As planned, Sabeco will publicly acquire more than 37.8 million SBB shares in the period from October 31 to December 25, 2024, thereby increasing its direct ownership from nearly 14.4 million shares (16.4%) to nearly 52.2 million shares (59.6%) and becoming the parent company of Sabibeco.

With a bid price of 22,000 VND per share, it is estimated that Sabeco will need to spend nearly VND 832 billion to complete this deal. Notably, this price is 24% higher than the current market price of SBB shares, which is around 17,800 VND per share.

In the stock market, SBB has been trading sideways recently after a strong surge in August when the stock advanced from around 14,000 VND per share to the 18,000 VND per-share range.

| SBB stock trades sideways after a strong surge in August 2024 |

Sabeco stated that during the acquisition process, it may increase the price (if necessary) to ensure the company’s interests, as well as set conditions for canceling the acquisition if the number of SBB shares registered for sale does not reach a minimum of 25.1 million shares (28.7% of the circulating supply) or if SBB reduces the number of voting shares.

The large-scale public acquisition did not come as a surprise to investors, as in September 2024, Sabeco’s Board of Directors approved the plan to publicly acquire SBB shares to expand its business scale.

Sabibeco is known for its Sagota beer brand, which includes a range of beer products such as draft beer, canned beer, fresh beer, and bottled beer, as well as contract manufacturing for brands like Saigon Special, Saigon Larger, Saigon 333 Export, and Saigon Export. They also offer malt-based beverages in lemon and raspberry flavors.

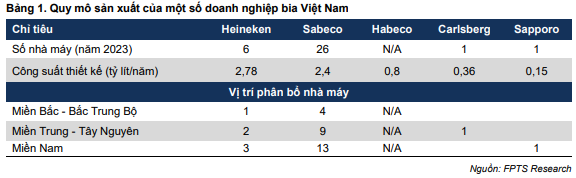

According to an initial valuation report on SAB shares by FPT Securities (FPTS), Sabeco’s total capacity will increase to 3.01 billion liters of beer per year in 2024, a 25.4% increase from its current capacity, making it the largest beer producer in Vietnam.

In the first half of the year, Sabeco recorded nearly VND 15,270 billion in net revenue and a net profit of nearly VND 2,246 billion, an increase of 5% and 6% respectively compared to the same period last year. The company achieved 44% of its revenue target and 52% of its profit target for the year.

By the end of the second quarter, Sabeco’s total assets stood at nearly VND 34,154 billion, an increase of VND 97 billion from the beginning of the year. Correspondingly, its liabilities were approximately VND 9,024 billion, a significant increase of VND 453 billion from the beginning of the year, mainly due to an increase in dividends payable.

“SABECO and the Communist Youth Union Join Forces to Aid Northern Provinces in Post-Storm Recovery Efforts”

SABECO, or The Saigon Beer, Alcohol and Beverage Joint Stock Company, has extended its support to six northern provinces affected by Typhoon Yagi. In collaboration with the Ho Chi Minh Communist Youth Union (Central Committee), local authorities, and business and media partners, SABECO provided post-disaster relief to those in need.

Can Sabeco Overtake Heineken in Vietnam with Control of Sabibeco?

With the acquisition of an additional six breweries from Sabibeco, Sabeco would boost its total brewing capacity to an impressive 3.01 billion liters of beer per year. This strategic move would solidify Sabeco’s position as Vietnam’s largest beer producer, dominating the market with an unparalleled scale of operations.