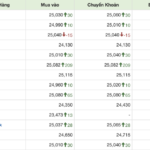

On October 22, the State Bank of Vietnam set the daily reference exchange rate at 24,240 VND/USD, an increase of 12 VND from the previous day. Since the beginning of October, the reference exchange rate has risen by approximately 119 VND (+0.49%).

Commercial banks have also continuously increased their USD selling prices, reaching the highest level since April 2024. Currently, Vietcombank is buying USD at 25,092 VND and selling at 25,452 VND, an increase of 22 VND from yesterday.

This is also the selling price of USD at Eximbank, Sacombank, and ACB. Meanwhile, the buying prices vary among these banks, with Eximbank offering 25,200 VND and Sacombank 25,080 VND/USD.

Since the beginning of October, the USD price at these banks has surged by 680 VND (+2.75%), representing a significant increase in the USD/VND exchange rate over the past 2-3 months.

In the unofficial market, some foreign currency exchange points in Ho Chi Minh City quoted USD buying and selling prices at 25,440 – 25,550 VND, just slightly higher than the official bank rates by less than 100 VND. This is the lowest differential between official and unofficial rates in recent times.

Rising USD/VND exchange rate in recent days

According to analysts, the appreciation of the USD against the VND occurs amid a strengthening US dollar in the international market. The US Dollar Index (DXY), which measures the strength of the USD against a basket of currencies, has returned to its highest level since the beginning of August 2024. The index currently stands at 103.8 points, a 2.9% increase from the beginning of October.

Tran Hoang Son, Director of Market Strategy at VPBank Securities (VPBankS), attributed the rise in the DXY to the possibility of the US Federal Reserve (Fed) prolonging the period of low-interest rates beyond market expectations. As the DXY climbed to 103, its highest level in four weeks, emerging market currencies, including the VND, have come under pressure. Additionally, recent US economic data indicating improved stability has further bolstered the strength of the USD.

“Seasonality plays a role in the Vietnamese market as there is typically an increased demand for USD in October for importing goods to meet the year-end export demand during Christmas and New Year holidays,” noted Tran Hoang Son. “The recent surge in USD demand is also related to international debt payment obligations.”

The appreciation of the USD against the VND is largely driven by seasonal factors, as the Fed is expected to maintain its low-interest rate policy in the foreseeable future. The USD price may stabilize or decrease after this surge. Moreover, the demand for USD could ease after October, leading to a potential cooling-off in the exchange rate. The State Bank of Vietnam’s efforts to absorb VND liquidity also help prevent a sharp rise in the exchange rate.

The Dollar’s Surge: A Cause for Concern?

Since the beginning of October, commercial bank USD rates have increased by approximately 730 VND, a significant rise in under a month.