I. MARKET ANALYSIS OF THE STOCK MARKET ON 10/24/2024

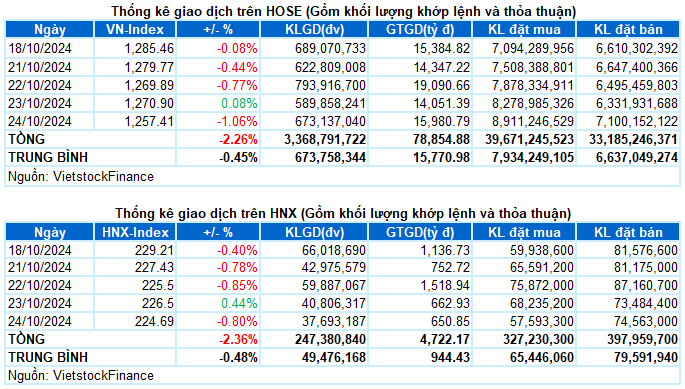

– The main indices fell sharply in the trading session on October 24. Specifically, VN-Index closed down 1.06%, to 1,257.41 points; HNX-Index decreased by 0.8%, to 224.69 points.

– The matching volume on HOSE reached more than 592 million units, up 10.6% compared to the previous session. The matching volume on HNX decreased by 13.6%, reaching nearly 35 million units.

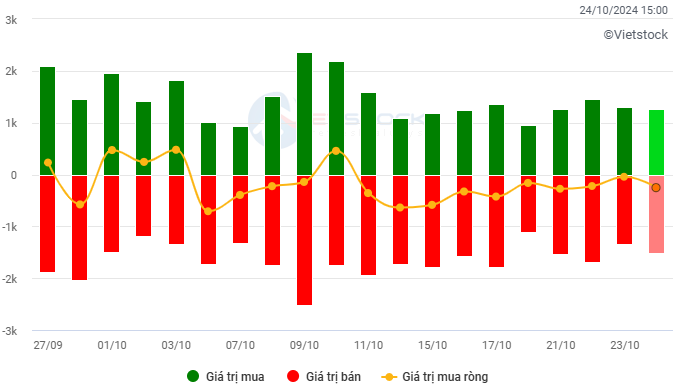

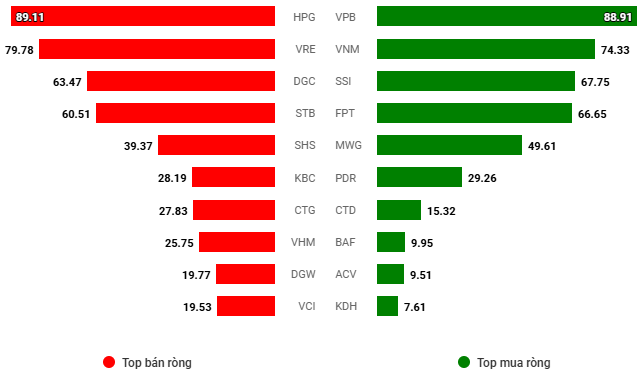

– Foreign investors net sold on the HOSE and HNX exchanges, with a value of more than VND 228 billion and nearly VND 45 billion, respectively.

Trading value of foreign investors on HOSE, HNX and UPCOM by day. Unit: Billion VND

Net trading value by stock code. Unit: Billion VND

– The trading session on October 24 continued to witness the familiar tug-of-war in the first half of the morning. However, the increasing selling pressure broke the balance in the context of low liquidity, VN-Index lost more than 3 points at the end of the morning session. The downward trend continued throughout the afternoon session, especially with the focus on selling large-cap stocks, making it even more difficult for the index to recover. At the close, VN-Index fell 13.49 points, to 1,257.41 points.

– In terms of impact, the 10 stocks that had the most negative impact on the VN-Index today took away nearly 10 points, especially VHM alone caused the index to fall by more than 3 points. Following were VIC, STB, and TCB, each taking away an additional 1 point. In contrast, the 10 stocks with the most positive impact only helped the VN-Index increase by more than 1 point, with VNM being the most notable with a contribution of 0.57 points.

– Large-cap stocks put heavy pressure on the market, with the VN30-Index closing down 20.1 points, or 1.49%, to 1,329.62 points. Sellers dominated with 22 codes decreasing, 6 increasing, and 2 standing.

VHM and STB plunged, even nearly hitting the floor with a decrease of 6.7% in today’s session. In contrast, VNM shone as it went against the market with a gain of 1.6%, while the remaining green stocks rose slightly by less than 0.5%.

Considering the industry groups, although the index fell sharply, half of the industry groups still managed to stay in the green. This is because the selling pressure was concentrated in the two groups of stocks with the largest market capitalization: real estate and finance, which decreased by 2.46% and 1.15%, respectively. Red dominated most of the codes, typically VHM (-6.7%), VIC (-2.66%), VRE (-2.68%), IDC (-2.94%), DXG (-2.11%), SZC (-2.31%); STB (-6.7%), TCB (-2.27%), VPB (-2.2%), MBB (-2.18%), TPB (-3.4%), MSB (-3.89%), VND (-2.05%), HCM (-2.42%), and FTS (-3.1%).

On the opposite side, the industrial group led the market with an increase of nearly 1%, mainly due to the green of ACV (+3.17%), PHP (+3.02%), SJG (+4.65%), PAP (+14.67%), and C4G (+1.19%). In addition, the non-essential consumer group also attracted positive buying force, notably MCH (+2.28%), VNM (+1.63%), SBT (+1.21%), MPC (+3.16%), MML (+2.85%), BHN (+1.44%), and HNG (+2.13%).

II. TREND AND PRICE FLUCTUATION ANALYSIS

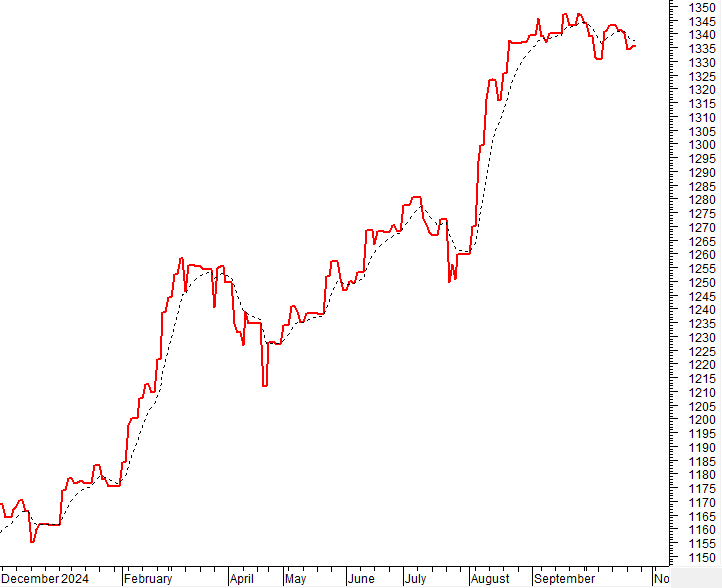

VN-Index – Appearance of a Black Marubozu Candlestick Pattern

VN-Index fell sharply with the appearance of a Black Marubozu candlestick pattern, simultaneously breaking the old bottom at the beginning of October 2024 (equivalent to the 1,265-1,270 point range). This indicates that investors are very pessimistic. In addition, trading volume remained below the 20-day average, indicating that buying demand is still limited.

Currently, the MACD indicator still maintains a sell signal while falling below the 0 threshold. This suggests that the correction in the coming time will continue.

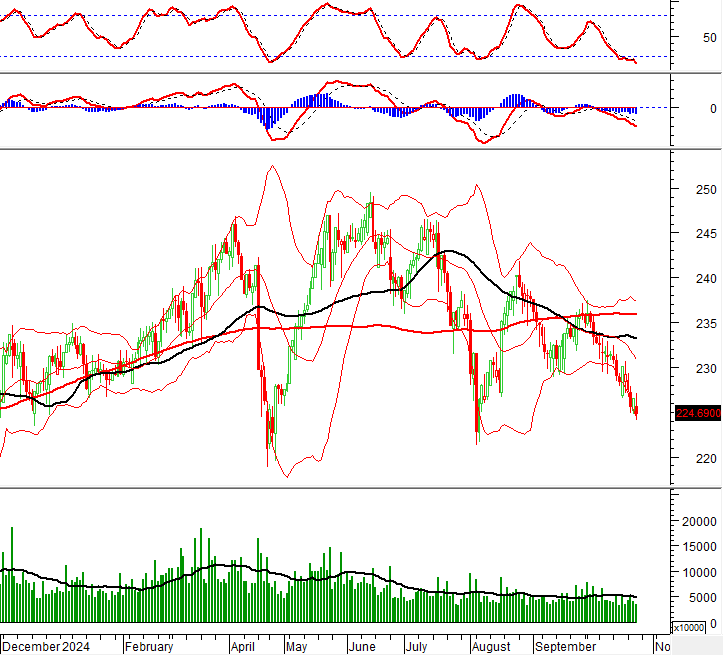

HNX-Index – Close to the Lower Bollinger Band

HNX-Index continued to fall and moved closer to the Lower Bollinger Band, which is expanding, indicating a rather pessimistic situation. In addition, trading volume remained below the 20-day average, indicating that money flow has not returned to the market.

At the moment, the MACD and Stochastic Oscillator indicators continue to decline after giving sell signals. This suggests that the short-term correction will continue in the coming time.

Analysis of Money Flow

Fluctuation of Smart Money Flow: The Negative Volume Index indicator of VN-Index cut down below the EMA 20 line. If this state continues in the next session, the risk of an unexpected drop (thrust down) will increase.

Fluctuation of Foreign Money Flow: Foreign investors continued to net sell in the trading session on October 24, 2024. If foreign investors maintain this action in the coming sessions, the situation will become even more pessimistic.

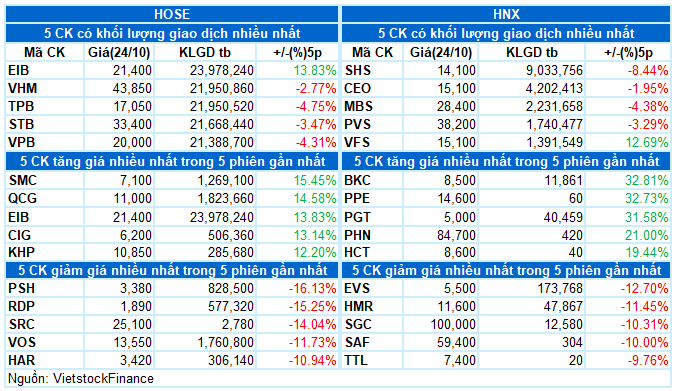

III. MARKET STATISTICS ON 10/24/2024

Economic Analysis and Market Strategy Department, Vietstock Consulting

The Market Beat: Buyers Strike Back, VN-Index Holds its Ground

The market ended the session on a positive note, with the VN-Index climbing 2.03 points (0.16%) to reach 1,288.39; the HNX-Index also rose, gaining 0.08 points (0.03%) to close at 231.37. The market breadth tilted in favor of gainers, with 372 advancing stocks against 317 declining ones. The large-cap VN30 basket painted a similar picture, as 15 constituents added value, 12 lost ground, and 3 remained unchanged, ending the day in the green.

The Big Shake-Up: Small-Cap Stocks’ Surprising Resilience

The “blue morning, red afternoon” trend persisted today, but losses were less severe. The market experienced a sharp decline towards the end of the afternoon session, with the VN-Index plunging as much as 3.7 points before recovering to close just 1.6 points (-0.12%) lower. The VNSmallcap was the sole index in positive territory and the only group to maintain liquidity compared to yesterday’s session.

“Failed Attempt, Cash Back to Bank Stocks”

The market witnessed a significant upswing in the afternoon session, with the VN-Index rallying towards the peak of 1,294 points achieved in the morning. However, in the last 15 minutes of continuous matching, a surge of sell orders caused a series of declines across stock prices. The ATC session delivered the final blow, pushing the index below the reference point.

The Flow of Funds: What to Do When Stocks Have Good Earnings but Prices Don’t Soar?

The Q3 2024 earnings season is in full swing, yet market movements have not reflected commensurate reactions. Last week, the VN-Index declined for the first three consecutive sessions, rebounded on Thursday, but faltered in the final trading session. The index once again retreated as it approached the 1,300-point mark. The HoSE’s average matching liquidity did not show any significant improvement and even witnessed a slight decline.