On October 21st, HoSE announced the results of its quarterly review of the HoSE-Index and investment indices for Q4 2024. According to the announcement, the VNDiamond index added MWG stock, while VRE stock was placed on the watchlist due to its FOL ratio (reflecting foreign investors’ holding ratio) falling below 65%. The new indices will take effect on November 4th, giving ETF funds until November 1st to complete their portfolio rebalancing.

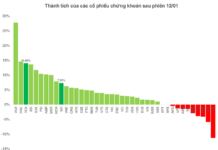

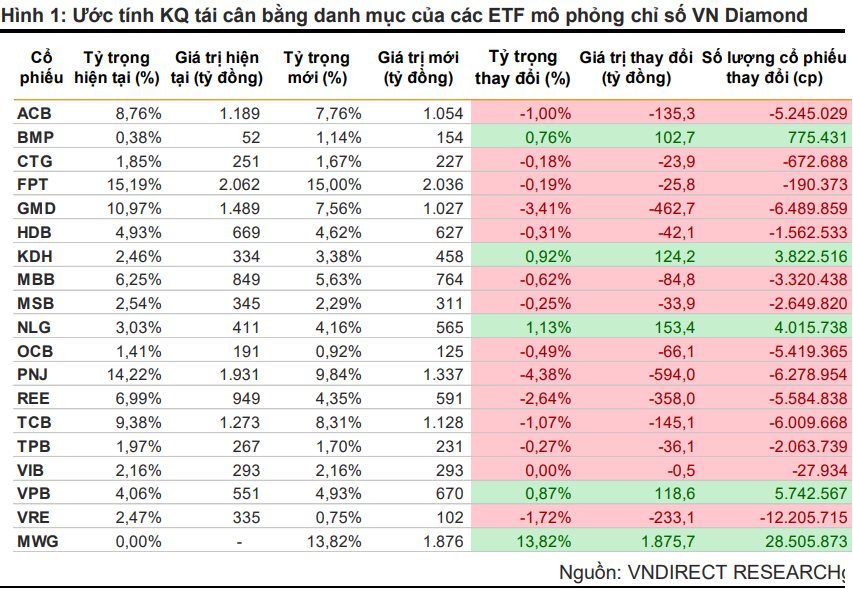

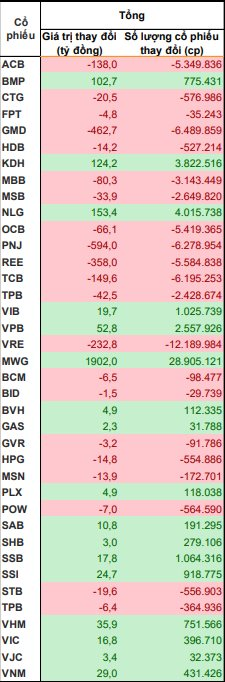

Based on HoSE’s review, VNDirect Securities provided an estimate of the expected trades for this quarterly rebalancing. They predicted that the stocks to be purchased the most by ETFs tracking the VNDiamond and VN30 indices would include MWG, NLG, and KDH with corresponding volumes of 28.9 million shares (~VND 1,902 billion), 4 million shares (~VND 153 billion), and 3.8 million shares (~VND 124 billion). In contrast, PNJ, GMD, and REE are expected to be among the most sold stocks, with volumes of 6.2 million shares (~VND 594 billion), 6.4 million shares (~ VND 462 billion), and 5.5 million shares, respectively.

Specifically, for the group of ETFs tracking the VNDiamond index, the MWG stock has been added to the index and will be subject to a 50% weight limit. Meanwhile, VRE stock has been moved to the watchlist and is also subject to a 50% weight limit. If VRE’s FOL ratio remains below 65% in the next review in Q2 next year, it will be officially removed from the VNDiamond index.

The VNDiamond index comprises 19 stocks, including 10 banking stocks with a market capitalization ratio limited to 40% and 9 stocks from other sectors. Currently, there are five ETFs tracking the VN Diamond index: DCVFM VN Diamond ETF, MAFM VN Diamond ETF, BVFVN Diamond ETF, KIM Growth Diamond ETF, and ABF VN Diamond ETF. The combined net asset value of these funds is approximately VND 13,500 billion.

Based on HoSE’s review, VNDirect anticipated that ETFs would buy nearly 29 million shares of MWG, almost 6 million shares of VPB, 4 million shares of NLG, and so on. Conversely, they expected sales of TCB (-6 million shares), PNJ (-6.3 million shares), GMD (-6.5 million shares), REE (-5.5 million shares), and others.

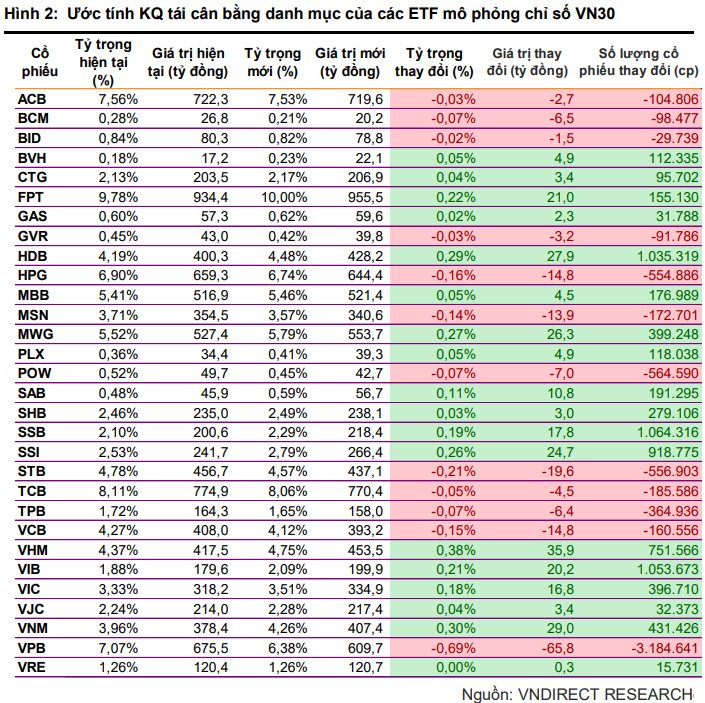

Regarding the group of ETFs tracking the VN30 index, this review only updated data and recalculated portfolio weights. Currently, there are four ETFs tracking the VN30 index: DCVFM VN30 ETF, SSIAM VN30 ETF, FUEMAV30 ETF, and KIM Growth VN30 ETF, with a combined net asset value of approximately VND 9,500 billion.

VNDirect estimated that these ETFs would buy VIB (1 million shares), SSB (1 million shares), HDB (1 million shares), and so on. Conversely, stocks expected to be sold include VPB (-3.1 million shares), POW (-564,000 shares), STB (-554,000 shares), and others.

The Big Shake-Up: Small-Cap Stocks’ Surprising Resilience

The “blue morning, red afternoon” trend persisted today, but losses were less severe. The market experienced a sharp decline towards the end of the afternoon session, with the VN-Index plunging as much as 3.7 points before recovering to close just 1.6 points (-0.12%) lower. The VNSmallcap was the sole index in positive territory and the only group to maintain liquidity compared to yesterday’s session.

The Cash Flow Crisis: VN-Index Plunges as Foreign Investors Sell-Off

The market was dull this morning as investors were reluctant to buy, and sell orders dominated. The VN-Index briefly touched green in the first few minutes, but it was short-lived as the market soon turned red and slid lower. The downward pressure continued throughout the morning session, with sell-offs triggered by low-price stop orders. The index closed the morning at its lowest point, with four times as many losers as gainers.

The Flow of Funds: What to Do When Stocks Have Good Earnings but Prices Don’t Rise?

The Q3 2024 earnings season is in full swing, yet market movements have not reflected commensurate reactions. Last week, the VN-Index declined for the first three sessions, rebounded on Thursday, but faltered in the final trading day. The index once again retreated as it approached the 1,300-point mark. The HoSE’s average matching liquidity also showed no significant improvement and even witnessed a slight decline.

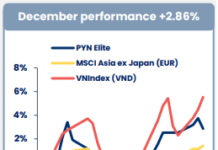

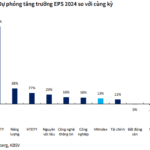

Five Factors Shaping Vietnam’s Stock Market Trends in Q4: KBSV Research’s Insights on VN-Index’s Surge to 1,320.

For the outlook of the second half of this year, KBSV Research believes that there are five key factors shaping the trends in the Vietnamese stock market. The VN-Index is projected to reach 1,320 points by the end of 2024.