Illustrative image

The Board of Directors of Asia Commercial Joint Stock Bank (ACB) has approved the plan to issue the third private placement bond in 2024 with a maximum total value of VND 15,000 billion.

Accordingly, ACB will issue a maximum of 150,000 bonds in 15 batches with a par value of VND 100 million/bond or a multiple of VND 100 million. The issue price is equal to the par value.

These are non-convertible bonds, without warrants, without assets, and are not ACB’s subordinated debt. The bonds have a maximum term of 5 years and a fixed or floating interest rate depending on market demand.

The offering is made to institutional investors who meet the legal requirements for professional securities investors.

According to ACB, the purpose of issuing bonds is to serve lending and investment needs, as well as to ensure compliance with safety ratios as prescribed by the State Bank of Vietnam.

Previously, ACB’s Board of Directors also approved the plan to issue the first and second private placement bonds in 2024 with a maximum issuance scale of VND 15,000 billion each. Thus, it is expected that in 2024, ACB will issue bonds worth up to VND 45,000 billion – a record high in the history of this bank’s operations.

According to data from the Hanoi Stock Exchange (HNX), as of early October, ACB has successfully issued 12 lots of bonds to the market with a total value of VND 27,840 billion. This makes ACB the largest corporate bond issuer in the market. Previously, the bank had issued a total of VND 18,900 billion of bonds in 2023.

Not only ACB, but many other banks have also promoted bond issuance in recent months.

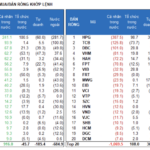

According to data from Military Bank Securities (MBS), the total value of corporate bonds issued by the banking sector in September is estimated at VND 60,000 billion. Notable issuances in September include: Techcombank (VND 2,700 billion, 24-month term, 5% interest rate), OCB (VND 2,500 billion, 36-month term, 5.5% interest rate), and VietinBank (VND 2,000 billion, 120-month term, 6.1% interest rate).

Cumulative from the beginning of the year, the banking sector has the highest bond issuance value with about VND 245,400 billion, up 188% over the same period in 2023 and accounting for 74% of the whole market. The weighted average interest rate was 5.6%/year, and the weighted average term was 5.3 years. The banks with the largest issuance value from the beginning of the year to now include ACB (VND 29,800 billion), Techcombank (VND 26,700 billion), and OCB (VND 24,700 billion)

“The fact that commercial banks promote capital mobilization through bond channels, even though the capital cost is more expensive than the 12-month deposit interest rate, is considered to supplement medium and long-term capital in the context of recovering loan demand,” MBS said.

MB Securities also believes that banks will continue to promote bond issuance to supplement capital to meet lending needs. From the beginning of the year to the end of the third quarter, credit grew by 8.53%, higher than the rate of 6.24% in the same period last year. Credit is expected to accelerate in the last months of the year following the strong recovery of production, export, and services.

In a recent bond market report, FiinRatings also predicted that the demand for borrowing and corporate bond issuance of enterprises, especially credit institutions, will increase in the second half of 2024. To meet the increasing credit demand, credit institutions will need to strengthen medium and long-term capital sources, including the form of bond issuance to increase Tier 2 capital. Therefore, the corporate bond issuance activities of credit institutions will become more active in the coming time.

“Taking advantage of the low-interest rate environment, credit institutions are increasing bond issuance to consolidate capital safety ratios, medium and long-term capital, and meet capital needs to prepare for credit growth in the second half of the year towards achieving the State Bank of Vietnam’s target of 14-15% for the whole year,” FiinRatings stated.

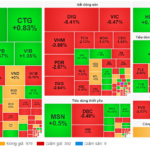

Market Beat: Buyers Return in Afternoon Trade, VN-Index Surges Over 9 Points

The market ended the session on a positive note, with the VN-Index climbing 9.87 points (0.78%) to reach 1,281.85, while the HNX-Index gained 0.25 points (0.11%), closing at 231.77. The market breadth tilted in favor of the bulls, as evident from the advance-decline ratio of 411:256. A similar trend was observed in the VN30 basket, with 22 stocks advancing, 6 declining, and 1 remaining unchanged, resulting in a sea of green on the screen.

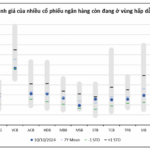

“Undervalued Banking Stocks: Unlocking the Potential of High-Growth Financial Powerhouses”

We recommend investing in bank stocks for a medium to long-term vision, even if short-term profit growth prospects are not particularly surprising. There are a handful of banks with strong and sustainable growth motivations that are currently undervalued, including ACB, CTG, MBB, TCB, and VPB. These financial institutions have the potential for substantial growth and their current valuations do not reflect their true worth. By investing in these banks now, you position yourself to benefit from their future success and unlock potential long-term gains.

The Market Beat: Will the “Morning Rise, Afternoon Fall” Trend Persist?

Today’s trading session concluded on a predictably bearish note, with the VN-Index consistently trending downward during the afternoon. The index closed at 1,281.08 points, a loss of over 5 points. Similarly, the HNX-Index dipped to 228.95, shedding nearly 2 points.

“Governor: SBV wants to lower interest rates, provide sufficient credit, but the mission must contribute to controlling inflation and stabilizing the macro-economy.”

As per the Governor, the State Bank of Vietnam (SBV), as the monetary and credit organization manager, aims to lower interest rates and provide sufficient credit. However, the SBV’s primary mission is to contribute to controlling inflation and stabilizing the macro-economy, ultimately creating a favorable business environment for enterprises.