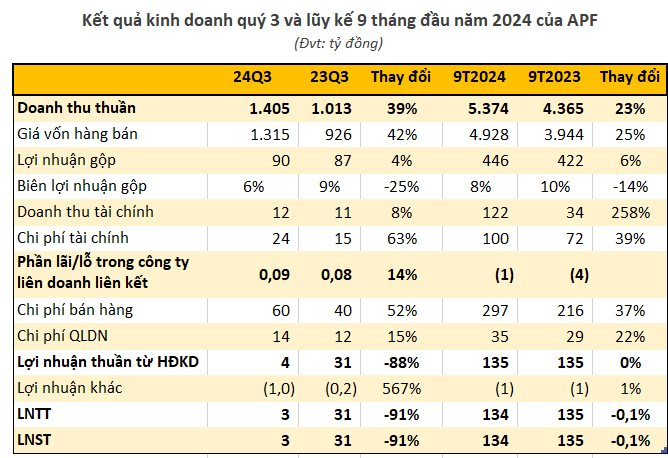

Quang Ngai Foodstuffs and Agricultural Products JSC (APFCO, code: APF) has announced its Q3/2024 financial statement with net revenue of VND 1,405 billion, a 39% increase compared to the same period last year. The cost of goods sold increased more than the revenue, causing the gross profit margin to narrow from 9% to 6%, corresponding to a slight 4% increase in gross profit of VND 90 billion.

In this period, financial revenue increased by 8% to VND 12 billion, while financial expenses surged by 63% to VND 24 billion. Selling expenses and administrative expenses also increased by 52% and 15%, respectively, to VND 60 billion and VND 14 billion.

As a result, APF reported a pre-tax profit of just under VND 3 billion in Q3, a 91% decrease compared to Q3/2023. APF did not recognize any current income tax expense, resulting in net profit equaling gross profit.

For the first nine months of 2024, APF’s net revenue reached nearly VND 5,374 billion, a 23% increase compared to the same period last year. Net profit remained almost unchanged, recording over VND 134 billion, a slight decrease of over VND 100 million compared to the previous year.

In 2024, APF set a target of VND 6,700 billion in revenue and VND 230 billion in after-tax profit. Thus, the company has achieved 80% of its revenue target and 58% of its full-year profit plan after nine months.

According to the company’s explanation, intense competition for raw materials has led to higher input prices. Additionally, continuously declining selling prices have resulted in increased cost of goods sold per unit, causing a 2.2% decrease in gross profit margin for Q3/2024 compared to the previous year. Consequently, net profit for Q3/2024 witnessed a significant 91% decline compared to the same period last year.

As of September 30, 2024, APF’s total assets amounted to VND 2,788 billion, a decrease of VND 380 billion from the beginning of the year, including over VND 101 billion in cash, nearly VND 484 billion in short-term receivables, and VND 637 billion in inventory.

On the capital side, APF’s payables stood at VND 1,540 billion, a decrease of nearly VND 400 billion from the beginning of the year, including VND 1,392 billion in financial borrowings. Owner’s equity reached VND 1,120 billion, a slight increase of VND 12 billion from the beginning of the year, with undistributed profit after tax amounting to nearly VND 388 billion.

APFCO is known as a leading company in the production of cassava starch and ethanol. Currently, APFCO’s products are mainly exported to Asian countries such as China and Japan.

On the stock market, APF shares have been undergoing a correction since their historical peak in early July. The trading price hovers around VND 55,200 per share, representing an 11% decrease from its peak. However, since the beginning of the year, the stock has still recorded an 18% increase.