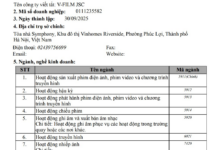

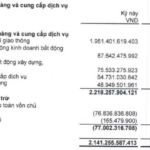

Dragon Capital Vietnam’s Fund Management (QLQ) earned more than VND 258 billion in revenue in the third quarter, a 5% decrease compared to the same period last year. Both core segments recorded less favorable results year-on-year, including a 7% drop in securities investment advisory to over VND 184 billion, and a 3% decrease in securities investment fund management and securities investment companies to over VND 72 billion.

In this context, the expense structure was almost entirely comprised of management fees, which increased by 26% to over VND 224 billion.

Ultimately, the company recorded a net profit of nearly VND 31 billion, a 63% decline. This quarter’s profit pulled down the cumulative profit for the first nine months to just over VND 168 billion, a 26% decrease compared to the same period in 2023.

|

DCVFM’s Q3 and cumulative 9-month business results in 2024

Unit: Billion VND

Source: VietstockFinance

|

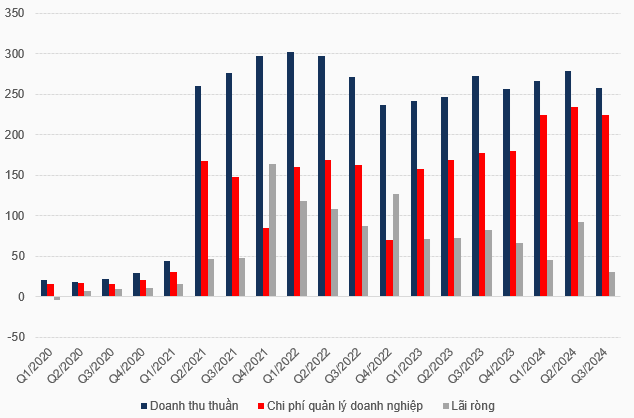

As of September 30, 2024, Dragon Capital Vietnam’s Fund Management’s asset size exceeded VND 1,163 billion. The structure was mostly comprised of cash and cash equivalents of nearly VND 463 billion, short-term financial investments of nearly VND 348 billion, and short-term receivables of almost VND 113 billion.

The short-term financial investment portfolio mainly consisted of holding fund certificates, but these were not detailed in the Q3/2024 financial statements.

On the other side of the balance sheet, the capital structure was dominated by accumulated profits of nearly VND 553 billion, owner’s equity of over VND 312 billion, and payables of more than VND 202 billion, largely comprised of employee salaries and bonuses.

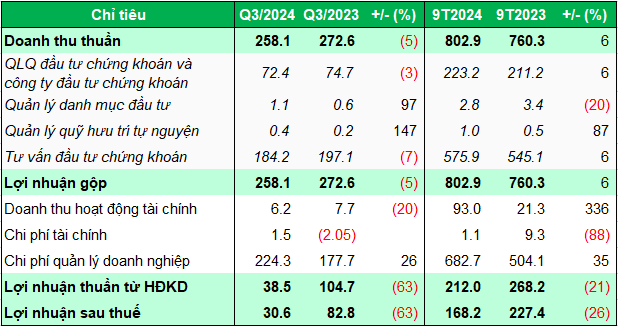

Lowest profit since the company’s scale began to explode

Looking at a longer cycle, the net profit of nearly VND 31 billion in Q3 2024 marks the lowest quarter since Q2 2021 – the period when business results started to surge, backed by a significant increase in asset and capital scale.

|

DCVFM’s business results have surged since Q2 2021

Unit: Billion VND

Source: VietstockFinance

|

By the end of Q2 2021, the company’s capital scale had increased to nearly VND 515 billion, up from over VND 362 billion in the previous quarter. The increase in capital was mainly due to a surge in payables from over VND 11 billion to over VND 94 billion due to higher performance bonuses; taxes and contributions to the state increased from nearly VND 43 billion to over VND 52 billion; and accumulated profits rose from over VND 153 billion to nearly VND 194 billion.

The asset structure also underwent significant changes, with cash and cash equivalents increasing from over VND 51 billion to nearly VND 100 billion; short-term receivables rising from nearly VND 25 billion to almost VND 114 billion, mainly due to new receivables for securities investment advisory services with related parties, such as Dragon Capital Management (HK) Limited.

The scale of short-term financial investments increased from nearly VND 42 billion to nearly VND 215 billion, mainly through the recognition of over 21.4 million unlisted fund certificates of the DC Fixed Income Enhancing Income Bond Fund (DCIP), corresponding to a 94% ownership of the circulating fund certificates.

On the other hand, the company no longer recorded long-term financial investments of VND 200 billion, mainly in bonds.

|

DCVFM’s asset size has increased significantly since Q2 2021

Unit: Billion VND

Source: VietstockFinance

|

|

DCIP was established on May 24, 2021, and is managed by Dragon Capital Vietnam’s Fund Management. DCIP is an open-ended bond fund with a conservative investment strategy, investing in bonds, certificates of deposit, and term deposits. According to the company’s disclosure as of September 30, 2024, DCIP’s net assets were nearly VND 1,185 billion, with an investment portfolio comprising 47.5% bonds, 27.3% cash and cash equivalents, and 25.2% certificates of deposit. |