Nguyen Yen Linh, the daughter of billionaire Nguyen Dang Quang, Chairman of Masan Group (MSN code), has just registered to buy 10 million MSN shares to increase her ownership. The transaction is expected to be executed by matching and/or matching orders from October 29 to November 18, 2024.

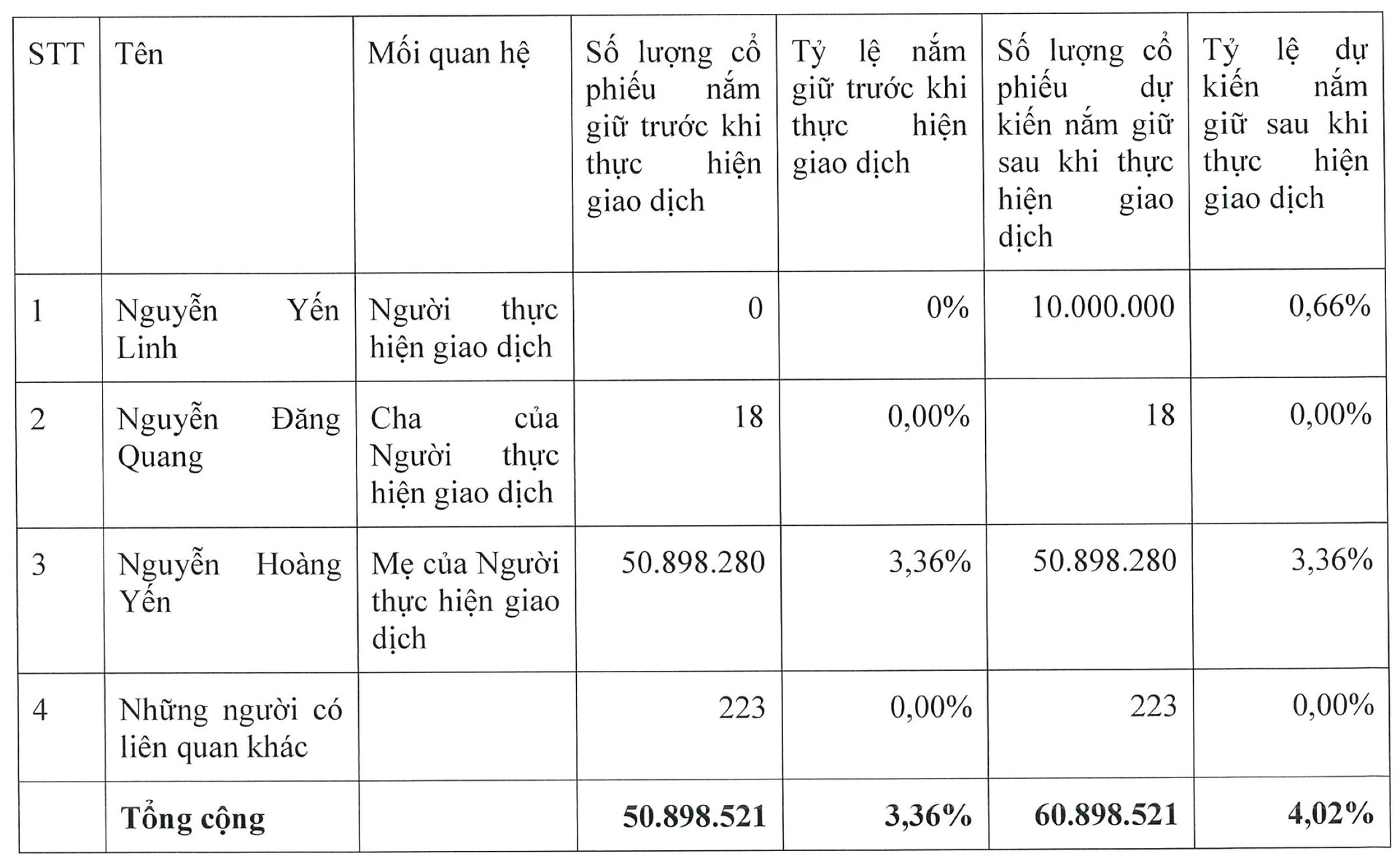

According to the registration, Mr. Nguyen Dang Quang’s daughter does not hold any MSN shares. Billionaire Nguyen Dang Quang directly holds only 18 MSN shares. Mr. Quang’s wife, Mrs. Nguyen Hoang Yen, holds nearly 50.9 million MSN shares (3.36%).

In addition to the small number of shares held directly, Mr. Nguyen Dang Quang mainly owns indirect shares in Masan Group through Masan Joint Stock Company. This is the largest shareholder of Masan Group, holding nearly 446.3 million MSN shares, equivalent to 31.19% ownership (according to Masan Group’s management report up to July 2024). At Masan, Mr. Nguyen Dang Quang is the Chairman of the Board of Directors and General Director.

In addition to MSN shares, Mr. Nguyen Dang Quang also directly holds nearly 19 million Techcombank shares (TCB code) and about 30,000 Masan Consumer Holdings shares (MCH code).

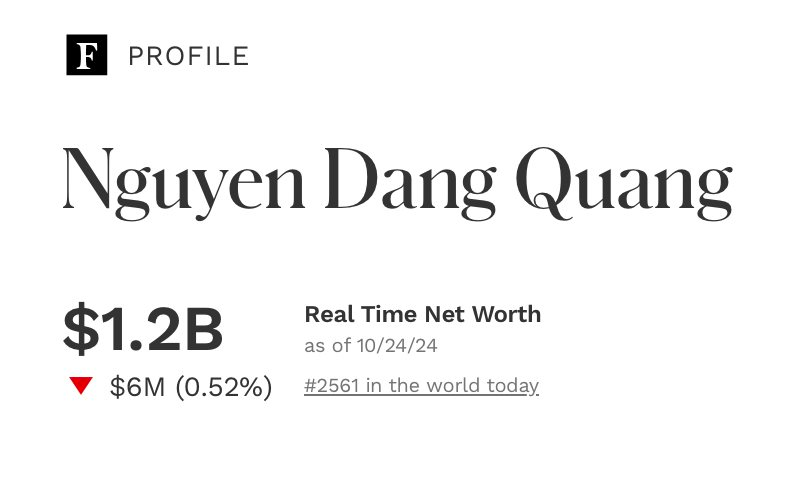

According to Forbes’ calculations, Mr. Nguyen Dang Quang currently has a net worth of $1.2 billion, ranking 2561st on the list of the world’s billionaires and 6th in Vietnam, after Mr. Pham Nhat Vuong, Mrs. Nguyen Thi Phuong Thao, Mr. Tran Dinh Long, Mr. Ho Hung Anh, and Mr. Tran Ba Duong.

On the stock exchange, MSN shares have increased by more than 17% since the beginning of 2024 to VND 78,500/share. Masan Group’s market capitalization is equivalent to nearly VND 113,000 billion (~USD 4.5 billion).

In terms of business results in Q3 2024, Masan’s net revenue reached VND 21,487 billion, up 6.6% over the same period last year. This was achieved thanks to the growth of consumer retail businesses, which offset the restructuring of the farm chicken business of Masan MeatLife and the temporary disruption of operations of Masan High-Tech Materials.

After-tax profit to shareholders of the parent company reached VND 701 billion, up nearly 1,400% over the same period last year. This result is a testament to the profitability of the consumer retail businesses. In addition, the company also recorded a decrease in net interest expense and no foreign exchange rate fluctuation expense. Masan has hedged 100% of its long-term USD loans since the beginning of the year.

“Long-Term Investment in Masan Group, SK Group Extends Put Option”

On September 4, 2024, Masan Group (HOSE: MSN) announced that it has agreed with SK Group to extend the put option timeline between the two parties by up to five additional years.

The Retail Giant: Generating $170 Million in Annual Tax Revenue

Masan Group is proud to be one of the largest taxpayers in the provinces where its factories operate, but its contribution to the community goes beyond that. The company provides employment opportunities for thousands of people, improving their livelihoods and positively impacting their lives. Additionally, Masan Group is committed to community development, allocating a portion of its profits to initiatives that make a lasting difference in the areas it serves.