On October 24, Masan Group Joint Stock Company (stock code: MSN) announced its Q3/2024 financial report.

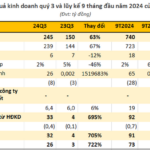

Accordingly, Masan achieved VND 21,487 billion in net revenue, up 6.6% over Q3/2023, thanks to sustainable growth from consumer retail businesses, offsetting the restructuring of farm chicken business of Masan MEATLife (MML) and the temporary disruption of Masan High-Tech Materials (MHT)’s business operations.

WinCommerce (WCM), the subsidiary operating WinMart supermarkets and Win stores, recorded a 9.1% growth compared to the same period last year, reaching over VND 8,600 billion.

WinCommerce upgrades point-of-sale model and launches WinMaet Urban

With a net profit of VND 20 billion, this is also the first quarter since the COVID-19 pandemic that WinCommerce has turned a profit, thanks to the new model specializing in urban (Win stores) and rural (WinMart+ Rural stores) areas, achieving same-store sales growth (LFL) of 12.5% and 11.5%, respectively. The traditional store model also increased by 8%.

Previously, WinCommerce also reported a profit in June but did not disclose the specific figure. WinMart supermarkets achieved positive operating profits while revenue growth remained unchanged, mainly due to improved shrinkage rates.

On a cumulative 9-month basis, this modern retail chain achieved approximately VND 24,404 billion in revenue, up nearly 9% over the same period last year. On average, they recorded more than VND 89 billion in revenue per day.

Diverse MEATDeli counters at WinMart supermarkets

As of the end of September, WinCommerce operated 3,733 supermarkets and stores, adding 60 new points of sale in Q3.

In addition to WCM, the consumer retail business, including Masan Consumer Corporation (MCH), Masan MEATLife (MML), and Phuc Long Heritage (PLH), maintained positive growth momentum along with higher profits from non-core businesses. Specifically, MCH achieved a 10.4% increase in revenue over the same period to VND 7,987 billion, while MML recorded a slight increase of 1.7% in revenue to VND 1,936 billion.

PLH’s net revenue increased by 12.8% over the same period last year to VND 425 billion, mainly due to contributions from 21 new stores outside of WCM opened in the same quarter.

“In Q3/2024, WinCommerce and Masan MEATLife achieved positive net profits and were key drivers in maximizing value for shareholders. This trend will accelerate further as we continue to implement strategic initiatives in the medium term,” said billionaire Nguyen Dang Quang, Chairman of Masan Group.

The Retail Giant: Generating $170 Million in Annual Tax Revenue

Masan Group is proud to be one of the largest taxpayers in the provinces where its factories operate, but its contribution to the community goes beyond that. The company provides employment opportunities for thousands of people, improving their livelihoods and positively impacting their lives. Additionally, Masan Group is committed to community development, allocating a portion of its profits to initiatives that make a lasting difference in the areas it serves.