Vietnam’s stock market experienced a volatile session on October 23rd, dipping into negative territory during the day before staging a late rally to close in the green. The VN-Index ended the session up 1.01 points at 1,270.90, with low trading volumes as the value of transactions on HOSE exceeded 14,000 billion VND.

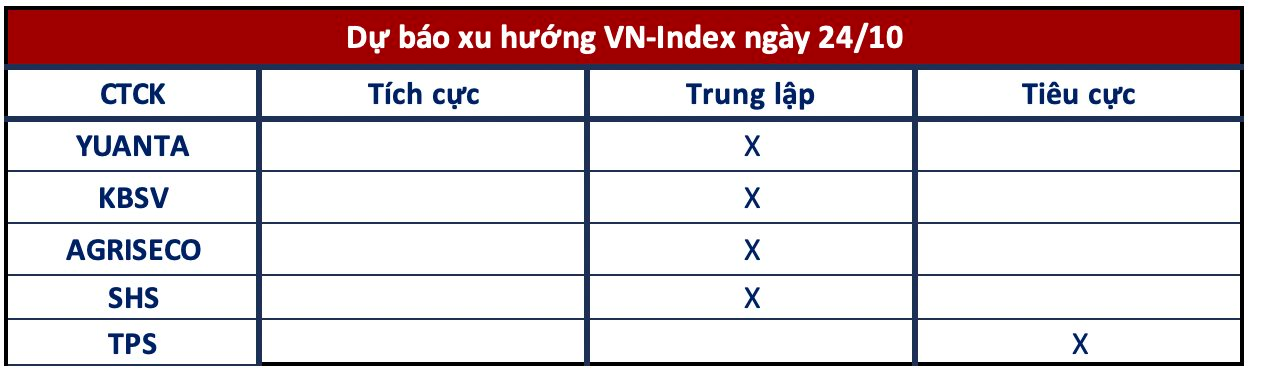

Looking ahead to the next trading session, most securities companies are adopting a relatively cautious stance, advising investors to be wary of chasing rallies.

Sellers Dominate the Market

Yuanta Securities: The market is likely to witness a rebound in the next session, but the recovery is expected to be weak and short-lived. Low trading volumes during the rebound indicate weak buying pressure, as investors remain hesitant to re-enter the market after the recent sharp decline.

KBSV Securities: Technical signals continue to favor sellers, but the current dynamics suggest that sideways trading will temporarily prevail in the short term, with the correction gradually easing until the index finds a new equilibrium.

SHS Securities: In the short term, SHS maintains its recommendation to avoid chasing rallies, as conveyed in previous reports. The short-term trend is accumulation, and this process may prolong due to the upcoming information vacuum after the Q3/2024 earnings season, as well as the uncertainty surrounding the upcoming US elections.

TPS Securities: A doji candle formed near the previous low of October 7th indicates weakening buying strength. However, TPS believes that maintaining a cautious approach will provide investors with less risky entry opportunities. The resistance and support levels for the VN-Index are 1,300 points and 1,260 points, respectively.

Increase Cash Allocation

Agriseco Securities: Technically, the VN-Index closed below the MA50-day support level, corresponding to the 1,270-point mark, after a sharp decline. The breakdown from the narrowing pattern and the high trading volumes suggest that the market may continue to face selling pressure in the upcoming sessions. Given these dynamics, there are no immediate signs of a market rebound.

Agriseco recommends that investors maintain a high cash balance to ensure flexibility when more attractive opportunities arise. For new investments, consider focusing on VN30 and blue-chip stocks trading at discounted valuations.

The Market Beat: VN-Index Struggles at the 1,270-Point Mark

The market closed with slight losses, as the VN-Index dipped by 0.67 points (-0.05%) to finish at 1,269.93, while the HNX-Index fell by 0.2 points (-0.09%) to 232.47. The market breadth was relatively balanced, with 330 decliners against 322 advancers. The large-cap VN30-Index painted a similar picture, with 16 stocks in the red, 11 in the green, and 3 unchanged.

The Stock Market Week of October 21-25, 2024: Short-Term Adjustment Pressures

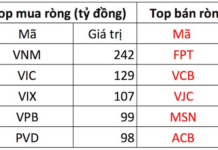

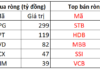

The VN-Index has been on a downward spiral, slipping below the middle Bollinger Band. This, coupled with trading volumes that remain below the 20-day average, indicates a persistent investor caution. To add to the woes, consistent net selling by foreign investors has also contributed to the mounting pressure on the index.

The Market Beat: Downward Momentum Persists, VN-Index Loses 1,260-Point Mark

At the end of the trading session, the VN-Index declined by 4.69 points (-0.37%), settling at 1,252.72. The HNX-Index witnessed a marginal loss of 0.06 points (-0.03%), closing at 224.63. The market breadth tilted towards decliners, with 377 stocks trading lower against 286 gainers. The VN30-Index, representing the top 30 stocks by market capitalization and liquidity, exhibited a similar trend, with 19 stocks closing in the red, 4 in the green, and 7 remaining unchanged.

The Cautious Sentiment Persists

The VN-Index closed the session with a slight gain, retesting the old bottom from early October 2024 (equivalent to the 1,265-1,270 point range). If, in the coming days, the index holds firm above this threshold, coupled with trading volumes surpassing the 20-day average, the short-term outlook will turn more positive. Moreover, the MACD indicator needs to flash a buy signal again to sustain this optimism.