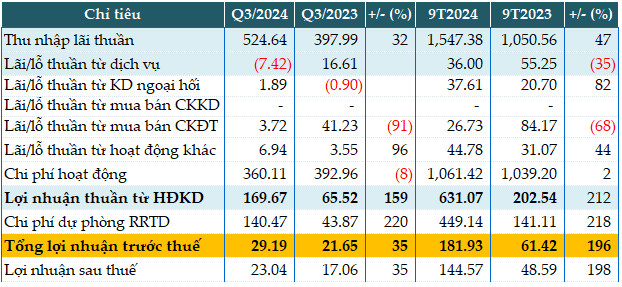

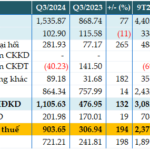

In the first nine months of 2024, BVBank reported a 47% year-on-year growth in net interest income, surpassing VND 1,547 billion.

Profit from foreign exchange trading decreased by 35% to VND 36 billion due to increased payment service charges.

Foreign exchange operations yielded nearly VND 38 billion in profit, attributable to increased earnings from spot foreign exchange transactions (VND 152 billion). The cost-to-income ratio (CIR) improved by 18%.

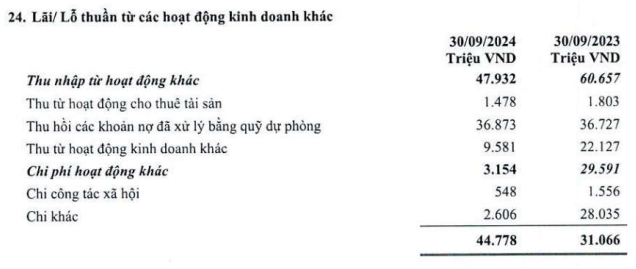

Profit from other activities also increased by 44% to nearly VND 45 billion due to reduced miscellaneous expenses (VND 2.6 billion).

Consequently, the bank’s profit from business operations exceeded VND 631 billion, triple the figure from the previous year. Despite setting aside over VND 449 billion for credit risk provisions (triple the amount from the previous year), BVBank still recorded a pre-tax profit of nearly VND 182 billion, almost triple the previous year’s figure. The bank attributed this performance to stable credit growth and capital restructuring measures.

With a pre-tax profit target of VND 200 billion set for the full year, BVBank has achieved 91% of its goal in the first nine months.

In the third quarter alone, BVBank’s pre-tax profit exceeded VND 29 billion, a 35% increase year-on-year, thanks to effective cost management and sustained credit growth to individual customers.

|

BVBank’s third-quarter and nine-month business results for 2024. Unit: Billion VND

Source: VietstockFinance

|

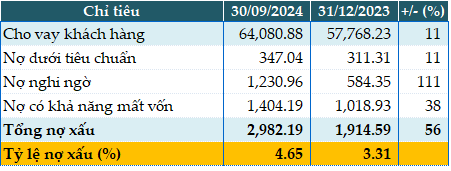

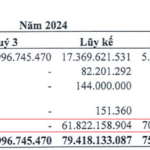

As of the end of the third quarter, the bank’s total assets increased by 13% from the beginning of the year to VND 99,419 billion. Cash increased by 35% (VND 675 billion), deposits with credit institutions rose by 45% (VND 15,150 billion), and loans to customers grew by 11% (VND 64,080 billion).

Customer deposits also increased by 6% from the beginning of the year to VND 60,432 billion. This included VND 67 trillion raised from economic organizations and the population

As of September 30, 2024, the bank’s total non-performing loans amounted to VND 2,982 billion, a 56% increase from the beginning of the year. The non-performing loan ratio increased from 3.31% at the beginning of the year to 4.65%.

|

BVBank’s loan quality as of September 30, 2024. Unit: Billion VND

Source: VietstockFinance

|

Han Dong

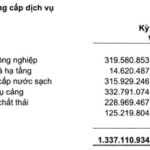

Why Did TIP’s Net Profit Decrease by Over 70% in Q3?

The absence of joint venture profit recognition in Q3 2024 caused a 72% decline in net profits for the Industrial Park Development and Investment Joint Stock Company (HOSE: TIP) compared to the same period last year.

“A Stellar Performance: Sonadezi Achieves 87% of Profit Plan in 9 Months”

Sonadezi Corporation (Sonadezi, UPCoM: SNZ), a leading industrial development company, announced its third-quarter financial results, reporting a net profit of over VND 192 billion, an 8% decrease compared to the same period last year. Despite this quarterly decline, the company remains on a strong trajectory, having achieved 87% of its full-year net profit target in the first nine months of the year.