Sustaining the Growth Momentum

VPBank’s consolidated pre-tax profit for the first nine months reached nearly VND 13.9 thousand billion, an increase of over 67% compared to the same period in 2023. The parent bank contributed over VND 13 thousand billion, while its subsidiaries continued their upward trajectory from previous quarters.

As a result, the bank’s consolidated operating income (TOI) grew by nearly 23% in the nine months, surpassing VND 44.6 thousand billion. Retail banking recorded an increase of over 26%, reaching VND 32 thousand billion, driven primarily by interest income. The bank’s cost-to-income ratio (CIR) was optimized at 24% due to comprehensive digitization and process automation.

FE Credit left its mark on VPBank’s nine-month financial performance, reporting a profit of nearly VND 300 billion in the third quarter. This was the outcome of a robust restructuring process that involved a selective approach to customer segments, enhanced debt collection, and operational refinements.

Notably, the group’s concerted efforts in debt recovery and digital transformation bore fruit, with consolidated recovery from resolved risky debts exceeding VND 3,200 billion in the first three quarters, a rise of over 90% year-on-year. VPBank’s diverse bad debt management strategies helped maintain the parent bank’s bad debt ratio (NPL) below 3%, as stipulated by the State Bank of Vietnam (SBV)

As of the end of the third quarter, the bank’s credit balance, including customer loans and corporate bonds, stood at over VND 581 thousand billion, reflecting a growth of more than 10% compared to the beginning of the year and outpacing the industry average of 8.5%. Credit was disbursed across diverse economic sectors and industries, with key products such as auto loans and credit cards.

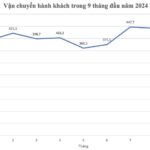

In tandem with the parent bank’s credit growth, core credit from the consumer finance segment, FE Credit, sustained its upward trajectory from the previous year. Disbursements for the first nine months of 2024 reached a level equivalent to the whole of 2023, indicating a rebound in consumer spending.

In line with the government and SBV’s efforts to support individuals and businesses affected by Typhoon Yagi, VPBank introduced a program offering interest rate reductions of up to 1% to facilitate recovery in production and business activities and stabilize the macroeconomic environment.

Safe and Efficient Operations

To meet the stable growth in lending demand, VPBank prudently managed its customer deposits and securities in line with credit growth, aiming for enhanced balance sheet efficiency. The bank continued to optimize its customer deposit portfolio and diversify its long-term international funding sources.

In the third quarter, VPBank and the Japan International Cooperation Bank (JBIC) signed a credit agreement worth up to USD 150 million to finance renewable energy and power transmission projects in Vietnam, contributing to the country’s net-zero emission goals by 2050.

The bank’s cost of funds remained optimized at 4.1% in the third quarter, a reduction of over 2% compared to 2023. Liquidity safety ratios, such as the loan-to-deposit ratio (LDR) of 82.3% and the short-term capital for medium and long-term loans ratio of 24.6%, were well within the SBV’s regulatory requirements.

The consolidated capital adequacy ratio (CAR) stood at 15.7%, leading the industry and providing a solid foundation for future growth.

Maximizing Opportunities, Leveraging Strengths

With a forward-thinking vision, VPBank inaugurated its first flagship branch in Ho Chi Minh City during the third quarter, pioneering the trend towards future banking in Vietnam amidst the digital era and propelling the bank’s journey towards international market expansion.

The strategy behind this new branch model, featuring superior amenities, technology, products, and services that meet international standards, is to cater to the diverse needs of various customer segments. This approach is expected to elevate the customer experience, retain existing clients, and attract new ones, including international customers from the emerging FDI segment.

Seizing the opportunity presented by the influx of FDI into Vietnam and building on its strategic partnership with SMBC, VPBank’s decision to expand into the large corporate, multinational, and FDI customer segment was a strategic move. In nearly two years, VPBank has onboarded over 500 FDI companies, each with a substantial employee base that represents potential future individual customers for the bank.

The third quarter witnessed a collaborative partnership between VPBank and Lotte C&F Vietnam, creating a platform to leverage their bilateral strengths and capitalize on the robust purchasing power of Vietnam’s nearly 100-million-strong market. While VPBank offers comprehensive financial solutions, products, and services, along with abundant resources, to Lotte C&F’s ecosystem of companies, Lotte C&F facilitates connections and promotes VPBank’s product portfolio within its group of companies. This synergy helps VPBank expand its network and enhance its market share in the FDI customer segment.

Additionally, VPBank has become a strategic partner of BYD, a leading electric vehicle manufacturer in Vietnam, providing attractive credit packages and streamlined lending processes to vehicle purchasers.

According to Brand Finance’s latest assessment, VPBank’s brand value in 2024 increased by nearly 6% compared to 2023, reaching USD 1.35 billion. This places the bank among Vietnam’s Top 10 most valuable brands in 2024.

“Scrutinizing Land Tax Regulations: A Government Initiative for Fairer Taxation with the New Land Pricing Scheme.”

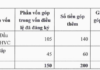

The Vietnamese government, in Resolution 188/NQ-CP, has directed the Ministry of Finance to review and amend the legal provisions pertaining to non-agricultural land use tax, land use fees, and land rental fees. The Ministry is tasked with reporting to the competent authorities and recommending adjustments to align with the practical application of the land price framework as stipulated in the 2024 Land Law. These steps are intended to provide much-needed support to businesses and individuals embarking on investment projects that involve land use.

Capital Injection for Year-End Business Boost

The banking sector is gearing up for the festive season with a plethora of loan offerings tailored for businesses and merchants. As the year draws to a close, financial institutions are rolling out attractive loan packages with a variety of incentives to support enterprises in their endeavor to meet the surging demand during this peak season.

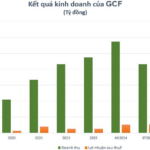

The Chairman of TTC AgriS: Working in the Interests of 91% of Shareholders and Investors

Amidst the growing interest from international investors and prominent financial institutions in Thành Thành Công – Biên Hòa Joint Stock Company (TTC AgriS) (HOSE: SBT), Ms. Đặng Huỳnh Ức My, Chairperson of the company’s Board of Directors, has assured that fairness and transparency will be upheld for shareholders, investors, and all stakeholders.