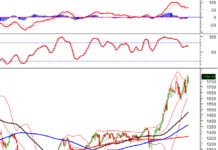

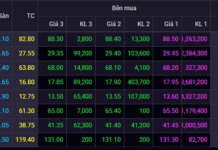

A spectacular derivatives expiry session. With pressure relieved, sentiment remained cautious throughout the morning, causing the index to continue dipping, but buying momentum picked up in the afternoon, leading to a strong rebound of 7 points to close at 1,286 points. The market breadth was much improved, with 224 gainers overpowering 128 losers. The two large-cap groups, banks and real estate, led the rally, with most stocks in these sectors turning green.

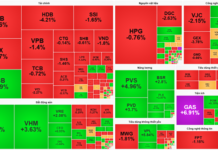

There was strong consensus among banks, with the exception of HDB, which closed in the red. The rest finished firmly in positive territory, including STB, LPB, MBB, TPB, and ACB. Large-cap stocks in this sector, such as VCB, BID, CTG, and TCB, also ended in the green but with more modest gains. Meanwhile, several real estate stocks surged to hit the daily limit, including NHA, PDR, and DXG, while others, such as CEO, DIG, NVL, HDC, and NLG, posted significant gains.

Securities companies also shone, with SSI, VCI, VIX, VND, and MBS climbing an average of 2%. No sector was left behind, as most other groups, including Materials, Software, Telecom, and Energy, also painted a lush green picture. The stocks that contributed the most to the market’s gains today were VCB, BID, MBB, STB, ACB, CTG, and MSB, with the banking group alone accounting for nearly 4 points of the index’s rise.

Money is flowing into the market, with combined liquidity on the three exchanges reaching VND18 trillion. Foreign investors, however, remained net sellers, offloading a total of VND418.8 billion, including VND359.3 billion on the HoSE alone.

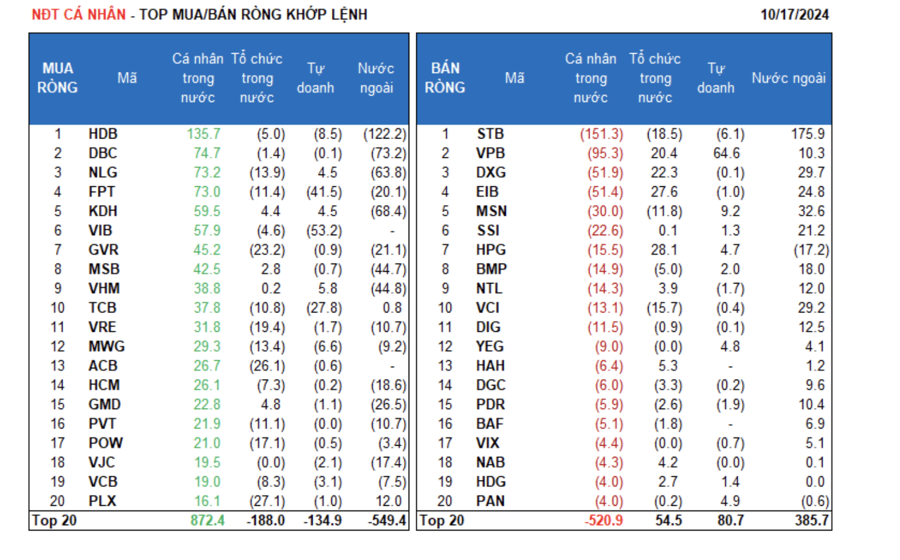

On the buying side, their main focus was on Financial Services and Oil & Gas stocks. The top stocks purchased by foreign investors on the matching board included STB, MSN, DXG, VCI, EIB, SSI, BMP, DIG, NTL, and PLX.

On the selling side, they offloaded mainly Real Estate stocks. The top stocks sold by foreign investors on the matching board included HDB, DBC, KDH, NLG, VHM, GMD, GVR, VNM, FPT.

Individual investors were net buyers to the tune of VND353.8 billion, with a matching net buy value of VND603.9 billion.

On the HoSE, they bought a majority of sectors, with Real Estate being their top choice. Their favorite stocks included HDB, DBC, NLG, FPT, KDH, VIB, GVR, MSB, VHM, and TCB.

On the selling side, they offloaded mainly Basic Materials and Media stocks. The top stocks sold by individual investors on the matching board included STB, VPB, DXG, EIB, MSN, SSI, BMP, NTL, and VCI.

Proprietary traders were net buyers, purchasing VND261.7 billion worth of shares, but they were net sellers on the matching board, offloading VND38 billion worth of stocks.

On the HoSE, they bought stocks from 8 out of 18 sectors, with the largest purchases in Food & Beverage and Construction & Materials. The top stocks bought by proprietary traders today were VPB, VNM, MSN, MBB, PC1, VHM, PNJ, PAN, YEG, and HPG. On the selling side, they offloaded mainly Banking stocks. The top stocks sold by proprietary traders were VIB, FPT, TCB, CTG, HDB, E1VFVN30, MWG, SHB, STB, and SSB.

Domestic institutions were net sellers, offloading VND211.2 billion worth of shares, with a matching net sell value of VND206.5 billion.

On the HoSE, they sold stocks from 15 out of 18 sectors, with the largest sell-offs in Banking. The top stocks sold by domestic institutions included PLX, ACB, GVR, VRE, STB, POW, VCI, VNM, MBB, and PNJ. On the buying side, they focused on Basic Materials stocks. The top stocks purchased by domestic institutions were HPG, EIB, DXG, VPB, BWE, HAH, GMD, KDH, GEX, and NAB.

Block deals today reached VND3,251.2 billion, up 85.6% compared to the previous session, contributing 17.5% to the total trading value.

A notable block deal took place in MSB, with 11.3 million shares worth VND152.6 billion changing hands between foreign institutions.

Individual investors also participated in block deals involving stocks in the Banking sector (STB, HDB, SSB), FPT, and GEX.

Money flow showed an increase in allocation to Real Estate, Banking, Securities, Steel, and Textiles, while decreasing in Construction, Chemicals, Food & Beverage, Retail, and Software.

On the HoSE, money flow favored mid-cap stocks (VNMID) while reducing allocation to large-cap (VN30) and small-cap (VNSML) stocks.