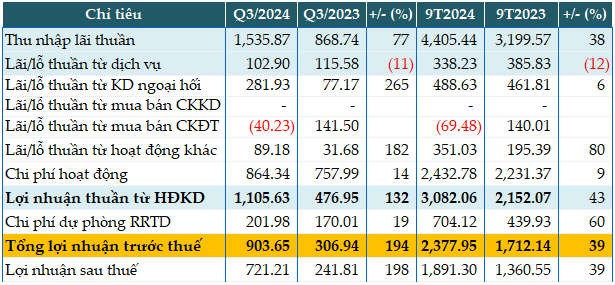

Eximbank reported that challenging economic conditions significantly impacted the performance of its individual and corporate clients. In the third quarter, Eximbank’s net interest income reached VND 1,536 billion, a 77% increase compared to the same period last year.

Non-interest income also saw robust growth, with foreign exchange trading profits tripling and other operating income increasing by 2.8 times.

On the other hand, service income decreased by 11% to VND 103 billion. Investment securities trading activities resulted in a loss of over VND 40 billion, while the same period last year yielded a profit of VND 142 billion.

Consequently, the bank’s net profit from business operations was nearly VND 1,106 billion, 2.3 times higher than the previous year. Despite setting aside VND 202 billion for credit risk provisions (+19%), Eximbank still recorded a pre-tax profit of nearly VND 904 billion, almost three times higher than the previous year.

For the first nine months of the year, Eximbank’s pre-tax profit reached nearly VND 2,378 billion, a 39% increase compared to the same period last year.

Compared to the full-year pre-tax profit target of VND 5,180 billion for 2024, Eximbank has only achieved 46% of its goal, although three-quarters of the year have passed.

|

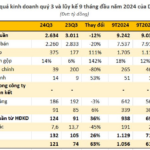

Eximbank’s business results for Q3 and the first nine months of 2024. Unit: VND billion

Source: VietstockFinance

|

As of the end of the third quarter, total assets reached VND 223,683 billion, an 11% increase from the beginning of the year. Capital mobilization from economic organizations and residents amounted to VND 167,603 billion, a 7% increase. Outstanding loans reached VND 159,483 billion, a 14% increase.

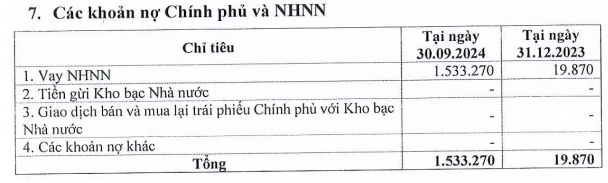

Deposits at the State Bank of Vietnam decreased by 37% to VND 2,546 billion. Deposits at other credit institutions also fell by 25% to VND 32,300 billion. Borrowings from the State Bank of Vietnam increased sharply to VND 1,533 billion, while it was only VND 20 billion at the beginning of the year.

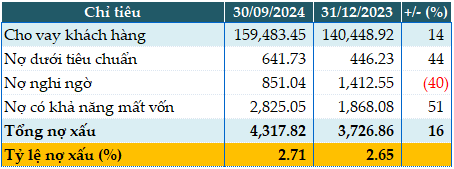

As of September 30, 2024, total non-performing loans (NPLs) stood at VND 4,318 billion, a 16% increase compared to the beginning of the year. The NPL ratio increased from 2.65% to 2.71% during this period.

|

Eximbank’s loan quality as of September 30, 2024. Unit: VND billion

Source: VietstockFinance

|

Recently, Eximbank has been the subject of rumors regarding the relocation of its head office, which is expected to be discussed at an upcoming extraordinary general meeting of shareholders scheduled for early November in Hanoi.

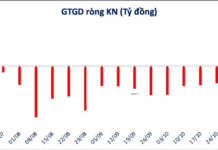

These speculations have kept EIB shares in the spotlight, with investors closely monitoring the situation. On October 25, the market witnessed a trading volume of 45.83 million EIB shares, valued at nearly VND 98 billion, equivalent to VND 21,310 per share, higher than the closing price of VND 20,850 per share.

Within just two weeks (October 15-25), the EIB share price increased by 10%, with an average daily trading volume of nearly 22 million shares.

| Price movement of EIB shares since the beginning of the year |

Eximbank responds to head office relocation rumors

Preserving the Heritage of Eximbank: A Call to Avoid Disruption

Eximbank Addresses Rumors Impacting its Stock Performance

The Controller’s Wife Wants to Sell Her EIB Shares

Mrs. Tran Thi Thanh Nha, the wife of Mr. Ngo Tony, an American citizen and the Head of the Supervisory Board of Eximbank, plans to sell her entire stake in the bank. The sale, which will take place between October 30 and November 8, involves 123,298 shares, representing 0.006% of the bank’s capital. Mrs. Nha aims to recover her investment through this divestment.

The Mighty Makeover: “Camau Protein’s Quarterly Profit Plunge: Hoarding a Staggering $9,000 Billion in Cash”

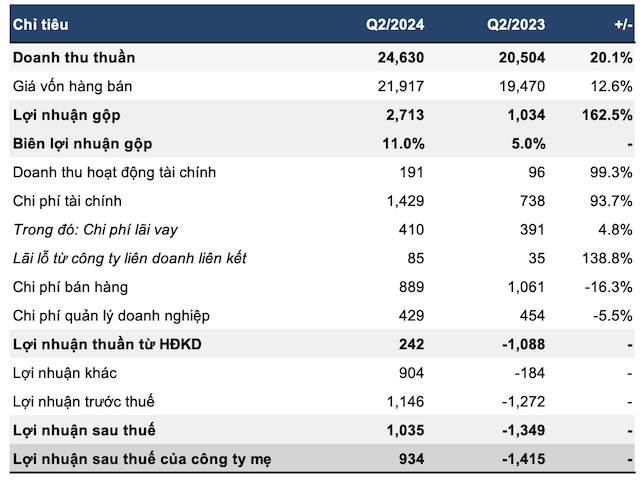

The explanation provided in the consolidated financial statements attributes the almost 63% increase in profit to the reduction in cost of goods sold, which outpaced the decrease in revenue. Additionally, this year’s revenue deductions were significantly lower than those of the previous year, contributing to the substantial growth in profit.

The Expert’s View: Scrapping Credit Room Could Mean Big Risks for Vietnam’s Banking System

“The removal of the credit room gives banks more flexibility in boosting capital for the economy, but it’s a double-edged sword,” says Le Hoai An, CFA Founder IFSS. “While it provides more options, completely abolishing the credit room could bring about greater risks and challenges that need to be carefully navigated.”

A Scandal Unveiled: Foreign Investors Exit Loc Troi Amid Corporate Governance Woes

Over the past five months, foreign shareholders have been consistently selling their stakes in Loc Troi Group Joint Stock Company (UPCoM: LTG). During this period, the company’s board of directors also removed Mr. Nguyen Duy Thuan from his position as General Director and subsequently issued a statement accusing him of deceitful behavior.