Proposal to Eliminate Approximately 3,000 Billion VND in Land Lease Exemptions Annually

The Ministry of Finance has announced that it is drafting a Decision to revoke nine decisions of the Government in the field of land finance. Among these, four decisions pertain to reducing land and water surface lease payments for entities affected by COVID-19 in the years 2020, 2021, 2022, and 2023.

Illustrative image. Source: TT |

These decisions were issued to alleviate difficulties caused by the COVID-19 pandemic for businesses, organizations, households, and individuals who lease state land annually. The annual amount of land lease payments exempted for these entities and individuals is approximately 2,900 billion VND. The total amount of exempted land lease payments for the four-year period, from 2020 to 2023, is estimated to be around 11,500 billion VND.

As one of the businesses benefiting from this policy, Ms. Nguyen Thu Thuy, director of a company specializing in commerce and sports services in Hanoi, shared that her company leases nearly 13,000 square meters of state land, with lease payments totaling approximately 21 billion VND for the 2020-2023 period. This period coincided with multiple closures due to the COVID-19 pandemic, resulting in significant revenue losses for the company.

Ms. Thuy expressed her gratitude for the policy, stating, “The exemption of land lease payments due to the impact of COVID-19 has helped our company maintain cash flow, pay employee salaries, and sustain our business operations. Even though the pandemic is over, we still face challenges, and we eagerly await further lease payment exemptions for 2024.”

Additionally, according to the Ministry of Finance, there are five decisions on land lease payment exemptions for specific projects, including the construction of auxiliary works along national highways, the construction of warehouses for storing rice, corn, cold storage for seafood, fruits, and temporary storage of coffee, and exemptions for households of fishermen in lagoon areas who have relocated to resettlement areas. There are also exemptions for households and individuals in difficult regions, border and island areas, who have been granted land use rights for residential land that was assigned without proper authority before October 15, 1993.

The Ministry of Planning and Investment, as one of the ministries related to the proposed revocation, agrees with the necessity of revoking decisions in the field of land finance. However, they suggest that the drafting agency should seek opinions from affected entities and carefully review the content of the draft with the 2024 Land Law to ensure consistent regulations. They also emphasize the importance of considering transitional cases and specific handling to ensure that the revocation of decisions does not adversely affect the rights and interests of people and businesses.

Some Ministries Argue to Maintain the Exemptions

Following the proposal by the Ministry of Finance, several ministries have expressed their desire to retain the tax exemption policies due to concerns about potential impacts on their production and business plans. The Ministry of National Defense has requested the retention of the exemptions for 2021, 2022, and 2023, arguing that discontinuing this support will affect their land use plans and those of defense-owned enterprises, which have already approved land use arrangements and the handling and rearrangement of houses and land in accordance with Resolution 132/2020/QH14.

In response, the Ministry of Finance clarified that the management and use of land for national defense and security purposes, combined with labor and economic development, were implemented before the 2024 Land Law came into force (August 1, 2024). However, after this date, financial policies related to land will be guided by the Ministry of Natural Resources and Environment.

Similarly, the Ministry of Construction has requested the retention of Decision 48/2012/QD-TTg, dated November 1, 2012, issued by the Prime Minister, which amends Decision 204/2005/QD-TTg on adjusting and supplementing subjects and mechanisms for borrowing capital for building houses in the program of constructing residential clusters and houses in areas frequently flooded by the Mekong River Delta. Nevertheless, the Ministry of Finance has decided not to accept this proposal. They suggested that if the Ministry of Construction deems it necessary to exempt or reduce land use fees for this case, they can propose it to the Ministry of Finance for synthesis and submission to the Government.

Mr. Dinh Trong Thinh, an economic expert, commented that the policy of exempting and reducing land lease payments for people, businesses affected by the epidemic, and special subjects such as key projects and policy beneficiaries in remote areas, has yielded practical results. However, he noted that this policy is appropriate for specific circumstances and periods. For example, as the COVID-19 pandemic has ended, discontinuing support measures is reasonable.

“For the convenience of people, businesses, and law enforcement agencies, legal documents must be consistent and synchronized. I believe that revoking these decisions to align with the 2024 Land Law is necessary. However, after the revocation, competent authorities should have appropriate handling measures to ensure the legitimate rights and interests of people and businesses, avoiding overlaps,” suggested Mr. Thinh.

|

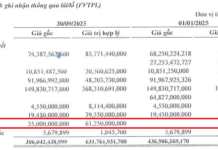

According to statistics from the Ministry of Finance, the total amount of exempted land lease payments for the four-year period from 2020 to 2023 for people and businesses affected by COVID-19, as per the decisions of the Prime Minister, is approximately 11,500 billion VND. The estimated land and water surface lease revenue for 2024 is nearly 27,000 billion VND. The actual revenue for the first nine months of 2024 reached nearly 30,900 billion VND, representing 114% of the estimate and a 64% increase compared to the same period in 2023. The Ministry of Finance attributed the increase in land and water surface lease revenue in 2024 to the non-implementation of exemption policies compared to the previous four years. |

Ngoc Linh

The Ever-Rising Bridge, a Lush Green Electrical Panel

Although the VN-Index only slightly increased by 3.24 points (+0.25%) by the end of this morning’s session, the index remained above the reference level for most of the time, with a breadth favoring the advancing side. This is a testament to the influx of buying power, even at higher price levels. Blue-chip stocks are spearheading this movement, dominating both the index and over half of the market’s liquidity.

“Governor: SBV wants to lower interest rates, provide sufficient credit, but the mission must contribute to controlling inflation and stabilizing the macro-economy.”

As per the Governor, the State Bank of Vietnam (SBV), as the monetary and credit organization manager, aims to lower interest rates and provide sufficient credit. However, the SBV’s primary mission is to contribute to controlling inflation and stabilizing the macro-economy, ultimately creating a favorable business environment for enterprises.