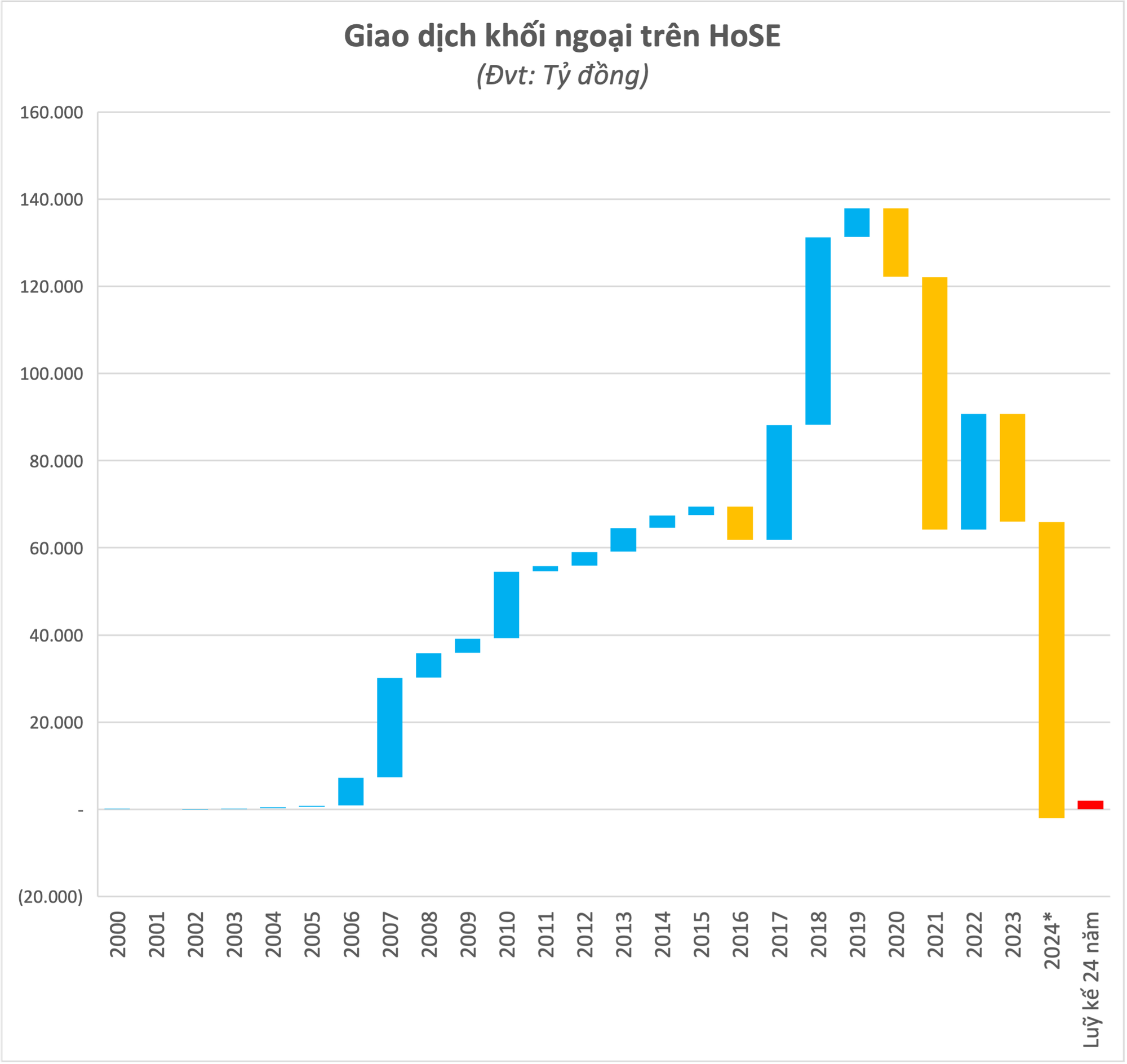

The trend of foreign net selling has been persistent in the Vietnamese stock market. Foreign investors have been net selling for the 9th consecutive month on HoSE, with a cumulative value since the beginning of the year reaching VND 67,000 billion (~ USD 2.7 billion), setting a new record.

The “sell-off” move shows no signs of stopping and it is possible that it will soon completely erase the net buying momentum that has lasted for over two decades. Cumulatively, since the Vietnamese stock market started operating in 2000, the net buying value of foreign investors is now just over VND 1,600 billion (according to HoSE statistics, only taking into account matched and matched transactions on the floor). This is a modest figure compared to the market capitalization of over VND 5 million billion and liquidity of about VND 15,000 billion/session on HoSE.

Data as of October 23, 2024

The continuous net selling of billions of dollars of stocks over a long period of time has led many people to question whether the Vietnamese stock market has lost its appeal to foreign investors. In episode 6 of the talk show “The Investors” co-organized by CafeF and VPBank Securities, Ms. Nguyen Hoai Thu, CFA, Executive Director of VinaCapital Securities Investment, confidently affirmed that foreign investors always appreciate Vietnam’s growth story because it is so obvious. Our country’s fundamental economy is expected to maintain a growth rate of about 6% – 7% in the next 5 or even 10 years thanks to a good resource base and a golden population structure with a high proportion of labor force.

However, the female leader of VinaCapital said that although foreign investors are optimistic, they are still concerned about how to access the country’s stock market, as the market has not been upgraded and does not yet meet some criteria related to the investment environment ranking.

“Once Vietnam gradually achieves new milestones such as upgrading from a frontier market to an emerging market and improving its investment environment ranking, it will have more credibility in the eyes of investors,” said Ms. Nguyen Hoai Thu.

In fact, the term “upgrade” has been mentioned repeatedly with high frequency, especially after the Government’s Strategy for Securities Market Development towards 2030 set a specific goal of striving by 2025 to upgrade the Vietnamese stock market from a frontier market to an emerging market. Many circulars and regulations have been issued to bring the Vietnamese stock market closer to the requirements of the ranking organization. The SSC has continued to coordinate with relevant units to vigorously implement solutions to ensure that the Vietnamese stock market meets the upgrade criteria. Most recently, the Ministry of Finance issued Circular No. 68/2024/TT-BTC on September 18, 2024, making amendments to many provisions. This circular removes the requirement for pre-deposit for international investors by updating regulations on securities trading, clearing and settlement, securities company operations, and information disclosure.

The efforts and solutions proposed by the management have been positively evaluated by international organizations and market members. In the event of an upgrade, Vietnam, which currently accounts for 28% of the frontier basket, will move to the emerging market group with a weight that may be just under 1%. But this does not mean that the selling capital flow will be stronger than the buying flow. According to calculations by VinaCapital’s team, if considered for upgrading by both FTSE Russell and MSCI, the net inflow of capital could be up to USD 5-8 billion.

Specifically, while MSCI’s regulations still pose many difficulties and require more time to meet, in the near term, the securities investment community is expecting Vietnam to be considered for an upgrade by FTSE Russell in 2025, along with an inflow of about USD 1 billion through funds. specialized investment in FTSE Russell’s emerging market group.

In its latest market ranking report in October 2024, FTSE Russell acknowledged the Vietnamese government’s continuous support for market reforms, stating that the next important announcement would be the publication of more detailed operating rules by the Vietnam Securities Depository and Clearing Corporation (VSDC). At the same time, the ranking organization also encourages exchanges between Vietnamese units and the international investment community to ensure that these rules meet the needs of stakeholders.

Looking at other countries that have gone through this stage, foreign capital often “takes the lead” compared to the official upgrade time and boosts the stock market to surge. Typically, the Qatar stock market increased by more than 45% from September 2013 to September 2014, Saudi Arabia increased by more than 23% from March 2017 to March 2018, and Romania increased by more than 18% from September 2018 to September 2019. Therefore, the expectation of an upgrade in the following year will help Vietnam be able to attract more investment funds to pour money into stocks to “catch the wave” of upgrading right now.

According to Ms. Nguyen Hoai Thu, the stock market upgrade is a pivotal step for the economy of Vietnam, not only helping to attract capital inflows into the market but also helping enterprises to be able to more easily mobilize capital from the international market. The upgrade process also brings in more institutional investors, thereby balancing with the force of individual investors who currently account for up to 90% of the market.

“The Investors” is an inspiring talk show series co-organized by CafeF and VPBank Securities (VPBankS), broadcast at 10:00 every Tuesday.

VPBank Securities Joint Stock Company (VPBankS) is the only securities company in the VPBank ecosystem with a leading charter capital in the market, with a scale of VND 15,000 billion. VPBankS is also in the top 10 securities companies with the largest margin debt in the market and has much room for growth in the future. Moreover, VPBankS has built a comprehensive ecosystem, fully integrating from products to platforms and services personalized according to each risk appetite, meeting the diverse investment needs of customers.

The Market Beat: A Rapid Decline, A Strong Surge in the Expiry of Derivatives

The VN-Index faced pressure throughout the morning session and the early minutes of the afternoon, dipping below 1,272 points. However, true to the nature of an expiration day for derivatives, the VN-Index staged a strong comeback, closing above 1,286 points. This impressive turnaround was largely driven by the banking, securities, and real estate sectors, which provided the much-needed boost to push the index higher.

The Cash Flow Crisis: VN-Index Plunges as Foreign Investors Sell-Off

The market was dull this morning as investors were reluctant to buy, and sell orders dominated. The VN-Index briefly touched green in the first few minutes, but it was short-lived as the market soon turned red and slid lower. The downward pressure continued throughout the morning session, with sell-offs triggered by low-price stop orders. The index closed the morning at its lowest point, with four times as many losers as gainers.

The Ever-Rising Bridge Tolls: A Costly Commute

Although the VN-Index only slightly increased by 3.24 points (+0.25%) during the morning session, the index traded above the reference level for most of the time, with a positive market breadth. This is a result of buying power pushing the market to higher price levels. Blue-chips are leading the gains and dominating market liquidity, accounting for more than half of the total trading volume.