Property prices soar out of reach for the majority

The National Assembly’s supervisory delegation has sent a report to deputies on the results of the supervision of “The implementation of policies and laws on the management of the real estate market and the development of social housing from 2015 to the end of 2023.”

Looking back at the period from 2015 to 2021, the market witnessed robust and vibrant development, with an abundant supply and the emergence of new types of real estate such as condotels and resort villas. However, the delegation noted an “inadequacy” in the structure of real estate products, with an imbalance between supply and demand, mainly catering to the high-end segment and investment purposes, and few options affordable for the majority of the population.

Entering the period of 2022-2023, the real estate market declined, and businesses faced numerous challenges due to the limitations of the previous phase, exacerbated by the pressures of the Covid-19 pandemic. The supply became far more limited compared to the previous phase, and property prices skyrocketed, far outpacing income growth for most people.

In Hanoi and Ho Chi Minh City, there are no longer any apartment segments with prices suitable for the income of the majority.

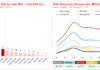

Statistical data reveals a widening gap in the structure of real estate products. According to the Hanoi People’s Committee report, the mid-range and high-end apartment segments dominate the market. In 2022, apartment prices soared while transaction volume remained low, accounting for only about 10% of the products offered in the market, and prices of individual houses remained high with almost no transactions.

Soaring property prices have made homeownership a distant dream for many families. Photo: Hoang Ha |

In Ho Chi Minh City, real estate transactions plummeted, and property prices rose unchecked, leading to a mismatch between price and value. According to the Ho Chi Minh City Real Estate Association, since 2021, there have been no more affordable apartments (priced below VND25 million/sqm) available in the city.

Meanwhile, a large number of real estate projects have encountered obstacles, delays, and stagnation, resulting in a waste of land resources and capital invested by enterprises. This situation exacerbates difficulties and increases costs for investors, ultimately driving up product prices.

Social housing prices remain exorbitant

The delegation’s report also points out the mismatch between the market’s surplus of high-end, large-area, and expensive properties and the lack of social housing and affordable options for the general public.

Additionally, the average price of social housing is still too high compared to the income of the target beneficiaries.

Chart: Hong Khanh. (Source: Ministry of Construction)

The report states, “State management of social housing remains inadequate and flawed. The support fund from the state budget for social housing credit programs is still low, and the procedures for borrowing through the Social Policy Bank are complex and redundant. The maximum loan amount for social policy beneficiaries is low and inconsistent with socio-economic conditions.”

Furthermore, the implementation of the VND120 trillion credit package for social housing, worker housing, and renovation and reconstruction of old apartment buildings has been slow, with complex and cumbersome conditions and procedures, high-interest rates, and a lack of attractiveness for investors and buyers of social housing, creating significant obstacles to the development of social housing.

The supply of social housing remains limited compared to the actual demand. Photo: 1,300 people draw lots for a chance to buy 149 NHS Trung Van social housing units (Hanoi) on May 20, 2023, with a ratio of almost 1/9. (Photo: Hong Khanh) |

Given these realities, the delegation proposes that one of the urgent tasks is to devise specific solutions to effectively implement the project to build at least 1 million social housing units for low-income earners and industrial park workers from 2021 to 2030, ensuring progress, quality, and alignment with the needs and living conditions of the beneficiaries.

In the long run, the delegation recommends completing research and proposing amendments, supplements, and new laws on taxation, including provisions for higher taxes on those who own large land areas and multiple houses, or those who leave land unused, in line with international practices and Vietnam’s socio-economic conditions.

Hong Khanh

“A Focused Approach: Targeting the Affordable Housing Market of $2.5 Billion and Below”

In the National Assembly session on October 28, a representative suggested that the government should focus on the affordable housing segment, specifically properties valued at 2.5 billion VND and below. This targeted approach would prevent the government from spreading its resources too thin. However, it is crucial to streamline the processes and avoid a bureaucratic maze when implementing social housing support policies.

“The Great Land Rush: Will Ho Chi Minh City’s New Pricing Regulations Spur a 50% Surge in Land Values?”

According to experts, the newly released land price table by the Ho Chi Minh City People’s Committee will impact every corner of the real estate market, with land prices expected to surge first.