Vietnam’s stock market experienced a volatile session on October 25th, with an initial upward trend followed by a downward turn towards the end of the trading day. The VN-Index closed the session down 4.69 points at 1,252, while trading volume remained low, with a value of over 13,700 billion VND on the HOSE.

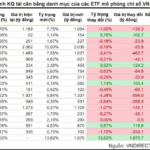

Foreign investors displayed a lack of enthusiasm as they offloaded a net sell value of 384 billion VND across the market.

On the HOSE, foreign investors sold a net value of 413 billion VND.

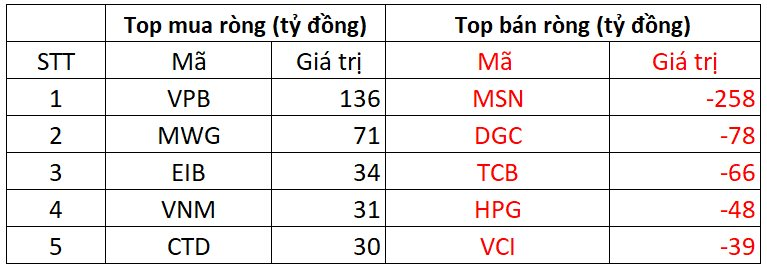

VPB was the most heavily purchased stock by foreign investors on the HOSE, with a value of over 136 billion VND. MWG and EIB followed suit, with net purchases of 71 billion VND and 34 billion VND, respectively. Additionally, VNM and CTD also saw net buying of 31 billion VND and 30 billion VND, respectively.

Figure 1: Foreign Investors’ Net Buying on HOSE

Conversely, MSN and DGC faced the most significant selling pressure from foreign investors, with net sell values of nearly 258 billion VND and 78 billion VND, respectively. TCB and HPG also witnessed notable net selling of 66 billion VND and 48 billion VND, respectively.

On the HNX, foreign investors recorded a net buy value of 12 billion VND.

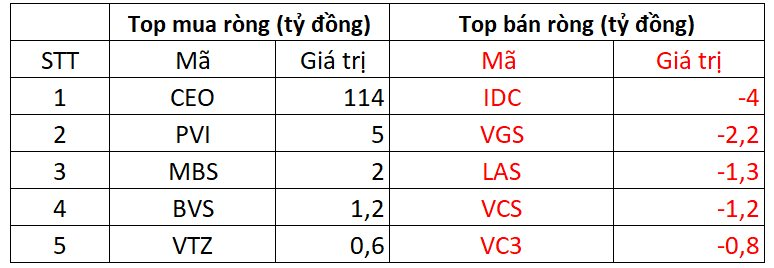

CEO was the stock with the highest net buy value on the HNX, amounting to 114 billion VND. PVI followed closely with a net buy value of 5 billion VND. Additionally, foreign investors also invested a few billion VND in MBS, BVS, and VTZ.

Figure 2: Foreign Investors’ Net Buying on HNX

On the other hand, IDC faced net selling pressure from foreign investors, amounting to nearly 4 billion VND. VGS, LAS, and VCS also experienced net selling of a few billion VND each.

On the UPCOM, foreign investors recorded a net buy value of 17 billion VND.

HNG was the most purchased stock by foreign investors on the UPCOM, with a net buy value of 8 billion VND. ACV and WSB also witnessed net buying of a few billion VND each.

Figure 3: Foreign Investors’ Net Buying on UPCOM

Conversely, AAS faced net selling from foreign investors, amounting to 1 billion VND. Additionally, foreign investors also offloaded holdings in TOW, KVC, and other stocks.

The Market Beat: VN-Index Struggles at the 1,270-Point Mark

The market closed with slight losses, as the VN-Index dipped by 0.67 points (-0.05%) to finish at 1,269.93, while the HNX-Index fell by 0.2 points (-0.09%) to 232.47. The market breadth was relatively balanced, with 330 decliners against 322 advancers. The large-cap VN30-Index painted a similar picture, with 16 stocks in the red, 11 in the green, and 3 unchanged.

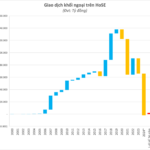

The Stock Market Week of October 21-25, 2024: Short-Term Adjustment Pressures

The VN-Index has been on a downward spiral, slipping below the middle Bollinger Band. This, coupled with trading volumes that remain below the 20-day average, indicates a persistent investor caution. To add to the woes, consistent net selling by foreign investors has also contributed to the mounting pressure on the index.

The Market Beat: Downward Momentum Persists, VN-Index Loses 1,260-Point Mark

At the end of the trading session, the VN-Index declined by 4.69 points (-0.37%), settling at 1,252.72. The HNX-Index witnessed a marginal loss of 0.06 points (-0.03%), closing at 224.63. The market breadth tilted towards decliners, with 377 stocks trading lower against 286 gainers. The VN30-Index, representing the top 30 stocks by market capitalization and liquidity, exhibited a similar trend, with 19 stocks closing in the red, 4 in the green, and 7 remaining unchanged.