Three Key Factors

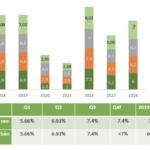

On October 24th, speaking at the seminar “Southern Real Estate Overcoming Challenges and Seizing Opportunities,” Mr. Nguyen Xuan Thanh, a lecturer at Fulbright University, shared insights into the country’s economic growth. He noted that the GDP growth for the first nine months of this year reached 6.8% year-on-year, with the third quarter alone achieving a remarkable 7.4% growth.

Mr. Thanh attributed this growth to three primary drivers: export-oriented industrial growth, foreign direct investment, and public investment. While the economy is experiencing high growth rates, he pointed out that the perception among citizens and businesses is that economic challenges persist.

Mr. Nguyen Xuan Thanh, Lecturer at Fulbright University

Breaking down the factors, Mr. Thanh explained that industrial growth focused on exports has not only recovered compared to 2023 but has also outperformed the post-COVID-19 recovery in 2022. Foreign direct investment (FDI) has also seen robust growth in both registered and disbursed capital, despite the absence of significant waves.

On the other hand, public investment is no longer a significant driver of economic growth. This year’s public investment is estimated at VND 679 trillion, with a disbursement rate of 47.3% for the first nine months, lower than the 51.4% achieved in 2023. Regarding the domestic economy, personal and household consumption is increasing slowly.

Mr. Thanh attributed this slow growth to reduced labor income due to job losses caused by last year’s export decline. Additionally, savings and assets of citizens were impacted by the corporate bond market and the real estate market during the 2021-2023 period. Private enterprise investment has stagnated due to a risk-averse mindset influenced by financial and legal concerns.

With low domestic market demand, inflationary pressures are no longer a significant concern. Mr. Thanh forecasted that inflation for 2024 would be controlled at around 3%, significantly lower than the target of 4-4.5%. This positive outlook allows for further relaxation of fiscal policy.

A Look Ahead to 2025

Turning to credit growth, as of September 30, credit growth stood at 9%, with a 16% year-on-year increase in September. A key challenge is the discrepancy between credit growth, which is currently at 16%, and money supply growth, which is at 12%. In reality, the economy’s credit demand is only growing by 10-11%.

Forecast for interest rate reduction in the coming year

The government is aiming for an ambitious growth target for the coming year, with a base scenario of 6.5-7% GDP growth but hoping to achieve a higher range of 7-7.5%. The inflation target is set at 4.5%, and exports are projected to increase by 10-14%.

Regarding monetary and credit policy, Mr. Thanh noted that the Fed and several central banks have entered a cycle of lowering policy rates. Vietnam will maintain an accommodative stance to support growth, and interest rates are forecast to decrease by 0.7% next year, even as inflation is expected to rise.

Fiscal policy will continue to focus on enhancing state budget revenue, with a total state budget revenue estimate of VND 1,960 trillion, a 15.6% increase. The budget deficit is projected at VND 471,500 billion (3.8% of GDP), and public debt is expected to be 36-37% of GDP. The government will also prioritize public investment, with a planned capital allocation of VND 791,000 billion, a 16.5% increase compared to the 2024 plan.

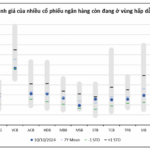

“Undervalued Banking Stocks: Unlocking the Potential for Robust Growth”

“We recommend accumulating bank stocks for a medium to long-term vision, even if short-term profit growth prospects don’t present many surprises. The aforementioned banks have strong and sustainable growth motivations and are undervalued compared to their potential; these include ACB, CTG, MBB, TCB, and VPB. These financial institutions have robust fundamentals and are well-positioned to capitalize on Vietnam’s growing economy and thriving business sector. With their diverse revenue streams and expanding digital presence, these banks are poised to deliver stable returns and outperform the market. This accumulation strategy is a prudent approach to investing in Vietnam’s financial sector, offering a balanced risk-reward proposition for investors with a long-term horizon.”

The Big Apple’s Five Districts, Four Localities Lag in Disbursing Public Investment Funds

Chairman of the Ho Chi Minh City People’s Committee, Phan Van Mai, has issued a directive to all department and local leaders, urging them to strictly adhere to and implement a critical phase of public investment capital disbursement. This phase, commencing on October 15th and extending until the end of the 2024 planning cycle, demands their utmost attention and diligent execution.

The $7 Billion Investment: Unveiling the Southeast Asian ‘Powerhouse’ and its Vision for Collaboration with Ba Ria-Vung Tau

Recently, Mr. Pham Viet Thanh, Secretary of the Provincial Party Committee and Chairman of the Provincial People’s Council of Ba Ria – Vung Tau, had a meeting with Mr. Pang Te Cheng, Consul General of Singapore in Ho Chi Minh City.