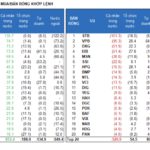

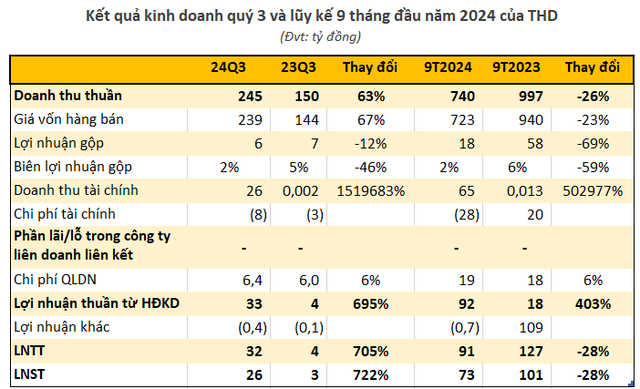

Thaiholdings Joint Stock Company (code: THD) has just announced its Q3/2024 financial report, showing a significant increase in financial revenue from nearly VND 2 million in Q3/2023 to VND 26 billion. This income is derived from interest on deposits and loans, with no further breakdown provided by the company.

In Q3/2024, Thaiholdings’ net revenue reached over VND 245 billion, a 63% growth compared to the same period last year. However, the higher cost of goods sold outpaced the revenue increase, resulting in a 12% decline in gross profit to VND 6 billion.

After deducting expenses, the company reported a post-tax profit of nearly VND 26 billion, a 722% surge compared to Q3/2023.

For the first nine months of the year, Thaiholdings recorded net revenue of VND 740 billion and post-tax profit of VND 73 billion, representing decreases of 26% and 28%, respectively, from the same period last year.

For 2024, the company targets consolidated net revenue of VND 1,114 billion and consolidated post-tax profit of VND 68 billion.

Explaining the 2024 profit plan, THD’s Board of Directors acknowledged that the real estate industry’s boom period has passed, and this is not a time for a rush to sell and realize profits or investment returns.

Thaiholdings believes that this is a period to focus on seeking clean land funds with clear legal status and financial investment items to enhance long-term investment efficiency.

With its performance in the first nine months, this real estate enterprise has accomplished 66% of its revenue target and exceeded its profit goal.

As of September 30, 2024, Thaiholdings’ total assets amounted to VND 4,416 billion, a slight increase of nearly VND 80 billion from the beginning of the year. Long-term financial investments accounted for 58% of total assets, valued at VND 2,542 billion, while cash holdings were a mere VND 13 billion.

On the liability side of the balance sheet, equity stood at VND 4,302 billion, an increase of over VND 70 billion from the beginning of the year. Retained earnings reached nearly VND 441 billion. Notably, the company has no financial debt.

In a related development, the Board of Directors of Thaiholdings Joint Stock Company approved the delisting of Thaigroup Joint Stock Company as a subsidiary and a change in the company’s model.

Specifically, on June 20, THD completed the transfer of 84 million shares in Thaigroup, resulting in a decrease in its ownership stake from 81.6% to 48%, and Thaigroup is no longer considered a subsidiary. As of the end of Q3/2024, Thaigroup is recognized as an associate of Thaiholdings with an original investment value of VND 1,800 billion.

The Lion City’s Sticker Shock: How Ho Chi Minh City’s Property Prices Surpassed Singapore’s, Ranking Among the Priciest in ASEAN

The real estate market in Ho Chi Minh City is experiencing a boom, with property prices soaring above those of its Southeast Asian counterparts. This vibrant city now boasts higher prices than the likes of Bangkok, Jakarta, and even Singapore.

“Proposed Higher Interest Rates for Second and Subsequent Home Buyers”

To curb speculative property investments, the Vietnam Real Estate Brokerage Association proposes an increase in interest rates for those purchasing their second or subsequent homes.