Sunrise Investment Joint Stock Company has responded to Document No. 1658/SGDHCM-NY regarding the mandatory delisting of SJF shares. The response was addressed to the State Securities Commission of Vietnam and the Ho Chi Minh City Stock Exchange (HoSE).

In the response, Sunrise Investment stated that they are currently focused on gathering and providing the required documents for the audit firm to conduct an interim review of the financial statements for the period from January 1, 2024, to June 30, 2024, and the audit of the financial statements for the fiscal year ending December 31, 2024.

Given the substantial volume of documentation, the auditors require additional time to review the files. Therefore, Sunrise Investment requested an extension for submitting the 2024 semi-annual reviewed financial statements until November 8, 2024.

Illustrative Image

Concurrently, Sunrise Investment appealed to HoSE to carefully consider their decision regarding the potential delisting of SJF shares, as it would directly impact the interests of over 6,600 shareholders and the company’s employees.

Previously, on October 17, 2024, HoSE had announced its intention to consider the mandatory delisting of SJF shares.

This decision by HoSE was based on the provisions of Point o, Clause 1, Article 120 of Decree 155/2020/ND-CP dated December 31, 2020, as well as the opinions of the State Securities Commission and the Vietnam Stock Exchange.

HoSE asserted that since the trading suspension, Sunrise Investment has continued to violate information disclosure regulations, and these violations are likely to persist, seriously infringing on the information disclosure obligations and affecting shareholders’ rights.

It is important to note that SJF shares of Sunrise Investment are currently under a trading suspension, as per Decision No. 726/QD-SGDHCM dated November 6, 2023, issued by the General Director of HoSE, due to repeated violations of information disclosure regulations on the stock market, even after being placed under trading restrictions.

On April 16, 2024, SJF was further placed under control based on two decisions by the General Director of HoSE. These decisions were made due to the external audit firm’s qualified opinions on the audited financial statements for two consecutive years (2022 and 2023) and the negative after-tax profit of the parent company in the audited consolidated financial statements for 2022 and 2023.

Also, on April 16, 2024, SJF shares were put on a warning status due to the negative after-tax profit recorded in the company’s 2023 audited consolidated financial statements.

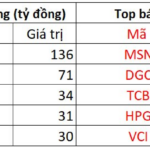

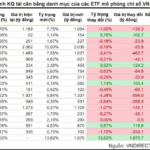

Top 10 Weekly Stock Movers: Surging Stocks “Ride the Wave” of Q3 Earnings, One Surges Post-Earnings Surprise

The market is highly polarized as the recovery momentum is largely concentrated on stocks with positive Q3 earnings.