TPBank’s Latest Savings Interest Rates

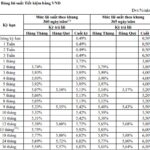

The interest rates offered by Tien Phong Commercial Joint Stock Bank (TPBank) for individual customers currently range from 3.5% to 5.7% per annum for tenors ranging from one month to 364 days, for over-the-counter deposits in regular accounts.

Specifically, interest rates for short-term deposits ranging from one to three weeks remain at 0.5% per annum.

The interest rates for tenors of one, two, and three months are 3.5%, 3.7%, and 3.8% per annum, respectively. The six-month savings rate is 4.5% per annum, while the nine-month, 18-month, and 364-day rates are 4.8%, 5.4%, and 5.05%, respectively.

TPBank’s counter deposit interest rate table.

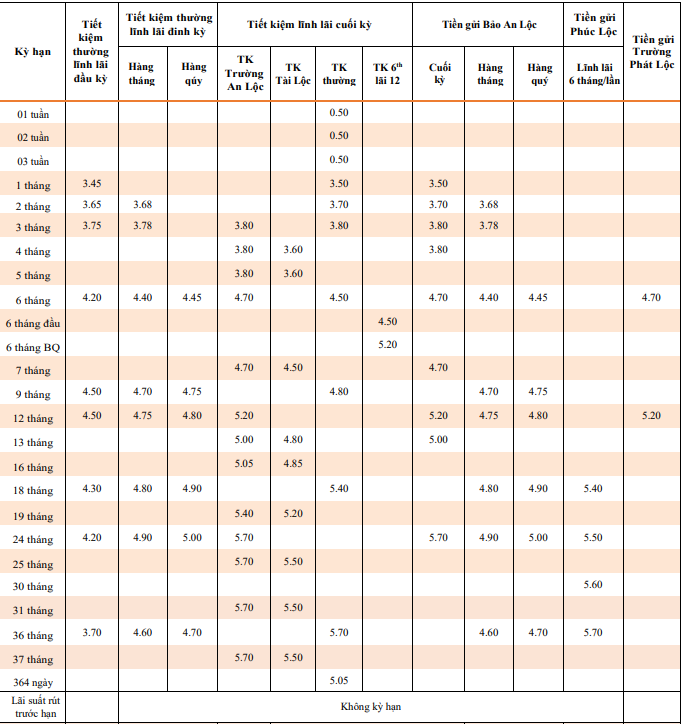

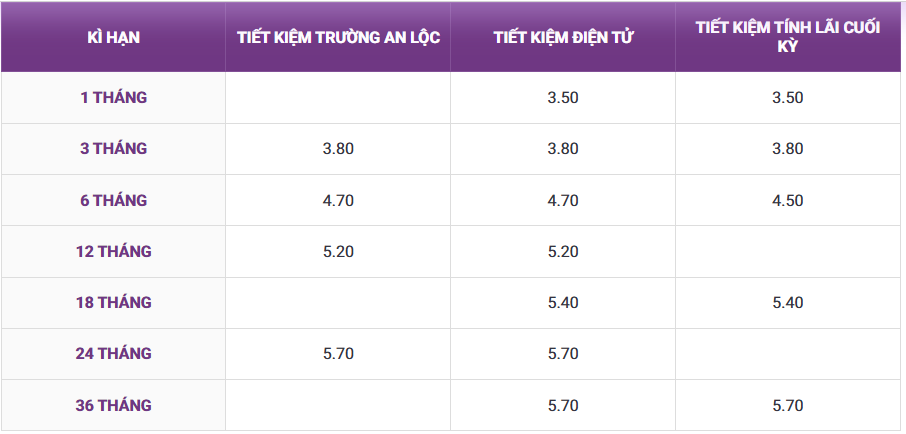

For online savings accounts with tenors ranging from one to 36 months, the interest rates range from 3.5% to 5.7% per annum.

The interest rates for tenors of one, two, three, six, nine, and 12 months are 3.5%, 3.7%, 3.8%, 4.7%, 4.8%, and 5.2% per annum, respectively. The 18-month and 24-month tenors offer an interest rate of 5.4% and 5.7% per annum, respectively.

TPBank’s online savings interest rates.

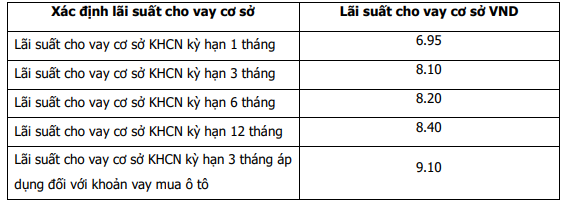

TPBank’s Latest Lending Interest Rates

TPBank has recently announced its base lending rates. Accordingly, the base lending rates for tenors of one, three, six, and 12 months are 6.95%, 8.1%, 8.2%, and 8.4% per annum, respectively.

The base lending rate for a three-month tenor applicable to auto loans is 9.1% per annum.

The Special Controlled Bank Continues to Increase Savings Interest Rates for the Second Time in September

Dong A Bank has once again raised its savings interest rates. This is the second time in September that the bank has increased its savings rates, marking a positive shift for customers.

The Two Main Reasons Behind Rising Deposit Interest Rates

Deposit interest rates continue to rise at many banks in September. Speaking to *Kiem Toan* Newspaper, financial and banking expert, Dr. Nguyen Tri Hieu, attributed this trend to two main reasons.