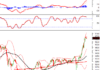

The stock market witnessed a significant drop of nearly 33 points, equivalent to a 2.5% decrease, the sharpest decline since the last week of June 2024. This large drop caused the VN-Index to break through the support channel that had been in place since the August 2024 lows. Experts unanimously considered this a negative technical signal.

Following last week’s unfavorable signal when positive earnings did not boost stock prices, selling pressure intensified this week as the market faced the State Bank’s money absorption activities. A similar money absorption phase in the second quarter of 2024 also significantly impacted the short-term developments in the stock market. While experts are not concerned about the rising exchange rate, they still believe that the short-term impact on the stock market occurs precisely when supportive information is lacking.

Due to the heightened short-term risk perception, experts unanimously reduced their equity holdings to low or medium levels and closed speculative positions. Opinions concur that the current downward trend remains a fluctuation within a broad range, as has been the dominant trend since April 2024. Within this trend, there will still be interspersed recovery phases. The expected safe support level is around 1200 points, equivalent to the August correction low.

Nguyen Hoang – VnEconomy

The market unexpectedly experienced a very strong decline of nearly 33 points. Many believe that the market turned negative due to the recent sharp rise in exchange rates and the State Bank’s money absorption. In fact, the USD/VND exchange rate has returned to its historical peak from May to June. What are your thoughts on this risk?

I want to emphasize that the issuance of bills is mainly to stabilize the exchange rate, not a sign of the State Bank tightening monetary policy. On the contrary, the State Bank still prioritizes stabilizing lending rates and supporting the economy at this stage. Therefore, I believe that exchange rate pressure will only affect the stock market in the short term.

Nguyen Thi My Lien

Nguyen Viet Quang – Director of Business Center 3 Yuanta Hanoi

In my previous article, I emphasized caution, so this week’s downward trend did not surprise me. The sharp rise in exchange rates, coupled with the State Bank’s money absorption, are factors that affect investors’ psychology and the market. If these factors continue to deteriorate in the coming time, the market sentiment will become even weaker, especially in the current phase of weak demand. In such a scenario, risks will increase significantly.

Nghiem Sy Tien – Investment Strategy Specialist, KBSV Securities

The exchange rate has been climbing since the end of September and is approaching the State Bank’s intervention selling rate of 25,450 VND/USD. I believe that this can be attributed to two main factors: the strengthening of the DXY index and the increased USD demand in the system. Even during this period, the State Bank has been conducting open market operations (OMO) to absorb VND, reducing pressure on the exchange rate. Although the two aforementioned reasons could cause continued tension in the exchange rate in the short term, the expectation of two more Fed rate cuts by the end of the year, along with significant foreign currency inflows from remittances, FDI, and trade surpluses, could help ease the pressure.

Le Duc Khanh – Director of Analysis, VPS Securities

The recent sharp increases in the exchange rate also coincided with a period of strong market adjustments. This year, a similar phenomenon occurred when, in response to exchange rate fluctuations, the State Bank issued bills within just three sessions, absorbing approximately VND 44 trillion. This amount is not excessive, and the upcoming exchange rate movements and the State Bank’s subsequent actions are what we should pay attention to. However, it’s essential to remember that this adjustment phase is only temporary and may be very brief. I anticipate it lasting until the end of October. Moreover, the financial results of many listed companies are quite positive. The adjustment pressure during this phase is significant but not overly concerning. In my view, the market will form a bottom next week and witness more evident recovery phases.

Nguyen Thi My Lien – Head of Analysis, Phu Hung Securities Joint Stock Company

Despite the existing exchange rate pressure, I believe it will subside in the coming period due to several factors: (1) The end of the year is typically when remittances pour in, boosting inflows; (2) The pressure to buy USD to repay debts has decreased after the large purchases by the Treasury; (3) The State Bank continues to issue bills, maintaining interest rates above 4%, narrowing the swap gap; (4) The USD-Index will cool down as the Fed is expected to cut rates in the next two meetings.

I want to emphasize that the issuance of bills is mainly to stabilize the exchange rate, not a sign of the State Bank tightening monetary policy. On the contrary, the State Bank still prioritizes stabilizing lending rates and supporting the economy at this stage. Therefore, I believe that the exchange rate pressure will only affect the stock market in the short term, and market sentiment will improve by the end of the year.

Capital Flow Trend: What to Do When Stock Prices Don’t Rise Despite Good Earnings?

642 Enterprises Report 17.8% Increase in Q3 Profit, Real Estate Group Officially Bottoms Out

Nguyen The Hoai, Director of Dong Nai Branch, Rong Viet Securities

The money absorption actions indicate short-term risks for the economy and the stock market. As for the exchange rate increase, I believe it is only temporary, as the Fed’s trend is still towards lowering interest rates.

Nguyen Hoang – VnEconomy

The anticipated positive scenario of surpassing 1300 points seems unlikely as the Q3 earnings season is about to end without much impact. Can you project how far the market might adjust?

Le Duc Khanh – Director of Analysis, VPS Securities

I assess that there are two very strong support levels below the 1250-1255 point region, namely 1230-1240 points. It is possible that the market will stabilize and rebound immediately from the 1250-1255 point region next week, as some unexpected scenarios often occur in the market.

Nguyen Thi My Lien – Head of Analysis, Phu Hung Securities Joint Stock Company

Looking back at the market in October, from a technical perspective, after failing to break through 1300 points at the beginning of the month, the market faced selling pressure, coupled with a lack of demand, pushing the index further away from this resistance level. I believe that the sideways movement throughout this month resembles a distribution area. With the broader picture of the medium-term sideways trend persisting since April, the emergence of a distribution area at the upper edge could push the market back to the lower edge of the channel (1180-1300). Therefore, despite the market currently approaching the MA200 (1240-1250) and the high expectations associated with it, I think this support may not hold for long, and the downward trend is likely to continue to lower levels. My expected target region is 1200-1220 points.

Nghiem Sy Tien – Investment Strategy Specialist, KBSV Securities

The supply-demand relationship in the market is becoming less favorable, and technical signals indicate that the VN-Index has entered a short-term correction phase. Although the 1180-1300 point range is a large-amplitude sideways zone for the index, with many interspersed and scattered support levels, I believe that the recovery reaction at these support levels will be relatively weak, and stronger support may lie around 1230 and 1200 points.

Nguyen The Hoai, Director of Dong Nai Branch, Rong Viet Securities

In the short term, investors need to pay attention to the State Bank’s actions, as they significantly impact the market’s adjustment level. However, it is challenging to pinpoint the exact numbers regarding the market’s adjustment. Still, with the current macroeconomic context, I believe that the downward trend will not be deep. As long as investors hold stocks of well-performing companies with reasonable valuations at a safe proportion, there is nothing to worry about.

I believe that the recovery reaction at these support levels will be relatively weak, and stronger support may lie around 1230 and 1200 points.

Nghiem Sy Tien

Nguyen Viet Quang – Director of Business Center 3 Yuanta Hanoi

The market has broken through the nearest support channel, and according to technical analysis, the nearest support zones are: around 1240 (the reaction in this zone is likely to be mild and will rebound in T+); around 1185 (this support zone is stronger, and if the VN-Index reaches this zone without forming a bottom, the rebound may last for 1-2 weeks).

Nguyen Hoang – VnEconomy

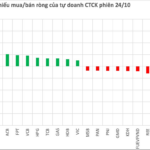

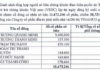

In our previous discussion, you mentioned that the demand for margin was not significant, but the Q3 statistics on margin show a large amount of borrowed capital. However, liquidity has been extremely low since the beginning of October, which seems contradictory. Could it be that investors are holding stocks with borrowed capital? Do you have any explanations for this buying power and the margin being used?

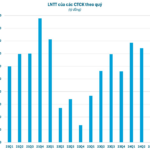

Nghiem Sy Tien – Investment Strategy Specialist, KBSV Securities

In my opinion, the view that investors are holding stocks with borrowed capital because the outstanding margin loans of securities companies are at a record high is unreasonable. If you observe carefully, you will see that many securities companies are continuously increasing their equity capital and issuing shares. With the rapid growth in equity capital, it is understandable that the absolute value of margin loans remains high. However, if we consider the ratio of margin to equity, the result will tell a less positive story, reflecting the subdued trading activities of investors, which is also evident in the market’s liquidity.

Nguyen Thi My Lien – Head of Analysis, Phu Hung Securities Joint Stock Company

In the late September to early October period, the market had high expectations of breaking through the 1300-point mark as Q3 financial results were announced and positive macroeconomic data was released. These expectations could have led investors to increase their margin loans. However, high margin demand does not always translate to increased market liquidity, as some of this borrowed capital may be “standing by” as investors decide to hold onto their stocks, hoping for a recovery after the recent sharp declines. Investor sentiment is also cautious due to unstable factors such as exchange rates and geopolitical tensions. Therefore, despite the high margin, cash flow is not positive, resulting in low liquidity.

The zone around 1185 points is stronger, and if the VN-Index reaches this zone without forming a bottom, the rebound may last for 1-2 weeks.

Nguyen Viet Quang

Nguyen The Hoai, Director of Dong Nai Branch, Rong Viet Securities

The high margin and low market liquidity indicate that large investors and organizations are using margin, and they have better goals, strategies, and vision. Small investors will not dare to use high margins when the market fluctuates within a narrow range with low liquidity.

Nguyen Viet Quang – Director of Business Center 3 Yuanta Hanoi

In my opinion, very few investors hold stocks long-term with borrowed capital, and most use borrowed money for short-term trading. If they use borrowed capital for long-term holdings, there are two possible reasons: i) The stock is losing value and has not yet reached the risk threshold, so the investor waits for a recovery; 2) The stock is still profitable and shows no signs of deterioration.

Regarding the current situation, I think it may be because enterprises find it challenging to raise capital through bonds or bank loans, so they may pledge their stocks for trading to obtain capital. As a result, a large margin loan amount is created for the market.

Le Duc Khanh – Director of Analysis, VPS Securities

We do not have precise data on buying power and margin usage in the market after the Q3 reports, but the demand for buying on credit always exists, and some investors still hold stocks with borrowed capital. This can be explained by the fact that when many investors expect the market to enter an uptrend, they may buy more stocks than they can afford or even purchase additional stocks with borrowed money when the market does not develop as expected.

Towards the end of the year, the government will accelerate the disbursement of public investment capital and implement measures to stimulate consumption to support economic growth. If these policies are effectively implemented, the market may attract additional capital inflows.

Nguyen The Hoai

Nguyen Hoang – VnEconomy

The market has been continuously declining throughout the week, and the afternoon sessions witnessed stronger upward movements, indicating significant selling pressure. Have you reduced your stock holdings? What is your current portfolio allocation? Are there any short-term information or events in November that could support the market?

Nguyen Viet Quang – Director of Business Center 3 Yuanta Hanoi

As I anticipated market risks last week, I proactively reduced my equity holdings. I sold a large portion near the 1300-point mark and another part when the channel broke. Currently, my portfolio comprises 30% stocks and 70% cash. I believe that November will be a relatively quiet period regarding information, and there is no news that can significantly support the market.

Nguyen Thi My Lien – Head of Analysis, Phu Hung Securities Joint Stock Company

As I observed the market’s negative performance and the breach of important bottoms, I promptly reduced my portfolio when I noticed the strong selling pressure in the first half of the week. My current equity holdings are at a low level (<30%).

In the first half of November, there will be important news such as Circular 68 officially taking effect (non pre-funding), allowing foreign investors to buy stocks without requiring sufficient funds, the Fed’s meeting, which is expected to result in another rate cut, and the US presidential election outcome. These expectations will

The Stock Market Blues: A Tale of Woes and Worries

The VN-Index has been struggling to conquer the 1,300-point threshold and is now falling deeply from this region.