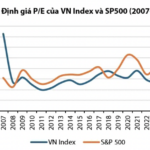

Why is the S&P 500 Hitting Record Highs While the VN-Index is Stuck Below 1200 Points?

Although the Compound Annual Growth Rate (CAGR) of EPS for the VN-Index (8.4%) outperforms that of the S&P 500 (7.6%) since 2016, the S&P 500 has witnessed a more remarkable surge, attributable to a more significant re-rating. Specifically, the S&P 500’s average P/E valuation has escalated from 15.3 times to 21 times, representing a substantial increase of 37%. In contrast, the VN-Index’s re-rating has been relatively modest, rising gently from 15.4 times to 16 times, a mere 4% increase.

The Market Beat: A Tale of Diverging Fortunes

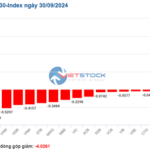

At the close, the VN-Index witnessed a slight dip of 2.98 points (-0.23%), settling at 1,287.94; while the HNX-Index shed 0.8 points (-0.34%) to close at 234.91. The market breadth tilted towards decliners, with 436 stocks falling against 272 advancing stocks. The VN30-Index basket saw a balanced performance, with 19 decliners, 8 advancers, and 3 stocks remaining unchanged, maintaining a green-red equilibrium.

The Market Beat: VN-Index Hanging on at 1,280 Points

The market closed with the VN-Index down 1.6 points (-0.12%) to 1,279.48, while the HNX-Index fell 0.69 points (-0.3%) to 228.26. The market breadth tilted towards decliners with 381 losers and 287 gainers. The large-cap stocks in the VN30-Index basket witnessed a similar trend, with 18 stocks declining, 9 advancing, and 3 unchanged.