Market liquidity decreased compared to the previous trading session, with the VN-Index‘s matched trading volume reaching over 525 million shares, equivalent to a value of more than 12.4 trillion VND; the HNX-Index reached over 36.3 million shares, equivalent to a value of more than 582 billion VND.

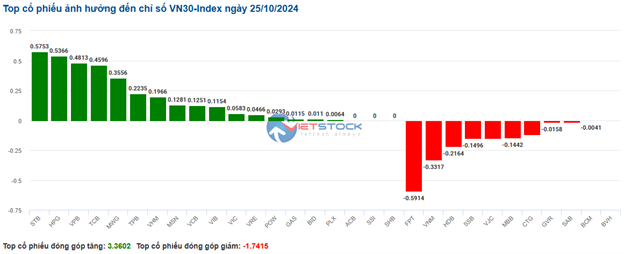

The VN-Index continued its lackluster performance in the afternoon session as selling pressure intensified, causing the index to plunge into negative territory. In terms of impact, BID, GVR, VIC, and MSN were the most negative stocks, taking away more than 2.2 points from the index. On the other hand, VPB, LPB, VCB, and VTP were the most positive stocks, but their impact on the index was negligible.

| Top 10 stocks with the highest impact on the VN-Index on October 25, 2024 |

Similarly, the HNX-Index also witnessed a lackluster performance, with negative impacts from stocks such as PVS (-1.05%), VCS (-1.26%), BAB (-0.84%), and NTP (-1.01%)…

|

Source: VietstockFinance

|

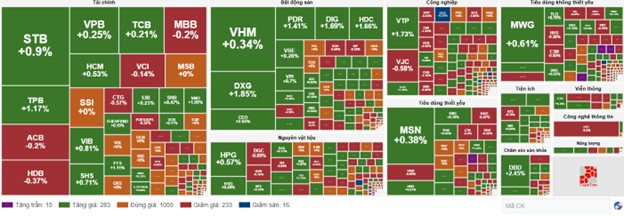

The energy sector recorded the largest decline in the market, falling by -0.85%, mainly due to losses in PVD (-0.97%), PVS (-1.05%), BSR (-0.93%), and PVC (-0.8%). This was followed by the materials and consumer staples sectors, which decreased by 0.6% and 0.56%, respectively. On the other hand, the consumer discretionary sector witnessed the strongest recovery in the market, rising by 0.65% with gains in VGI (+0.91%), YEG (+1.68%), FOX (+0.22%), and FOC (+1.74%)

In terms of foreign trading activities, foreign investors continued to net sell on the HOSE with a value of more than 399 billion VND, focusing on stocks such as MSN (242.16 billion), DGC (78.17 billion), TCB (64.6 billion), and VCI (37.49 billion). On the HNX, foreign investors net bought nearly 12 billion VND, mainly investing in CEO (14.23 billion), PVI (5.07 billion), MBS (2.05 billion), and BVS (1.3 billion)

| Foreign Trading Activities – Net Buying and Selling |

Morning Session: Mixed Performance with Narrow Range

The market traded weakly with mixed performances within a narrow range. At the end of the morning session, the VN-Index slightly decreased by 0.02%, settling at 1,257.2 points; while the HNX-Index increased by 0.2%, reaching 225.15 points. The market breadth was relatively balanced, with 295 declining stocks and 286 advancing stocks.

Liquidity remained low, with the total trading volume of the VN-Index reaching over 249 million units, equivalent to a value of more than 6 trillion VND. The HNX-Index recorded a volume of over 20 million units, with a value of approximately 337 billion VND.

Large-cap stocks were relatively quiet in the morning session, with stocks in the VN30 basket mostly recording slight gains or losses of less than 1%. As a result, the 10 stocks with the most positive and negative impacts on the VN-Index only contributed or deducted approximately 1.5 points from the overall index.

Sector performances were mixed, with fluctuations within a narrow range of less than 0.5%. The real estate sector led the market, although its gains were modest at 0.27%. Several stocks attracted significant buying interest, including DXG (+3.38%), IDJ (+3.28%), CEO (+2.65%), DIG (+2.42%), PDR (+2.11%), NHA (+1.74%), DXS (+1.72%), and HDC (+1.66%)

The healthcare sector showed positive signals from stocks such as IMP (+1.56%), DBD (+2.45%), PMC (+4.21%), and DVN (+0.46%). However, the sector index only recorded a slight increase of 0.16% as selling pressure prevailed in stocks like DHT (-0.57%), DMC (-1.53%), TNH (-0.46%), and MKP (-11.82%)

On the declining side, the energy sector temporarily ranked at the bottom with a decrease of 0.33%, mainly due to losses in the two large-cap stocks, BSR (-0.46%) and PVD (-0.58%). This was followed by the information technology and consumer staples sectors, which decreased by approximately 0.2%.

Foreign selling pressure continued without any signs of easing, as foreign investors net sold nearly 89 billion VND on the HOSE in the morning session. The selling volume was concentrated in the MSN stock (nearly 55 billion). Meanwhile, on the HNX, foreign investors net bought slightly over 6 billion VND, mainly investing in the CEO stock (nearly 10 billion)

10:35 am: VN-Index finds balance around the 1,260-point level

The combination of selling pressure and slightly declining liquidity in the morning session indicated a reduction in investor pessimism after the previous sharp decline. Currently, the main indices, which started the day with strong gains, are fluctuating around the reference level. As of 10:30 am, the VN-Index increased slightly by 1.55 points, trading around 1,258 points. The HNX-Index gained 0.35 points, trading around 225 points.

Stocks in the VN30 basket showed a slightly more dominant performance, with STB, HPG, VPB, and TCB contributing 0.58 points, 0.53 points, 0.48 points, and 0.46 points to the overall index, respectively. On the other hand, FPT, VNM, HDB, and SSB faced selling pressure, deducting more than 1.2 points from the VN30-Index

Source: VietstockFinance

|

The real estate sector performed well in the market, although there was still some mild divergence. Notably, VHM increased by 0.57%, CEO by 2.65%, DXG by 1.85%, and PDR by 1.17%… Meanwhile, stocks such as KDH, KOS, BCM, and RCL continued to face selling pressure, but the declines were not significant.

Following closely, the non-essential consumer goods sector also witnessed a strong recovery, with MWG rising by 0.61%, GEX by 0.49%, HAX by 4.24%, and VGT by 0.75%… On the declining side, stocks such as TCM, FRT, CTF, TLG, and others showed red signals, but the declines were not significant.

Additionally, from a technical perspective, during the morning session of October 25, 2024, HAX stock price surged strongly, forming a Bullish Engulfing candlestick pattern, and the trading volume was expected to exceed the 20-day average at the end of the session, indicating a more optimistic investor sentiment. Furthermore, the Stochastic Oscillator continued its upward trajectory after generating a buy signal, further reinforcing the short-term recovery potential. Currently, the stock price is in the process of forming a Triange pattern and is being supported by the SMA 50-day and SMA 100-day moving averages, while the MACD is trending upward and has crossed above zero, suggesting a positive mid-term outlook.

Source: https://stockchart.vietstock.vn/

|

Compared to the start of the session, the tug-of-war between buyers and sellers continued intensely, with over 1,000 stocks trading around the reference price, and buyers slightly outnumbering sellers. There were 283 advancing stocks and 233 declining stocks.

Source: VietstockFinance

|

Opening: Positive Start

At the beginning of the October 25 session, as of 9:30 am, the VN-Index gained slightly over 2 points, reaching 1,259.66 points. Meanwhile, the HNX-Index also traded slightly above the reference level, reaching 225.27 points.

The market witnessed a dominant performance by the bulls, with several stocks in the telecommunications sector recording strong gains from the start of the session, such as VGI increasing by 1.37% and CTR by 0.7%. Additionally, stocks in the real estate sector also recorded notable gains, including VHM (+1.03%), DIG (+0.97%), PDR (+0.7%), DXG (+0.92%), and others.

Large-cap stocks, including VHM, PGV, and GAS, led the market with gains of more than 1 point. On the other hand, CTG, HDB, and SSB weighed on the market, deducting nearly 0.5 points from the index.

The utilities sector also witnessed robust growth, with most of the leading stocks in the sector trading in positive territory. Notably, PGV (+4.75%), GAS (+0.42%), REE (+0.31%), and POW (+0.41%) recorded gains.

“Seamless Trading of Dragon Capital’s Fund Certificates via VPBank’s NEO Invest Platform.”

“The partnership between VPBankS and Dragon Capital is a powerful alliance that will elevate the customer experience and maximize the strengths of both entities. VPBankS investors will now have access to an expanded range of financial products directly through the NEO Invest app, eliminating the need for platform switching and streamlining their investment journey.”

The Cautious Sentiment Persists

The VN-Index closed the session with a slight gain, retesting the old bottom from early October 2024 (equivalent to the 1,265-1,270 point range). If, in the coming days, the index holds firm above this threshold, coupled with trading volumes surpassing the 20-day average, the short-term outlook will turn more positive. Moreover, the MACD indicator needs to flash a buy signal again to sustain this optimism.

The Market Beat: A Rapid Decline, A Strong Surge in the Expiry of Derivatives

The VN-Index faced pressure throughout the morning session and the early minutes of the afternoon, dipping below 1,272 points. However, true to the nature of an expiration day for derivatives, the VN-Index staged a strong comeback, closing above 1,286 points. This impressive turnaround was largely driven by the banking, securities, and real estate sectors, which provided the much-needed boost to push the index higher.