The market pulled back as the VNI once again approached the 1300-point peak. This afternoon’s decline clearly faced significant selling pressure. However, the important thing is how that selling pressure affects stock prices, as it is normal to sell around the old peak. Now is the time to observe how many people are willing to bet on the possibility of a new market high and how many will back down.

The VNI lost quite a few points in this intraday decline (from up more than 11 points to over 4 points) mainly due to the weakness of some large-cap stocks, with VCB, BID, and VIC as examples. However, observing the breadth, the change from the peak at 2 pm to the close, only a few dozen tickers reversed from green to red, while the majority adjusted in the form of narrowing the rising range.

Many stocks do not have a peak or technical resistance level that coincides with the 1300-point peak of the VNI. When the index fell, the general psychology was affected, and new selling pressure emerged. This is a normal effect, as many investors still look at the index to buy and sell. The breadth at the end of the day was still quite good (209 gainers/177 losers), and the number of strong losers (over 1%) was not large (55 stocks, but only 20 stocks had acceptable liquidity). Simply put, today’s adjustment took place mainly in the green zone.

To keep prices in the green zone, there must be enough buying support, on the one hand, to prevent prices from falling too deeply while creating high liquidity. Today, the sellers unloaded relatively strongly and were much more proactive than yesterday, even though the total liquidity was equivalent. The two exchanges have consecutively seen two trading sessions exceeding 20k billion, which is very impressive, confirming the presence of a large amount of active capital.

Selling at the 1300-point peak is not unusual, as at least the previous four times were correct. Not all investors are ready to bet at this time – many who bet earlier have failed miserably. So the question is whether this time is different, and the answer is difficult, we have to wait for the market to signal supply and demand in the coming days. One possible difference to note is that liquidity is increasing rapidly and foreign capital is buying strongly for the first time in 2024.

In the previous failures at the 1300-point peak, liquidity was also high, but in the end, there were enough stocks to saturate the money flow, and prices turned down. The resistance levels are inherently formed by supply and demand, not technical factors, and it could be that many people simultaneously regard that technical level as important, leading to a corresponding supply and demand relationship. Therefore, the view of assessing risks/opportunities at each time point is the decisive factor. If we always fail at old peaks or resistances, the market will never be able to rise.

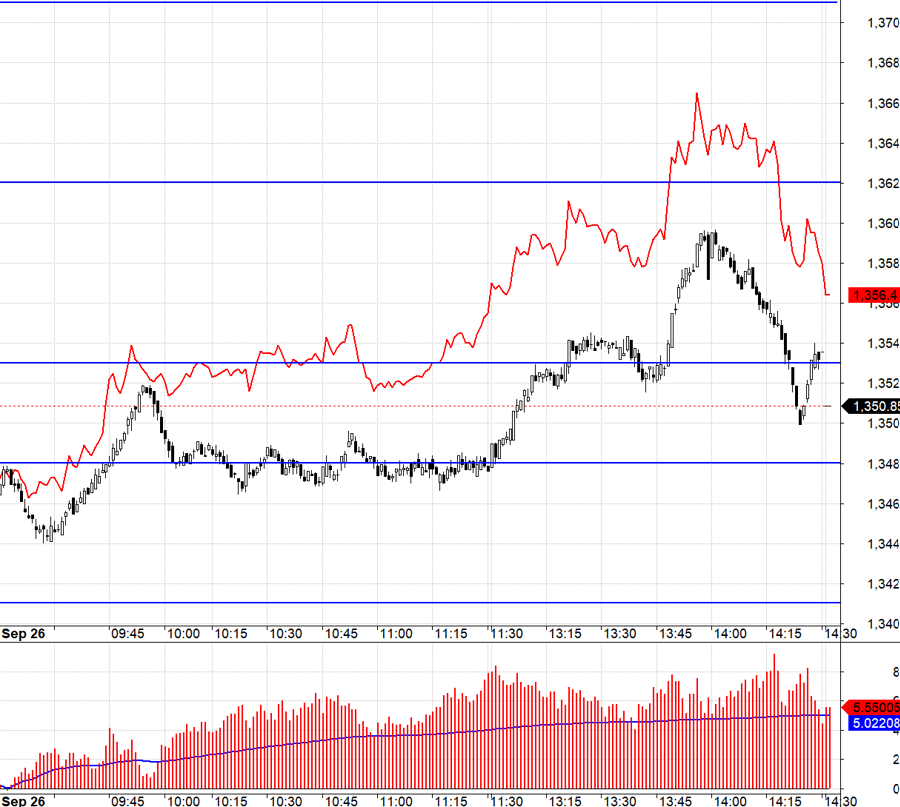

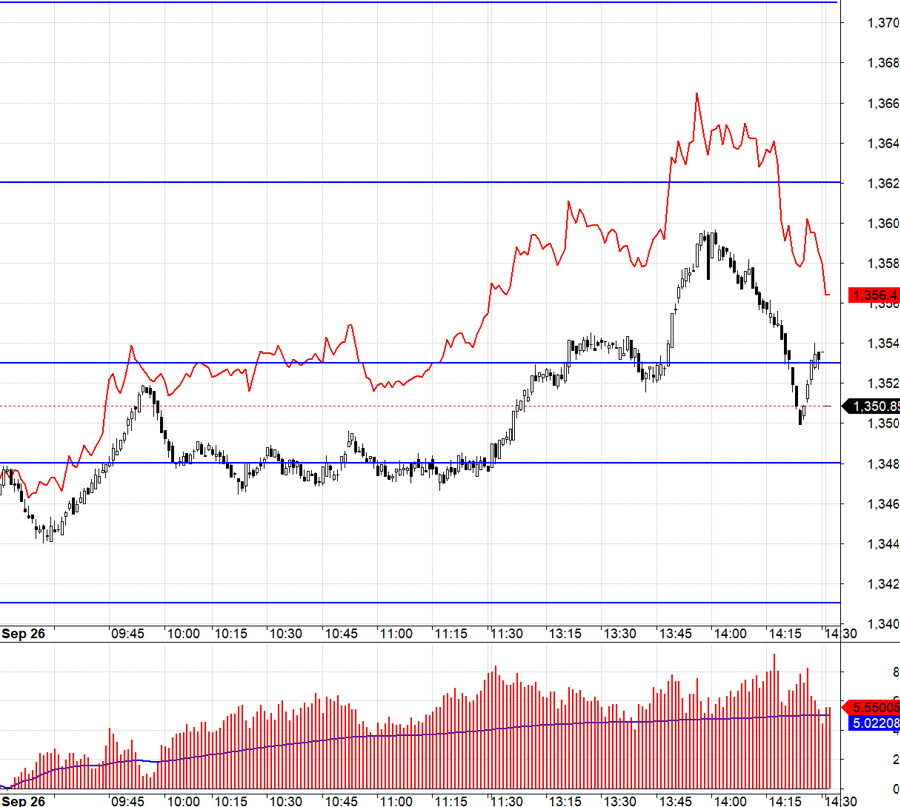

Now is the time for the market to test faith and test new money. Today, the derivatives market was significantly more active with the highest liquidity in six sessions. However, trading was not easy, as Long suffered basis losses, and Short had no setups that met the standards, and the ability to hold the position was difficult to guess when money poured into the banking group too aggressively. VN30 had a narrow range from 1348.xx to 1353.xx and above, and below this region was an open range. The upward momentum at the beginning of the session pushed the index up to 1353.xx before retreating to around 1348.xx, where it hovered for a long time. A positive signal is that the basis expanded its spread, reflecting notable confidence.

In theory, such a wide basis benefits Short, but only if the VN30 falls into the open range on the downside. Long is naturally at a disadvantage and must rely on the ability to maintain the spread; otherwise, it will suffer losses when the basis contracts or be in danger if the VN30 breaks below 1348.xx. The strategy only favors Long if the VN30 reaches the open range on the upside, in which case, even if the basis contracts, it will still be advantageous. This scenario occurred, and F1’s widest range occurred when the VN30 rose from 1348 to 1353.

Today’s profit-taking session did not cause any harm, and the positive aspect is that it released a large amount of stock that was not ready to bet on the uptrend. If money continues to maintain an intensity of over 20k billion, that would be excellent. Tomorrow, the market may fluctuate widely, so pay attention to intraday liquidity in both the downward and upward movements. The strategy is flexible Long/Short.

VN30 closed today at 1350.85. Tomorrow’s nearest resistance levels are 1354, 1362, 1372, 1377, 1384, and 1392. Support levels are 1348, 1341, 1335, 1325, and 1318.

“Stock Market Blog” is personal and does not represent the opinions of VnEconomy. The views and assessments are those of the individual investor, and VnEconomy respects the author’s views and writing style. VnEconomy and the author are not responsible for any issues arising from the published investment views and opinions.

The Stock Brokers’ View: Downside Pressure Mounts, VN-Index to Test 1,240-1,250 Support Zone

According to VDSC, investors may consider the current corrective action as an opportunity to buy select stocks at attractive prices for short-term gains.

The Market Beat: Downward Momentum Persists, VN-Index Loses 1,260-Point Mark

At the end of the trading session, the VN-Index declined by 4.69 points (-0.37%), settling at 1,252.72. The HNX-Index witnessed a marginal loss of 0.06 points (-0.03%), closing at 224.63. The market breadth tilted towards decliners, with 377 stocks trading lower against 286 gainers. The VN30-Index, representing the top 30 stocks by market capitalization and liquidity, exhibited a similar trend, with 19 stocks closing in the red, 4 in the green, and 7 remaining unchanged.