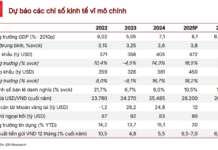

Vietnam’s capital absorption capacity is showing signs of improvement. According to the State Bank of Vietnam, as of September 30, credit growth increased by 9% from the beginning of the year and 16% compared to the same period last year. Previously, the State Bank of Vietnam reported that the credit growth of the entire system reached 7.38% by mid-September 2024 compared to the end of 2023 (5.73% compared to the same period).

These figures indicate that credit growth is gaining momentum, as the previous figure at the end of August 2024 was 6.63%. The State Bank has recently requested credit institutions to continue implementing solutions for safe, effective, and substantive credit growth, directing credit to production and business fields, priority areas, and growth drivers. They are also actively resolving difficulties and obstacles to promote effective and substantive credit growth, especially in the field of consumer lending.

Illustrative image

Mr. Tu Tien Phat, General Director of Asia Commercial Joint Stock Bank (ACB), shared that ACB’s credit growth rate for the first nine months reached 13.3%, significantly higher than the industry average.

“We are injecting capital into key projects, such as the 500kw circuit 3 project. Secondly, we are also providing capital to large companies and corporations to boost production, exports, and domestic consumption,” added Mr. Phat.

The capital demands of businesses and the economy are noticeably improving month by month. This has led to a significant enhancement in many banks’ loan disbursement rates in the third quarter. Mr. Nguyen Hung, General Director of TP Bank, shared that their credit growth rate has reached nearly 14%, and they might have to request an additional limit to meet the rising capital demands.

According to Mr. Hung, “Our credit growth has reached 13.9%. According to the State Bank of Vietnam’s new method of allocating new credit capital, we are allocated 18%. We are confident that we will utilize this limit, and if given more, we are fully capable of further increasing our lending capacity.”

Banks believe that, by the end of the year, commercial banks will diversify their capital mobilization channels, maintain low-interest rates, support businesses, streamline loan application procedures, and provide solutions related to software and technology to enhance the experience of corporate customers, especially in cash flow management.

PGS. TS. Nguyen Huu Huan, from the University of Economics Ho Chi Minh City, shared his assessment: “The economic recovery has started to attract a considerable amount of capital for credit growth, contributing to higher growth rates. I believe that from now until the end of the year, the credit growth rate will continue to increase. We can achieve the credit growth target set at the beginning of the year.”

To achieve the 15% credit growth target for this year, banks will need to expand their credit scale by an additional VND 800 trillion. This unblocked credit flow will create momentum for strong economic growth in the coming years.

“KB Securities Vietnam Advises on Successful Listing of Tri Viet Education Group Joint-Stock Company Shares”

On the morning of October 23, 2024, the Hanoi Stock Exchange (HNX) hosted a ceremony to mark the listing of 5 million shares of Tri Viet Education Group Joint Stock Company (Stock Code: CAR) on the HNX, with a reference price of VND 19,800 for the first trading day.

The Devastating Plummet of Plum Prices to a Mere 2,000 VND per kg: A Bitter Blow for Farmers.

The devastating drop in cantho orange prices has left many farmers in dire straits, facing significant financial losses.

“Russia Values Energy Cooperation with Vietnam”

The Russian Energy Minister affirmed that the leadership of the Russian Government, as well as the Ministry of Energy, highly appreciates the cooperation between Vietnam and the Russian Federation in the past years and expressed a desire to further promote and foster new collaborative projects in diverse fields in the future.