The combined trading value of the HoSE and HNX floors today reached only VND 9,782 billion, falling to the lowest level since the session on May 9, 2023, equivalent to an 18-month low. During this time, liquidity has fallen below the VND 10,000 billion mark only three times. The extremely low liquidity indicates that selling pressure has eased significantly, allowing buying power to push prices up rather smoothly towards the end of the session.

This afternoon’s market once again seemed to be failing when the recovery effort at the beginning of the afternoon session was subsequently drowned. VN-Index set its intraday high at 1:30 pm, up 2.5 points, then immediately plunged back and set a new low at 2:25 pm, down 1.8 points, and close to 1,250.94 points. Surprisingly, in the last few minutes, stocks suddenly turned around and closed the index up 2.05 points, equivalent to +0.16% compared to the reference price.

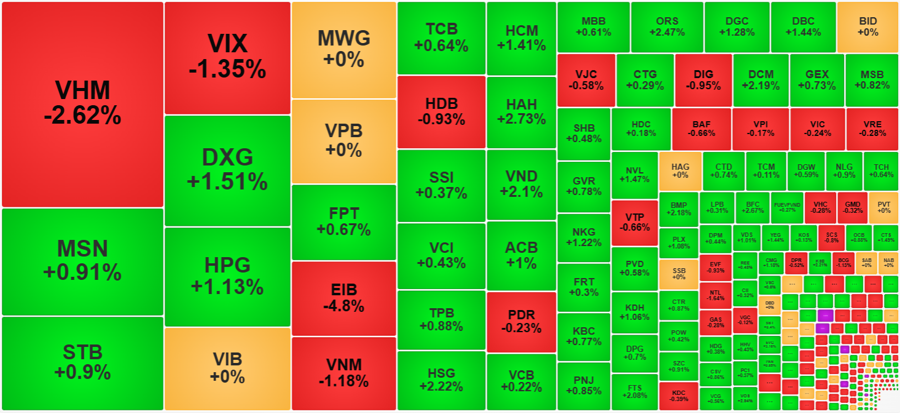

This lightning-fast reversal was largely contributed by the blue-chips. VN30-Index, at the end of the continuous matching period, was still down about 0.6 points but ended up gaining 2.79 points. The series of impressive gains included HPG, MSN, GVR, PLX, and ACB. Unfortunately for the VN-Index, some pillars did not participate in this reversal, for example, VCB stood still, closing up slightly by 0.22%; VHM even weakened, closing down 2.62%; VIC, GAS did not improve, still down 0.24% and 0.28%, respectively. If there had been support from these pillars, the VN-Index could have jumped even higher.

Nevertheless, the afternoon’s reversal had a fairly good spread. Specifically, at the index’s deepest low at 2:25 pm, the breadth recorded 170 gainers and 206 losers. In just a few minutes, and during the ATC period, the breadth improved to 211 gainers and 162 losers. Moreover, HoSE’s matched orders this afternoon were extremely low, reaching only VND 4,606 billion, slightly lower than in the morning, but stock prices were better. This indicates that selling pressure has indeed eased significantly.

Statistics show that up to 83% of HoSE stocks have “bottomed out” to varying degrees. About 41.8% of stocks rose a minimum of 1% from their intraday lows. With such a recovery margin, if the selling volume were still high, the liquidity to reverse prices would have shown a very large number. However, today, HoSE matched just over 400.5 million shares worth VND 9,219 billion, an 18-month low.

Thus, it is highly likely that selling pressure has weakened after a week of continuous “torture.” Investors who wanted to sell have already done so, and at this point, only those who accept high risk remain and hold on to their stocks. Today’s developments indicate that there was a new wave of profit-taking, which even lasted for most of the afternoon session, but it did not push liquidity up or cause stock prices to fall further.

With the breadth tilting towards gainers at the end of the session, only those stocks without liquidity were left behind. Out of the 162 losers, 41 stocks still fell more than 1%, but only 5 stocks had high liquidity: VHM fell 2.62% with a matching volume of VND 840.5 billion; VIX decreased by 1.35% with VND 361.2 billion; EIB dropped by 4.8% with VND 199.6 billion; VNM declined by 1.18% with VND 196.5 billion, and NTL decreased by 1.64% with VND 23.2 billion.

On the gaining side, of course, the picture was better. Out of the 211 gainers, 86 stocks rose more than 1% (compared to 57 stocks in the morning session). The liquidity of this group accounted for about 24% of HoSE. The group that attracted the best money flow included DXG, up 1.51% and trading at VND 355.9 billion; HPG increased by 1.13% with VND 318.8 billion; HSG rose by 2.22% with VND 135 billion; HCM gained 1.41% with VND 132.2 billion; HAH climbed by 2.73% with VND 128.8 billion, and VND advanced by 2.1% with VND 126.5 billion… Securities stocks unexpectedly stood out, with up to 13 stocks rising more than 1% from the reference price, including many blue-chips such as VND, BVS, HCM, and FTS…

Foreign investors’ afternoon trading was much more balanced as selling decreased significantly and buying increased. Specifically, this group dumped VND 654.5 billion, a decrease of 15% compared to the morning session, and bought VND 557.8 billion, an increase of 38%. The net balance was accordingly -VND 96.7 billion, much lower than the figure of -VND 360.9 billion in the morning. MSN suffered additional selling, recording -VND 279.9 billion for the day. Besides, there were HPG -VND 72.2 billion, DXG -VND 50.9 billion, VNM -VND 38.1 billion, KBC -VND 35.9 billion, BID -VND 33.8 billion, HDB -VND 32.8 billion, VCI -VND 27 billion, and DGC -VND 24.5 billion. On the buying side, there were FPT +VND 49.8 billion, EIB +VND 48.8 billion, STB +VND 46.6 billion, MWG +VND 44.5 billion, TCB +VND 28.8 billion, VPB +VND 21.8 billion, and BMP +VND 21.4 billion.

The Flow of Funds: Riding the Storm, How Far Will the Market Correction Go?

The stock market witnessed a steep decline of almost 33 points, or 2.5%, last week—the biggest drop since the end of June 2024. This significant downturn caused a break in the VN-Index’s support channel, which had been intact since the August 2024 lows. Experts unanimously deemed this a negative technical signal, a harbinger of potential challenges ahead for investors.

The Stock Market Blues: A Tale of Woes and Worries

The VN-Index has been struggling to conquer the 1,300-point threshold and is now falling deeply from this region.