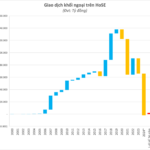

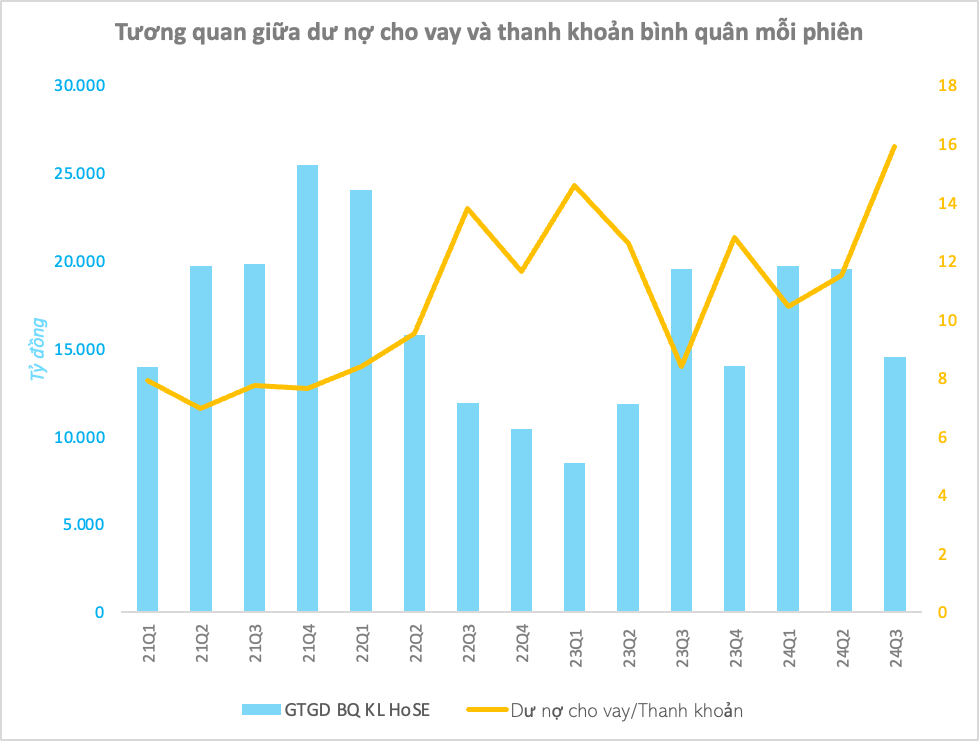

The trading situation on the Vietnamese stock market has been rather dull lately. The average trading value in the third quarter fell below 14,600 billion VND per session, a 25% decrease from the second quarter.

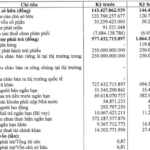

In contrast to the shrinking money flow, loan debts are ballooning. As of September 30, 2024, the estimated loan debt at securities companies reached 232,000 billion VND, a 7,000 billion increase from the previous quarter, setting a new record. Of this, margin debt amounted to approximately 223,000 billion VND, also the highest in the history of Vietnamese stocks. It’s important to note that this figure does not include third-party loans, and the actual number could be higher.

This contrasting development pushed the ratio of Loan Debt to Average Liquidity per session to its highest level in over four years (since the first quarter of 2020). This somewhat reflects investors’ increased use of margin debt.

In reality, leveraging margin is a powerful tool for investors to quickly grow their account size if used wisely. It boosts market liquidity and provides impetus for the market’s upward trajectory. However, the peak in margin loans without a corresponding improvement in liquidity indicates an increased level of risk in the stock market. A single strong correction could easily trigger a “margin call,” leading to cross-selling between stocks and further downward pressure on the market, resulting in account “burnout.”

Additionally, margin debt in the stock market has long been considered a partial substitute for bank loans. This phenomenon is referred to as the “bankification” of securities companies or, to some extent, “shadow banking” in the context of the challenges in accessing bank loans or issuing bonds.

The loan debts at securities companies are used by large shareholders to borrow funds by pledging their stocks rather than solely serving as a leverage tool for stock investors. As a result, the increase in loan debts among individual investors accounts for only a portion, with the remainder coming from organizations and “big players” in the market. A portion of this capital does not entirely flow into the market but is utilized for other purposes, which could be a reason why liquidity does not move in tandem with margin debt.

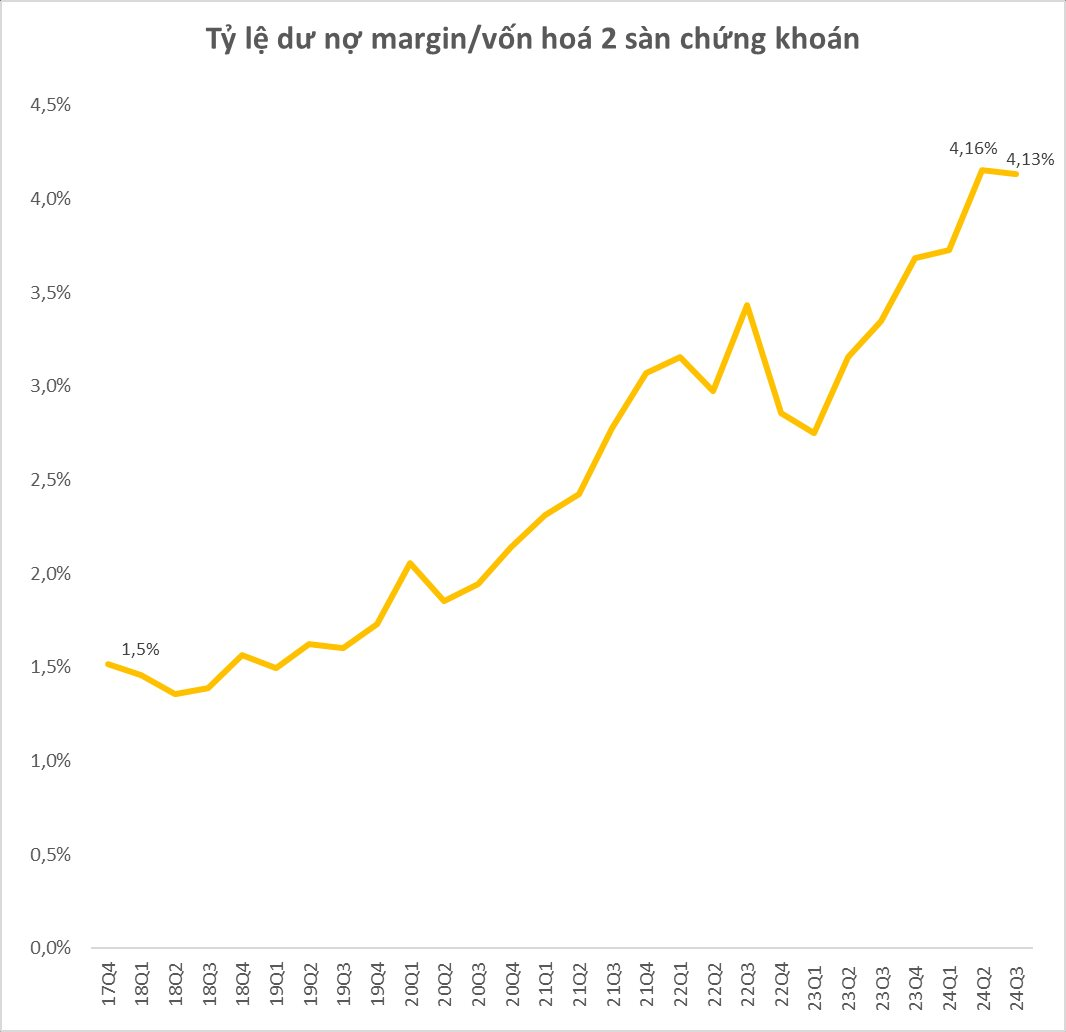

Moreover, the ratio of Loan Debt to Market Capitalization is also hovering near its peak. The ratio stood at 4.13% at the end of the third quarter, slightly down from the record high in the previous quarter due to an improvement in capitalization. Nonetheless, this number remains relatively high, given the VN-Index’s struggle to surpass the 1,300-point threshold despite multiple attempts.

It’s evident that the Vietnamese stock market is becoming increasingly reliant on margin usage, even though the main index is still far from its peak.

In the future, it is possible that margin debt could continue to reach new highs as securities companies still have room to lend more. The Margin Debt to Equity ratio is still well below its peak, as well as the safe limit stipulated by regulations, and a series of capital increase plans are being implemented. It is estimated that up to 277,000 billion VND could be lent to investors for margin trading in the coming period. It’s important to note that this figure is a theoretical calculation, and in reality, the market-wide Margin/Equity ratio has never reached two times even during the most booming trading periods. Moreover, the amount of additional margin an investor can borrow depends on their corresponding collateral (including cash and stocks).

The Stock Market Week of October 21-25, 2024: Short-Term Adjustment Pressures

The VN-Index has been on a downward spiral, slipping below the middle Bollinger Band. This, coupled with trading volumes that remain below the 20-day average, indicates a persistent investor caution. To add to the woes, consistent net selling by foreign investors has also contributed to the mounting pressure on the index.

Stock Market Uplift: Vietnam’s Economy Springboard, Attracting Billions in Foreign Investment

According to calculations by the team at VinaCapital, if both the FTSE Russell and MSCI re-evaluations are considered for an upgrade, net inflows could reach a substantial $5 to $8 billion.

The Market Beat: Buyers Strike Back, VN-Index Holds its Ground

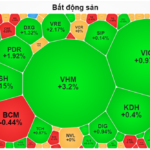

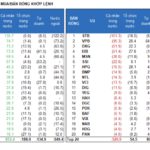

The market ended the session on a positive note, with the VN-Index climbing 2.03 points (0.16%) to reach 1,288.39; the HNX-Index also rose, gaining 0.08 points (0.03%) to close at 231.37. The market breadth tilted in favor of gainers, with 372 advancing stocks against 317 declining ones. The large-cap VN30 basket painted a similar picture, as 15 constituents added value, 12 lost ground, and 3 remained unchanged, ending the day in the green.

The Flow of Funds: What to Do When Stocks Have Good Earnings but Prices Don’t Soar?

The Q3 2024 earnings season is in full swing, yet market movements have not reflected commensurate reactions. Last week, the VN-Index declined for the first three consecutive sessions, rebounded on Thursday, but faltered in the final trading session. The index once again retreated as it approached the 1,300-point mark. The HoSE’s average matching liquidity did not show any significant improvement and even witnessed a slight decline.

The Savvy Investor: Pouring Money into the Market, a Smart Strategy?

Individual investors today bought a net amount of 353.8 billion VND, of which their net buying value via matched orders was 603.9 billion VND.