On October 26, the State Bank of Vietnam (SBV) set the daily reference exchange rate at 24,255 VND/USD, a decrease of 5 VND. In the US, the US Dollar Index (DXY), which measures the strength of the US dollar against a basket of six major currencies (EUR, JPY, GBP, CAD, SEK, CHF), stood at 104.32, a 0.26% increase.

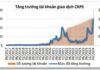

Since the beginning of October, the DXY has risen by 3.5%. Compared to the beginning of the year, the Vietnamese dong has depreciated by approximately 4.2-4.7% in both the official and free markets.

INFLOW OF FOREIGN CURRENCY EASES PRESSURE ON EXCHANGE RATE

The recovery of the DXY in October 2024 was supported by several factors, according to analysts at Rong Viet Securities.

Firstly, investors regained optimism about the US economy due to positive labor market and retail sales data in the previous month. Specifically, the US unemployment rate fell to 4.1% in September, down from 4.2% in August. US retail sales also increased by 0.4% in September compared to the previous month, higher than the 0.1% rise in August.

According to CME Watch Tool, the probability of the Fed not cutting interest rates further in the last two meetings of the year has increased from 0% to 8.2% for the November meeting and 2.3% for December. In addition to better-than-expected economic data, the narrowing gap between the two US presidential candidates in polls has also boosted the US dollar, with expectations of a Trump victory.

Meanwhile, the movement of the USD/JPY exchange rate has been notable, crossing the 150 threshold in the past month and increasing by 5.8% since the beginning of October, as expectations of a rate hike by the Bank of Japan (BoJ) have been pushed back to next year.

Additionally, the monetary policies of other central banks, such as the ECB, BoE, BoC, and the recent easing by the People’s Bank of China, have also contributed to the US dollar’s recovery.

Lastly, escalating geopolitical risks in global hotspots have also driven up the value of the US dollar. In the short term, the movement of the DXY is heavily influenced by the upcoming US election. Historical data from BofA shows that the DXY tends to rise in the two months leading up to the election, which has occurred in 10 out of 13 US election cycles. Particularly, as betting odds in Trump’s favor increase in battleground states, the DXY may gain momentum before and after the election if Trump wins.

Currently, the DXY is on the rise again but has not surpassed its previous peak. Based on this correlation, VDSC expects the USD/VND exchange rate to return to its previous high and trade around this level in the short term.

In addition to the correlation with the DXY, the movement of the USD/VND exchange rate in the last quarter of the year is often influenced by the demand for foreign currency for debt payments, raw material imports, and profit repatriation by foreign-invested enterprises, leading to a supply-demand imbalance in the domestic foreign exchange market.

Towards the end of the year, foreign currency inflows from remittances and exports can help ease this supply-demand imbalance. In the scenario where the DXY surpasses its previous high in November if Trump wins the election, the pressure on the Vietnamese dong may intensify, prompting the SBV to sell part of its foreign exchange reserves to control the depreciation of the currency to below 5%.

MONETARY POLICY “TWEAKS” SUPPORT ECONOMY AND STABILIZE EXCHANGE RATE

The SBV’s activities in the open market were relatively quiet in the first half of the month until the resumption of treasury bill issuances on October 18. The issuances were relatively high in the initial sessions but have since decreased in recent days.

As of October 25, the total amount of treasury bills issued by the SBV was approximately VND 67,000 billion, including VND 17,800 billion in 14-day bills (approximately 27% of the total issued) and the remainder in 28-day bills. Although the SBV resumed open market operations through the term deposit channel in recent days, the net withdrawal amounted to VND 57,600 billion due to the large volume of term deposits maturing at the beginning of the month.

In summary, the SBV made a net withdrawal of approximately VND 124,600 billion during the period from October 1 to 25.

Currently, despite the exchange rate approaching its previous high, VDSC believes that the pressure on the banking system’s liquidity from the SBV’s actions is not significant, considering the net withdrawal amount and the scale of foreign currency sales in recent days.

The net withdrawal in the current period may also be lower than in the May-June 2024 period for several reasons. First, the SBV has been issuing 14-day and 28-day treasury bills instead of solely 28-day bills, and the net withdrawal through this channel has been decreasing in recent days. Second, the SBV has been balancing dong liquidity by providing funds through the repo channel again. Third, interbank interest rates have remained relatively stable, with the overnight lending rate on October 24 at 3.68% per annum, a decrease of 76 basis points from the end of September and an increase of about 102 basis points from the lowest level recorded on October 18.

According to the SBV, credit growth as of the end of September was 9.0% compared to the beginning of the year, equivalent to a 16% increase over the same period last year. Credit growth in the real estate sector was almost on par with the overall growth, increasing by 9.15%. Outstanding loans for commercial real estate development rose higher than those for consumer real estate, up 16.0% and 4.6% year-to-date, respectively.

Since the beginning of October 2024, the SBV has also taken steps to encourage credit growth towards the end of the year. Additionally, the credit growth target for the next year is set at over 15%. Thus, monetary policy remains geared towards supporting economic growth while also addressing short-term fluctuations, such as exchange rate pressures.

The Flow of Funds: Riding the Storm, How Far Will the Market Correction Go?

The stock market witnessed a steep decline of almost 33 points, or 2.5%, last week—the biggest drop since the end of June 2024. This significant downturn caused a break in the VN-Index’s support channel, which had been intact since the August 2024 lows. Experts unanimously deemed this a negative technical signal, a harbinger of potential challenges ahead for investors.

The Greenback’s Turbulent Ride

The USD exchange rate has been surging across various banks and is now eyeing the peak of 25,450 VND per USD.